Bitcoin’s current wave of whale promoting strain is typical of a late-stage crypto cycle and ought to be no extra regarding than it has been up to now, in line with analysts from Glassnode.

On Thursday, a serious Bitcoin whale, recognized as dealer Owen Gunden, made strikes towards promoting, transferring 2,400 Bitcoin (BTC), value $237 million, to the crypto alternate Kraken, in line with blockchain analytics platform Arkham.

It provides to a current spate of Bitcoin whales seemingly shifting away from the cryptocurrency.

Glassnode analysts, nonetheless, argued that the info present that narratives reminiscent of “OG Whales Dumping” or “Bitcoin’s Silent IPO” are extra nuanced in actuality.

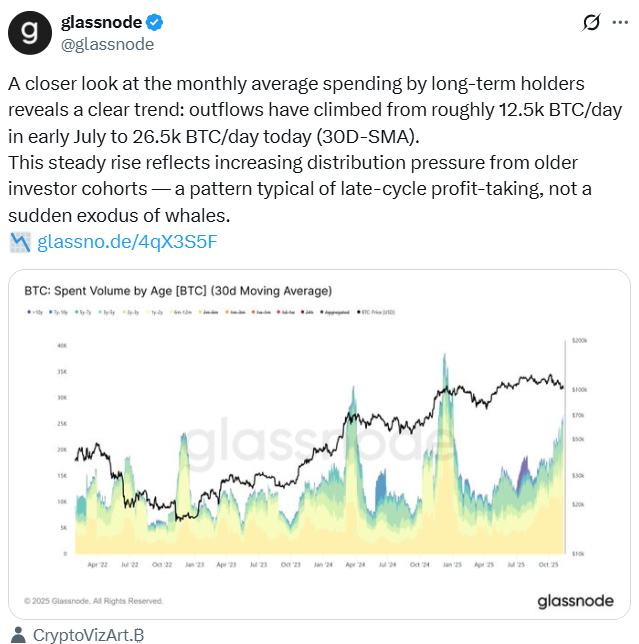

Month-to-month common spending by long-term holders signifies inflows have climbed from over 12,000 Bitcoin per day in early July to round 26,000 as of Thursday, Glassnode mentioned, which factors to repeatedly and evenly spaced distribution, not “particularly OG dumping, however regular bull-market conduct.”

“This regular rise displays rising distribution strain from older investor cohorts — a sample typical of late-cycle profit-taking, not a sudden exodus of whales.”

“Lengthy-term holders have been realizing earnings all through this cycle, simply as they did in each earlier one,” Glassnode added.

Crypto market hasn’t topped but: Kronos Analysis

Talking to Cointelegraph, Vincent Liu, the chief funding officer at quantitative buying and selling agency Kronos Analysis, mentioned that whale gross sales are a structured cycle stream, and regular revenue rotation, slightly than panic, usually point out a late-cycle part, together with rising realized positive factors and resilient liquidity.

Liu, nonetheless, mentioned this “late-cycle” part doesn’t essentially imply the market has topped, so long as there are patrons to scoop up the brand new provide.

“Late cycle doesn’t imply the market is capped, it means momentum has cooled whereas macro and liquidity steer the ship. Fading rate-cut bets and short-term softness have slowed upside, not sunk it,” Liu mentioned.

“On-chain readings trace at a possible backside. Bitcoin’s web unrealized revenue ratio at 0.476 indicators short-term lows could also be forming, providing strategic positioning nevertheless it’s simply certainly one of many indicators that should be tracked to verify a market backside.”

Crypto market sentiment has been fearful because the broader market continues to stoop. Analysts have attributed this to a spread of macroeconomic components, reminiscent of merchants shifting to property with clearer publicity to financial insurance policies and credit score flows.

Market tops are often 4 years aside

Charlie Sherry, the top of finance at Australian crypto alternate BTC Markets, mentioned whales promoting in isolation isn’t often important, however this time, there’s a noticeable lack of significant help on the purchase facet to soak up that promoting.

Nonetheless, he nonetheless thinks it’s too early to know if this can be a signal of a cycle peak, although it’s believable.

Market tops have traditionally occurred roughly 4 years aside, as seen in December 2017, round 1,067 days after the underside, after which in November 2021, roughly 1,058 days after the low.

“The current all-time excessive on Oct. 6 2025 got here 1,050 days from the underside. From that view, it’s believable that we’ve got already topped this cycle and are getting into the early levels of a bear market,” Sherry mentioned.

Market cycles won’t maintain sway anymore

On the similar time, nonetheless, Sherry famous that the “four-year cycle idea isn’t bulletproof,” as there are just a few examples to attract on, and Bitcoin continues to evolve with completely different demand dynamics fueled by exchange-traded funds and company treasuries.

Associated: Bitter crypto temper may gas an sudden rally this month: Santiment

“These patrons don’t commerce cycles or comply with the four-year rhythm. The urge for food of those gamers has been weak lately, however that may change shortly,” he mentioned.

“Solely time will inform whether or not we’ve got simply seen a cycle prime. There are elementary the explanation why Bitcoin might not comply with a four-year rhythm, however the power of these fundamentals is being examined proper now.”

Journal: Good luck suing crypto exchanges, market makers over the flash crash