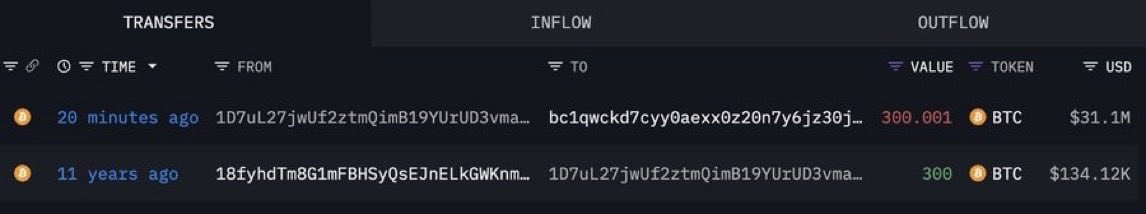

- A whale held 300 Bitcoin and offered it at $31 million after 11 years of holding it.

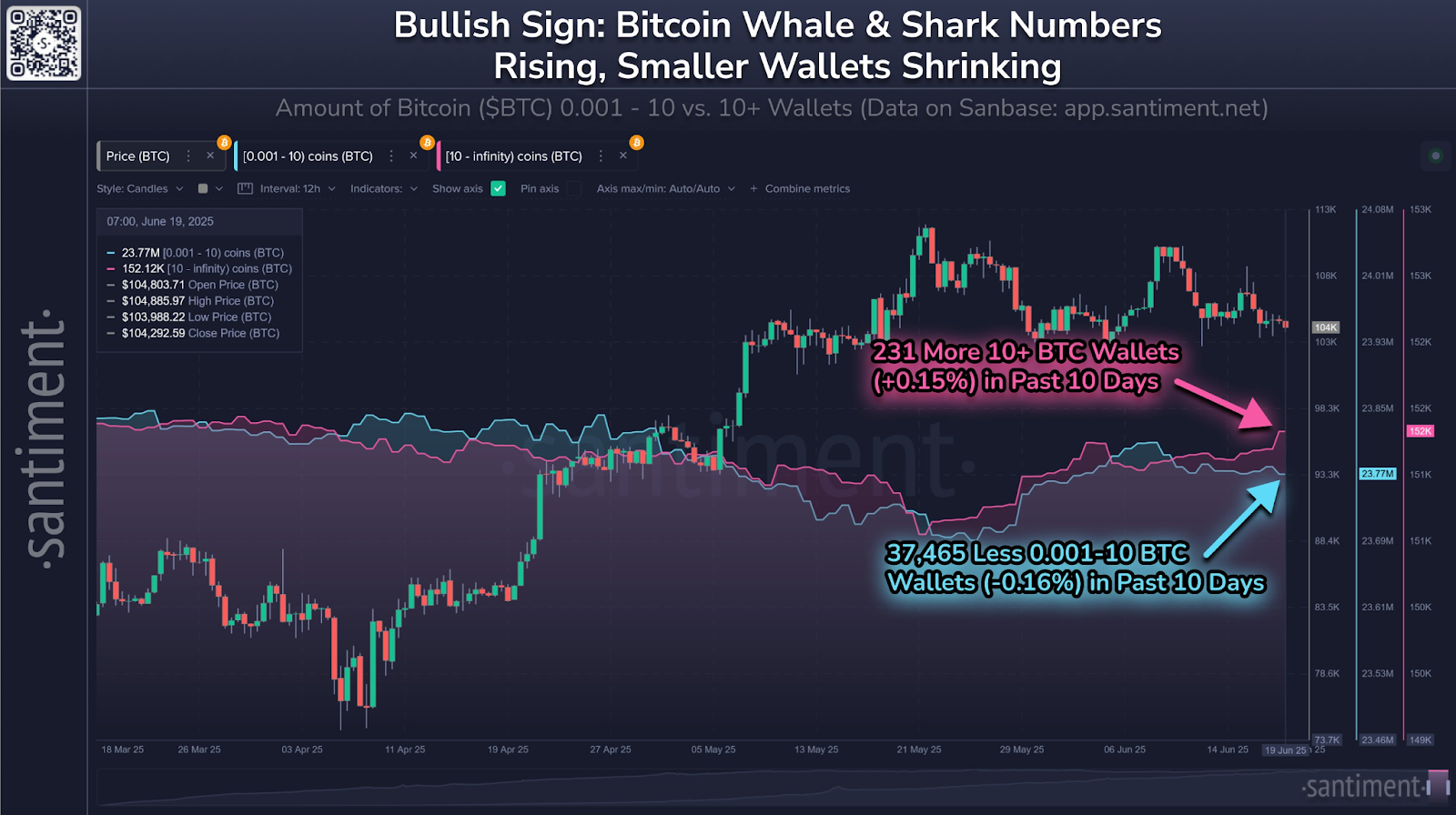

- There is a rise in whale wallets and depreciation of small wallets, indicating a change in Bitcoin holdings.

- Bollinger Bands of Bitcoin are narrowing down, and consultants predict there will probably be a breakout as soon as main resistance factors are damaged.

A Bitcoin whale has exited a decade-long place, promoting 300 BTC for roughly $31 million. Blockchain information exhibits the pockets has held the cash since 2013, with the final inbound transaction recorded over 11 years in the past. The funds had been lately transferred to a brand new pockets, indicating a possible over-the-counter sale or custodial transfer.

Supply:X

On-chain transactions point out that certainly the 300 BTC had been first added when Bitcoin was valued at a mere fraction of its present-day worth of $104,000. This fast motion has been accompanied by more and more excessive hoarding by whale wallets and a pointy drop in alternate reserves.

CryptoQuant information reveals that every one reserves of Bitcoin decreased to 2.4 million BTC – the indicator has not been noticed since 2021. This descending pattern has remained unchanged since its inception in late 2023, whilst Bitcoin’s value surged to a neighborhood excessive of $105,800.

On-chain evaluation additionally signifies that large holders are buying aggressively. In response to Santiment, there are 231 extra whale wallets with 10 BTC or extra throughout the previous 10 days. Smaller wallets, then again, are leaving the market. Greater than 37,000 addresses that contained 0.001-10 BTC have offered over the identical time, which signifies that retail buyers are responding to worry and uncertainty. Such redistribution means that whales are actively accumulating Bitcoin towards retail holders.

Bollinger Bands Sign Imminent Breakout

Technical indicators are in favour of a breakout. The Bollinger bands of Bitcoin have additionally narrowed down, an inclination normally adopted by massive value strikes. The present bands align with the latest value band of $100,000 and $110,000.

In response to analyst Daan Crypto Trades, this squeezing of volatility is a bullish sign and may very well be used with bullish ascending triangles to extra predictably forecast a rally. With Bitcoin discovering help round $104,000, a transparent break above the $110,000 resistance could set off a collection of bullish strikes on the boundaries at $114,000 and $118,000.

Supply: X

One other technical analyst, Jonathan Carter, famous that the decrease help of a rising triangle on the 8-hour chart had seen Bitcoin rebound. He additional famous that recapturing the 50-period shifting common would in all probability improve the velocity of aggressive costs, reaffirming short-term traits on the bullish aspect.

#BTC

Bitcoin is bouncing from the decrease help of an ascending triangle sample on the 8H chart🔍

A breakout above the MA 50 may propel the worth towards targets at $109,000, $110,500, $114,000, and $118,000🎯 pic.twitter.com/SkqCiPN5iM

— Jonathan Carter (@JohncyCrypto) June 19, 2025

Nonetheless, regardless of pullbacks within the final 24 hours and week, the macro place of Bitcoin stays robust. The buying and selling quantity stands at $37.1 billion, displaying a gradual market curiosity. The seven-day drop of 1.96% is indicative of consolidation however not weak spot.

These elevated exchanges to chilly pockets deposits, bullish buildings, and whale presence point out that the asset is doubtlessly gearing up in direction of a big upward leg. The principle areas to watch are the help at $100,000 and the resistance at $110,000 ranges, which can decide the short-term dynamics of Bitcoin.