Bitcoin has skilled sharp volatility in latest days, pushed by escalating and de-escalating geopolitical tensions within the Center East. Over the weekend, BTC broke under the important thing $100,000 psychological degree following studies of US army strikes on Iranian nuclear amenities, sparking panic amongst buyers. Nevertheless, sentiment swiftly shifted when information of a ceasefire settlement between Israel and Iran broke, triggering a robust rally. Bitcoin surged again above $105,000, highlighting the market’s hypersensitivity to international battle headlines.

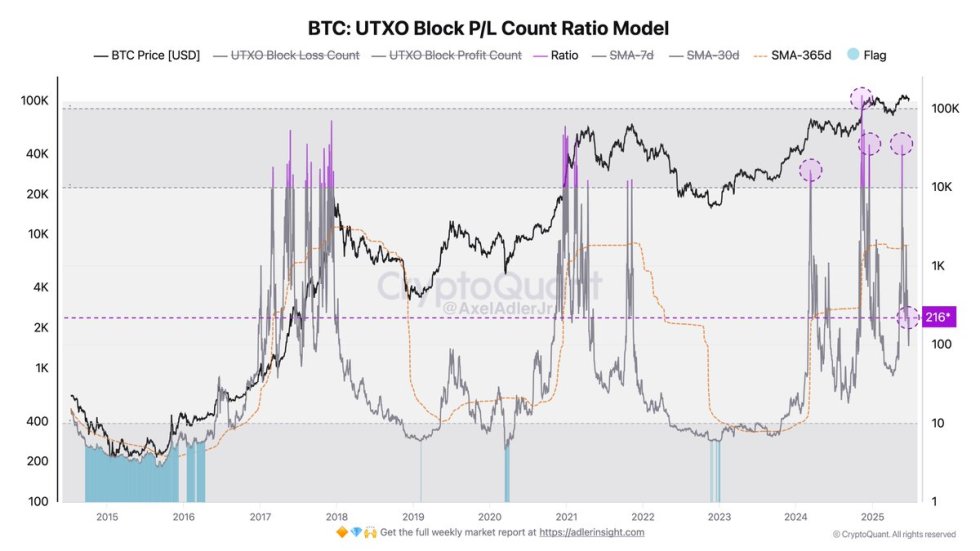

Supporting this restoration is knowledge from the UTXO Block P/L Rely Ratio Mannequin by CryptoQuant, which provides perception into investor conduct. On the $112K peak earlier this month, the mannequin recorded a spike to 34,000 factors, signaling a wave of profit-taking as many holders bought into energy. Since then, the metric has plunged to simply 216 factors, suggesting that worthwhile promoting has dried up, and a rising portion of transactions at the moment are being realized at a loss.

This shift signifies that sellers have largely stepped apart, and patrons are starting to take management at these decrease ranges. So long as Bitcoin maintains energy above $100K, the trail ahead may favor a extra secure restoration.

Bitcoin Eyes Stability After Risky Surge

Bitcoin is as soon as once more at a pivotal second, having surged greater than 7% in below 25 hours to reclaim greater value ranges above $105,000. Whereas the bounce has renewed bullish hopes, Bitcoin stays firmly throughout the consolidation vary that has outlined value motion since Could. Regardless of the aggressive transfer, short-term route stays unclear as international tensions—particularly within the Center East—and tightening macroeconomic circumstances proceed to inject volatility into the market.

High analyst Axel Adler shared contemporary insights that spotlight a key shift in investor conduct. In response to CryptoQuant’s UTXO Block P/L Rely Ratio Mannequin, when Bitcoin hit its $112,000 all-time excessive earlier this month, the mannequin spiked to 34,000 factors. This marked a wave of profit-taking, as many buyers capitalized on peak valuations. Nevertheless, the metric has since plummeted to simply 216 factors, indicating that worthwhile gross sales have nearly vanished and that extra individuals at the moment are realizing losses.

This steep decline indicators that sellers have largely exited the market, creating house for brand new patrons to build up at decrease ranges. The shift in conduct means that whereas draw back dangers nonetheless exist, a pointy value crash is much less doubtless within the close to time period. With promoting strain cooling and long-term conviction returning, Bitcoin seems to be coming into a extra constructive part.

BTC Holds Above Key Help Amid Rebound Try

The every day Bitcoin chart reveals a pointy bounce from the $98,200 low again towards the $105,000 area, reclaiming a crucial help zone close to $103,600. This degree had beforehand acted as each help and resistance since March and is now a key battleground for bulls. Worth briefly dropped under the 50-day easy transferring common (SMA) however has shortly recovered above it, signaling renewed short-term energy.

The bounce additionally comes after Bitcoin examined the 100-day SMA (close to $96,000), a traditionally dependable space of purchaser curiosity throughout corrective phases. Nevertheless, regardless of the bullish response, BTC has but to reclaim the $109,300 resistance degree that capped a number of rallies since early June.

The spike in quantity on the latest inexperienced candle suggests demand is returning at decrease ranges, validating on-chain knowledge that indicated sellers are stepping apart. Nonetheless, Bitcoin stays in a broad consolidation sample, and a failure to interrupt above $109,300 would hold the present rangebound construction intact.

To sign a real development reversal and renewed momentum towards all-time highs, BTC should shut decisively above $109,300. Till then, merchants ought to anticipate continued choppiness as macro uncertainty and geopolitical occasions weigh on short-term sentiment.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.