The main digital asset fell sharply after Trump’s Wednesday tariff announcement and has since been languishing under $82K.

BTC Dives as Trump’s Tariffs Roil Markets

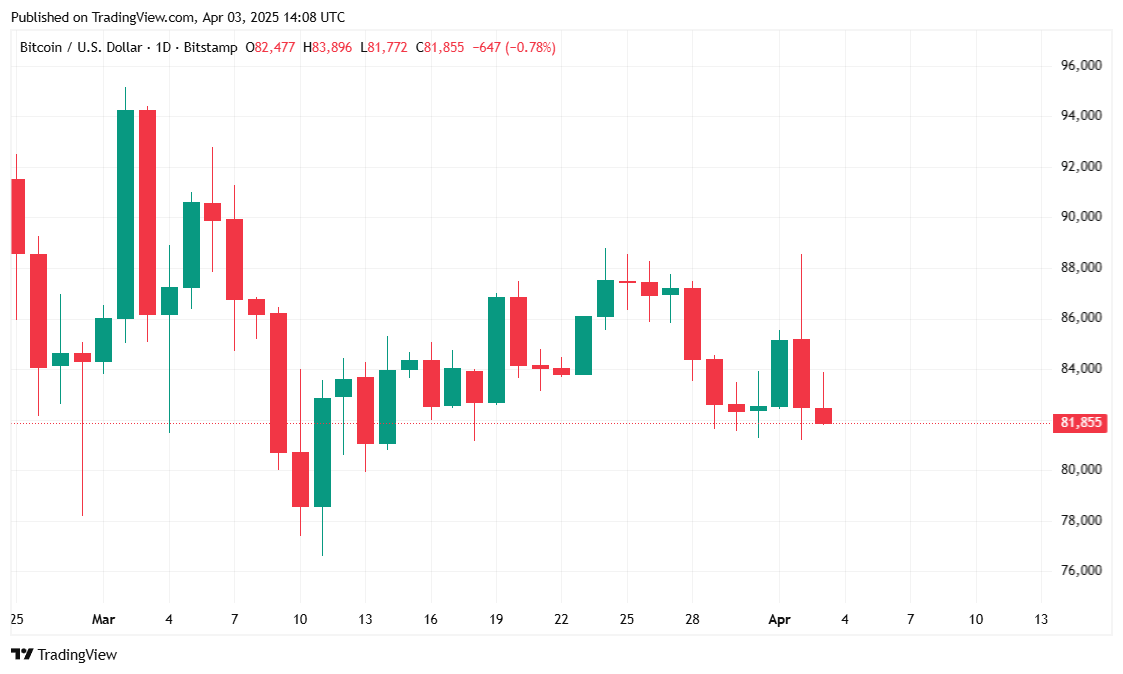

President Donald Trump introduced aggressive new U.S. tariffs on greater than 100 international locations on Wednesday afternoon, sending bitcoin ( BTC) plunging to $81K from yesterday’s excessive of greater than $88K.

The cryptocurrency’s value swung between $81,786.22 and $88,466.96 over the previous day and is at present buying and selling at $81,888.94 down 4.15% within the final 24 hours and 5.06% over the previous week.

( BTC value / Buying and selling View)

Overview of Market Metrics

Bitcoin’s buying and selling quantity surged to $54.72 billion over the previous 24-hour cycle, marking an 88.43% improve as nervous buyers offered the asset within the wake of Trump’s announcement. Bitcoin’s market capitalization has now fallen to $1.62 trillion, a decline of 4.41% since yesterday, reflecting broader investor warning.

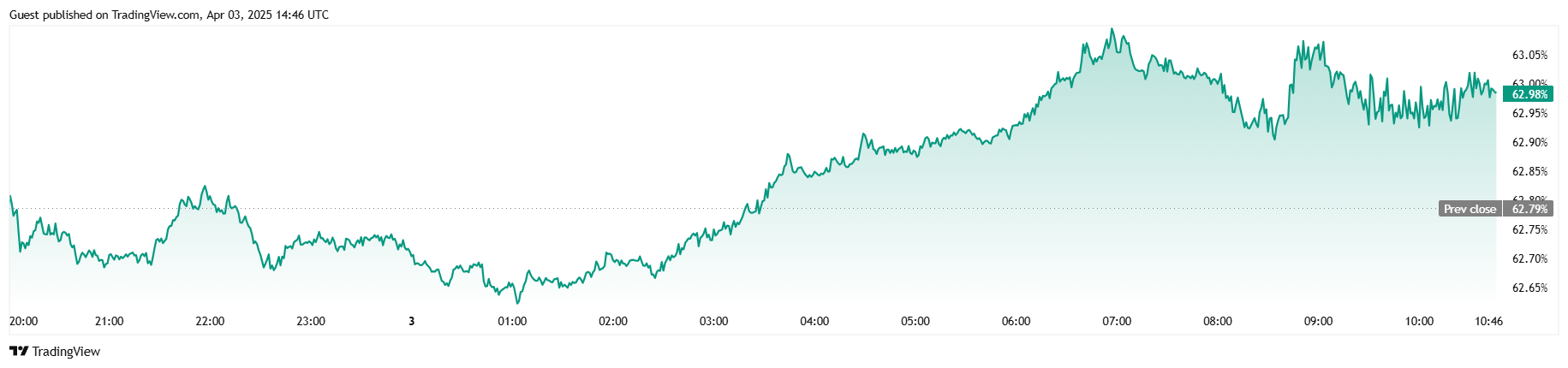

BTC dominance at present stands at 62.92%, up by 0.64% during the last 24 hours, as some merchants look like retreating to the relative security of bitcoin as altcoin costs take large hits. Moreover, whole bitcoin futures open curiosity has dropped by 5.29% to $52.20 billion, suggesting that leveraged positions are being unwound in response to the risky setting.

( BTC dominance / Buying and selling View)

Liquidation knowledge from Coinglass reveals that whole bitcoin liquidations reached $10.30 million previously day. Lengthy positions accounted for $3.42 million, whereas brief liquidations totaled $6.88 million, indicating that bearish bets had been largely off-target because the market moved in opposition to these positions.

Markets Hunch Following Trump’s “Liberation Day” Tariff Shock

Trump’s Wednesday tariff announcement set off an unprecedented commerce conflict with just about all U.S. buying and selling companions, sending each conventional and world markets right into a nosedive.

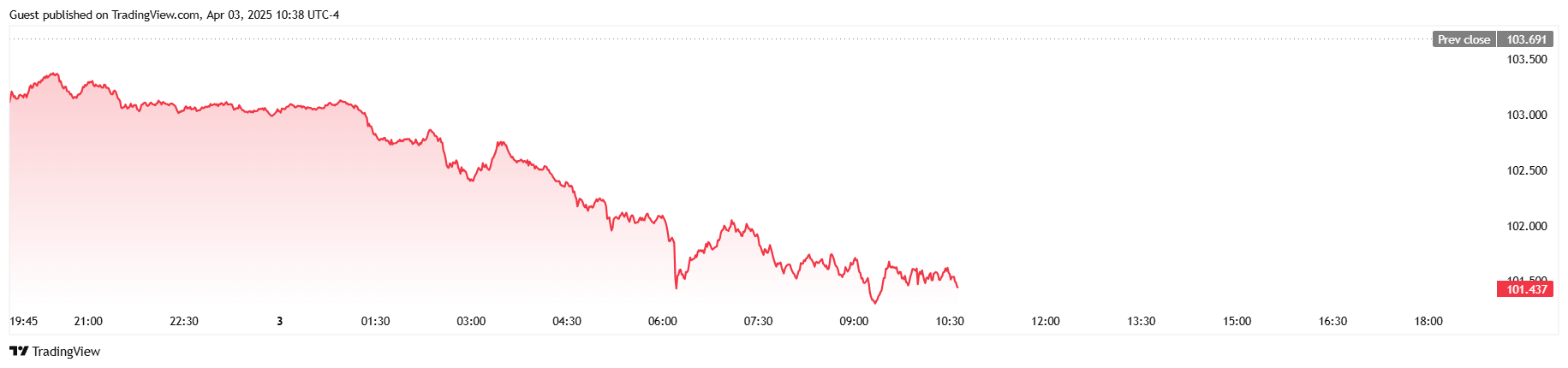

On the time of reporting, the S&P 500 has misplaced 4.17%, the Dow Jones Industrial Index has dropped 1,464 factors, and the U.S. Greenback Index, which tracks the power of the greenback in opposition to a basket of main currencies has slid by 2.19% to 101.43, its lowest since October 2024.

(The united statesdollar has fallen to its lowest since October 2024 / Buying and selling View)

Coinmarketcap exhibits the worldwide crypto market cap at $2.63 trillion, down 4.26% over 24 hours.

Will probably be attention-grabbing to see if buyers will proceed to view bitcoin as a safe-haven asset, which might see it climb again as much as its current highs.

Bitcoin Value Outlook

Wanting forward, bitcoin’s outlook stays combined. On one hand, its current value weak point could entice discount hunters and long-term buyers looking for a brief value dip. Then again, if world commerce tensions persist and macroeconomic uncertainties proceed, bitcoin might face further downward stress.

Buyers will probably be intently watching upcoming coverage developments and world market indicators for clues. Analysts counsel that if BTC stabilizes above key help ranges round $81,500, it could ultimately rebound; nevertheless, additional declines can’t be dominated out, particularly given the unpredictable nature of Trump’s commerce insurance policies or what some have dubbed “The Trump Impact.”