Bitcoin’s mining community might face an issue adjustment on the decrease aspect for the primary time in almost 4 years. The problem might go down 9% inside the subsequent 5 days, which might be the steepest since July 2021, when China’s ban on mining operations brought about a 50% collapse in international hashrate.

Over the previous two weeks, the overall computational energy securing the Bitcoin blockchain has dropped by almost 30%, in accordance with information from Mempool.house.

Glassnode metrics present that the community’s hashrate now stands slightly below 700 exahashes per second (EH/s), in comparison with a current excessive of round 1,000 EH/s.

Bitcoin miners at this time nearly solely depend on ASICs (application-specific built-in circuits) {hardware}. In earlier occasions of the community’s historical past, CPUs and GPUs had been sufficient to mine cash. Profitability now requires custom-built machines consuming vital energy, over 7,000 watts, and working on 220-volt methods with excessive amperage.

The Bitcoin protocol recalibrates its mining problem each 2,016 blocks to keep up a block manufacturing price of roughly 10 minutes. When fewer machines compete for block rewards, the community responds by decreasing the issue to compensate. This time, the response is anticipated to be extra pronounced.

Profitability metrics spell mining stress

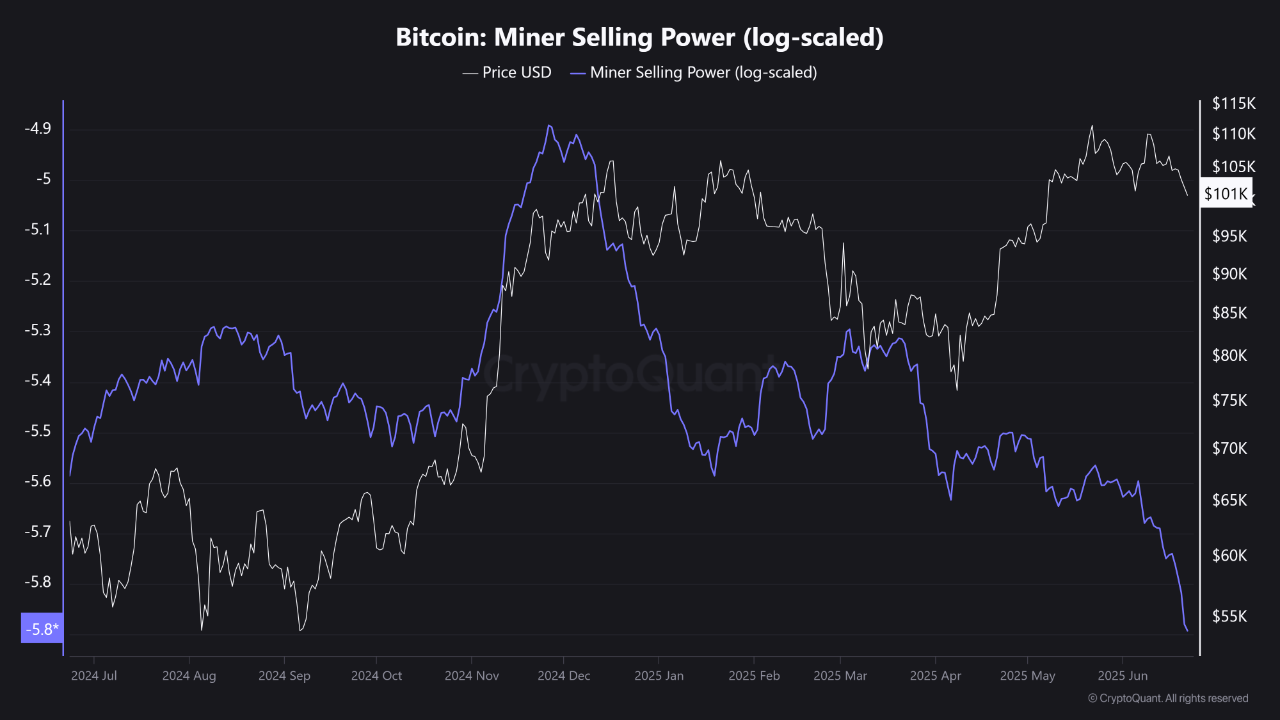

Knowledge from CryptoQuant contributor IT Tech reveals that Bitcoin miners are actually “extraordinarily underpaid.” Per the analyst, the market is in a section of pressured selloffs from mining operations to remain afloat.

In current weeks, the sustainability metric has dropped deep into destructive territory, with an uptick in promoting energy, which means miners are leaning in the direction of letting go of their holdings and away from mining.

Miners had been pretty compensated during times when Bitcoin traded within the $90,000–$105,000 vary between March and Could. But, since early June, the profitability is sort of totally eroded.

CryptoQuant’s Bitcoin: Miner Promoting Energy (log-scaled) chart reveals a downturn within the promoting power of miners. The metric, which accounts for a way a lot Bitcoin miners are able to offloading into the market, has hit a brand new low.

Bitcoin Miner Promoting Energy Chart. Supply: Cryptoquant

As of June 24, problem and hashrate values, a single miner working at 390 TH/s and consuming 7,215 watts of energy at $0.05/kWh would generate a mere $11.76 per day in revenue. It could now take 5,156 days, greater than 14 years, to mine a single Bitcoin below these circumstances.

Mining energy slides as geopolitical variations chunk

On June 22, america launched focused airstrikes towards Iranian nuclear amenities. Whereas not confirmed formally, it’s believed that energy stations could have been impacted.

Iran legalized Bitcoin mining in 2019 and constructed up a large community utilizing sponsored electrical energy from fossil fuels and nuclear vegetation. At its peak, Iran accounted for about 4.5% of the worldwide Bitcoin hashrate. The determine now stands nearer to three.1%.

Following the US strikes, there have been a number of reviews of blackouts and digital community disruptions from each Iran and neighboring Israel. The outages might have affected mining amenities, both damaging or forcing them to close down as a consequence of energy loss.

Some analysts noticed a pointy decline in Bitcoin’s hashrate earlier this week, with the community’s computational energy dropping by 8% between Sunday and Thursday. The hashrate reportedly fell from 943.6 million terahashes per second (TH/s) to 865.1 million TH/s.

The market has thus far rebounded towards the backdrop of US President Donald Trump’s announcement of a “complete ceasefire” settlement between Iran and Israel. Phrase from Trump seemingly helped restore investor confidence, pushing Bitcoin again up above the $106,000 degree on Monday. On the time of this report, the biggest coin by market cap is altering arms round $105,300.