As Bitcoin flirts with the important thing psychological threshold of $100,000, derivatives merchants are carefully looking ahead to indicators that might mark the ultimate leg up—and are already positioning for what could comply with.

Derivatives specialists Gordon Grant and Joshua Lim instructed BeInCrypto that Bitcoin’s transfer previous $100,000 now displays a long-term holding technique, in contrast to the speculative buying and selling seen when it first crossed that threshold after Trump’s election victory.

Bitcoin Nears $100K: A Totally different Type of Ascent?

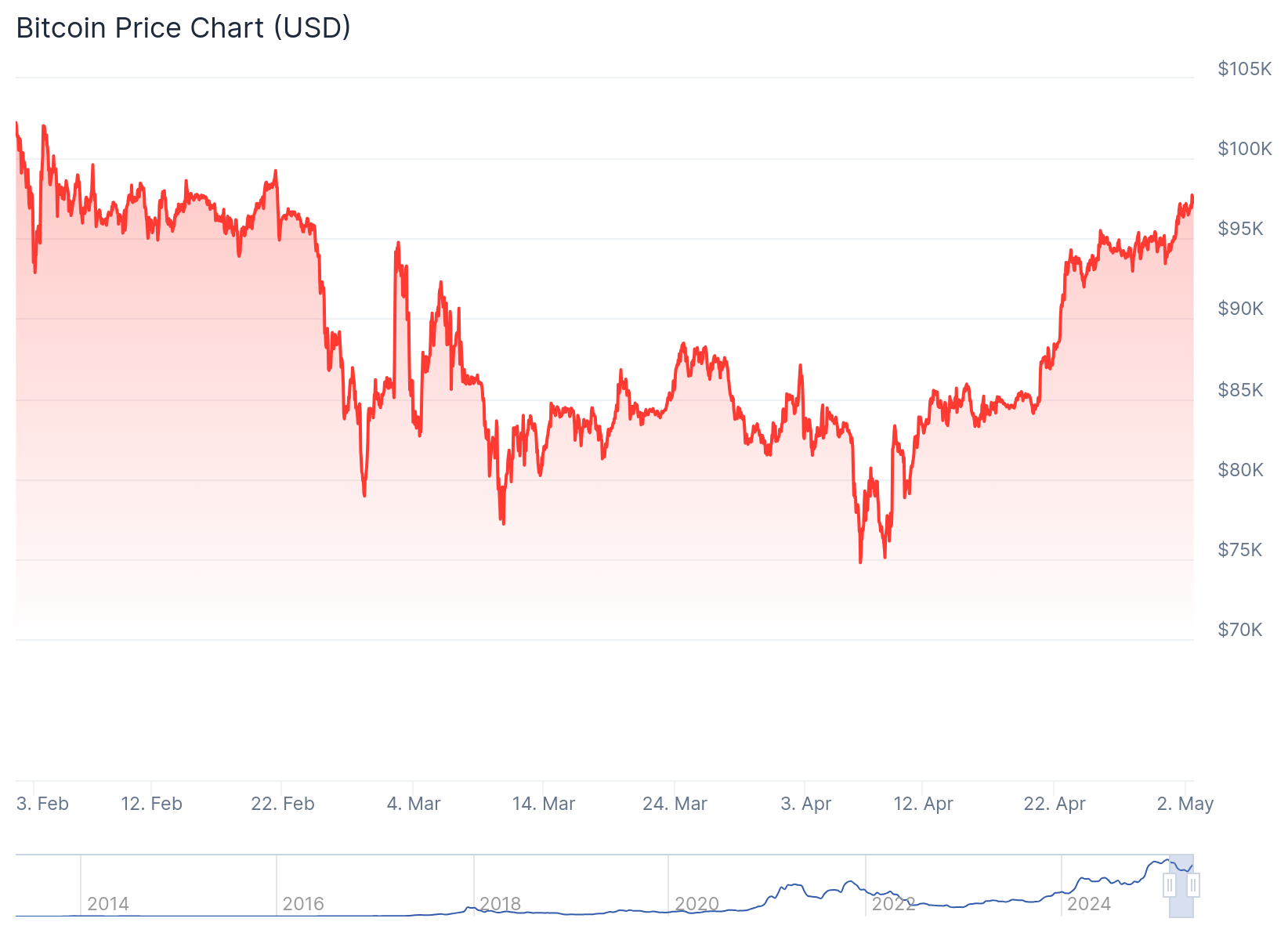

On the time of press, Bitcoin’s worth hovers slightly below $98,000. Because it grows, merchants anxiously look ahead to it to surpass the $100,000 threshold. When it does, will probably be the second time in crypto historical past that this may occur.

Bitcoin worth chart. Supply: CoinGecko.

In line with Cryptocurrency Derivatives Dealer Gordon Grant, the present transfer towards six figures lacks the euphoric power of previous rallies, such because the one after Trump gained the US common election final November. Nevertheless, which may be a very good factor.

“This present bounce again feels rather more of a low-key, torpid reclamation of these highs,” Grant instructed BeInCrypto, referencing Bitcoin’s restoration from lows round $75,000 in early April. “The positioning rinsedown via all key transferring averages… was a correct washout.”

He added that this washout, a pointy transfer decrease that flushed out weak arms, cleared the decks for a more healthy rebound. A “high-velocity bounce” adopted, as Grant phrased it.

“[It] has since responsibly slowed down on the $95,000 pivot—a degree at which Bitcoin has been centered, +/- 15%, for over 5 months now,” he added.

In Grant’s view, this units the stage for Bitcoin to realize a extra vital and lasting climb via the $100,000 mark. This might lead its worth in direction of the $110,000 peak it touched across the time of the US inauguration earlier this yr.

Nevertheless, he additionally identified a number of key elements that have to be aligned within the derivatives marketplace for Bitcoin to launch greater.

Contained Volatility: A Key Ingredient for Bitcoin’s Subsequent Surge

For Bitcoin to achieve unprecedented ranges, volatility wants to stay in verify.

Volatility measures the extent and velocity of Bitcoin’s worth modifications. A bullish state of affairs favors secure or progressively rising costs over wild swings.

In line with Grant, merchants who promote choices on Bitcoin volatility now exhibit calmer conduct than throughout January’s worth rally.

“Present complacency amongst vol sellers in fading the technical threshold at $100K is markedly completely different,” he stated.

Grant added that, again in December, volatility spiked on expectations of a speedy moonshot towards $130,000–$150,000. Now, nonetheless, implied volatility has really fallen by round 10 factors throughout the last 10% of Bitcoin’s climb—an uncommon dynamic that has punished merchants holding out-of-the-money choices who had been betting on massive worth swings.

This time, the substantial lack of market optimism additionally contributes to the scenario.

The Rise of Institutional Patrons

Market sentiment has shifted considerably since January. The thrill seen throughout Trump’s election has been changed by uncertainty. In line with Grant, souring macro circumstances reminiscent of tariff-driven fairness selloffs and rising warning amongst merchants have contributed to this temper shift throughout markets.

“Whereas BTC on first launch to/via $100K was accompanied by euphoria about presidential insurance policies… the re-approach has been marred by malaise,” Grant defined.

In brief, the motivation to purchase could now be pushed extra by worry than greed.

Joshua Lim, World Co-Head of Markets at FalconX, agreed with this evaluation, highlighting a notable shift within the main supply of Bitcoin demand.

“The dominant narrative is extra round Microstrategy-type equities accumulating Bitcoin, that’s extra constant patrons than the retail swing merchants,” Lim instructed BeInCrypto.

In different phrases, extra speculative retail shopping for may need fueled earlier enthusiasm round Bitcoin’s worth hitting $100,000. This time, the extra constant and vital shopping for is coming from massive firms adopting a long-term Bitcoin holding technique, much like the one adopted by Michael Saylor’s Technique.

The current formation of 21 Capital, backed by mega firms like Tether and Softbank, additional confirms this shift in motivation.

Constant institutional shopping for may maintain a rise in Bitcoin’s worth over time.

Why Are Establishments More and more Bullish on Bitcoin?

With rising momentum from sovereign gamers and company treasuries, institutional shopping for could also be crucial in sustaining Bitcoin’s subsequent upward trajectory.

Grant highlighted that creating international locations looking for to maneuver away from a weakening greenback and in direction of a extra impartial asset like Bitcoin might play a major function. If this had been to occur, it’d signify a probably tectonic shift to international financial coverage.

“The World South, tiring of wonky and inconstant greenback insurance policies, could also be actually desirous about dumping {dollars} for BTC,” Grant defined, clarifying, “That’s a reserve supervisor choice, not a spec/leverage place.”

Elevated institutional adoption strengthens the concept that Bitcoin now serves as a strategy to scale back danger in opposition to points pertinent to monetary methods, like inflation or foreign money devaluation.

In the meantime, extra firms are viewing Bitcoin as a reliable treasury asset.

“The proliferation of SMLR, 21Cap, and plenty of others, together with NVDA deciding they should derisk their stability sheets by rerisking on BTC—even because it approaches the highest decile of all-time costs,” Grant pointed to as proof.

Merely put, even massive establishments are selecting to tackle the danger of Bitcoin’s worth fluctuations as a possible offset to different, probably bigger monetary dangers.

Regardless of the thrill surrounding Bitcoin’s method to $100,000, the true anticipation facilities on its persevering with improvement as an more and more everlasting part of the monetary system.