Bitcoin (BTC) continues to commerce beneath the psychological $90,000 degree, with its value standing at $82,346. This marks a 24.3% drop from its all-time excessive above $109,000 recorded in January.

Regardless of this downward pattern, new on-chain knowledge suggests {that a} surge of high-net-worth buyers, or “new whales,” has been accumulating BTC aggressively, which might have vital implications for the market’s trajectory.

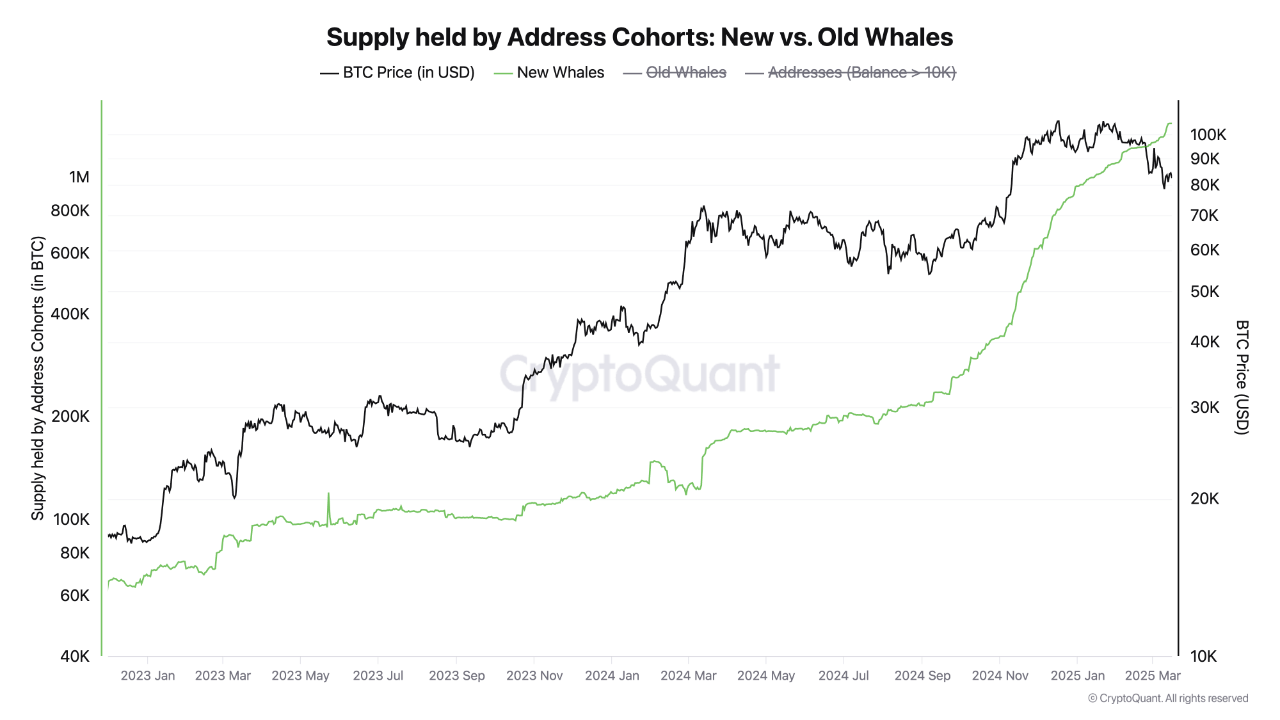

In response to CryptoQuant analyst onchained, a definite group of Bitcoin holders with at the least 1,000 BTC—acquired inside the previous six months—has been actively accumulating.

This pattern, which began in November 2024, has accelerated considerably in latest weeks, with these new whales amassing over 1 million BTC in whole and including greater than 200,000 BTC simply this month alone.

New Whales Drive Market Accumulation

Onchained’s evaluation highlights that this unprecedented accumulation pattern signifies sturdy confidence in Bitcoin’s long-term outlook. The fast enlargement of latest whale holdings means that institutional buyers or high-net-worth people are growing their publicity to Bitcoin.

The information additional reveals that almost all of those newly acquired holdings are being retained for brief intervals (lower than six months), reinforcing the concept that buyers see worth at present value ranges and are keen to carry regardless of market fluctuations.

If this accumulation pattern continues, it might function a robust help mechanism for Bitcoin’s value within the coming months. Onchained additionally speculated that Bitcoin might revisit its all-time excessive and doubtlessly break past it, mentioning doable value targets of $150,000 and even $160,000.

Nevertheless, market circumstances, liquidity, and investor sentiment will play a vital position in figuring out the sustainability of this pattern.

The Surge of New Bitcoin Whales

“Since November 2024, these wallets have collectively acquired over 1 million BTC… Their accumulation tempo has accelerated notably in latest weeks, accumulating greater than 200,000 BTC simply this month.” – By @0nchained pic.twitter.com/jVsFPjY8WA

— CryptoQuant.com (@cryptoquant_com) March 18, 2025

Is Bitcoin Demand Weakening?

Whereas whale accumulation suggests sturdy long-term conviction, one other CryptoQuant analyst, BilalHuseynov, has identified potential considerations about Bitcoin’s demand momentum.

His evaluation exhibits that Bitcoin noticed peaks in demand in each March and December 2024, marking the primary time two demand peaks have occurred in shut succession. Nevertheless, following the March peak, a big decline in demand has been noticed.

BilalHuseynov in contrast the present pattern to earlier market cycles, particularly the 2017-2018 interval, when momentum peaks had been adopted by value fluctuations and a gradual decline in demand.

Whereas components comparable to market dimension, buying and selling quantity, and liquidity have modified considerably since then, the present pattern means that Bitcoin’s demand could also be softening, which might affect value actions within the close to time period.

Function picture created with DALL-E, Chart from TradingView