The Bitcoin worth has rebounded almost 20% after slipping near $60,000 on February 6. The transfer has revived “buy-the-dip” hopes and fueled discuss of a neighborhood backside. On the similar time, US demand indicators have began to get well from latest lows.

However beneath the floor, quantity indicators, on-chain knowledge, and worth construction recommend the rally could also be fragile. A number of warning patterns now resemble setups that preceded main declines on this cycle.

Bear Flag Exhibits Huge Cash Is Not Totally Dedicated

One of many clearest warning indicators comes from the Klinger Oscillator, a volume-based indicator that tracks huge cash move.

In contrast to indicators such because the CMF, which focus primarily on short-term big-money stress, the Klinger Oscillator measures large-wallet quantity depth throughout traits. It’s designed to focus on how massive gamers place themselves over time, not simply day-to-day exercise.

In easy phrases, it exhibits whether or not huge cash is quietly accumulating or getting ready to promote into rallies.

Between October 6 and January 14, Bitcoin fell from round $126,000 to $97,800, a decline of roughly 22%. Throughout that interval, the Klinger Oscillator moved larger whereas the value weakened. This created a bearish divergence.

Weakening Institutional Flows: TradingView

That divergence warned that quantity power by massive wallets (presumably whales and establishments) was not supporting worth restoration. Inside weeks, Bitcoin prolonged its decline towards $60,000 because the Klinger studying dropped sharply (doable huge cash outflows).

An analogous sample is forming once more.

Between February 2 and February 9, the value drifted decrease whereas the Klinger Oscillator trended upward. This means massive gamers could also be positioning (latest buys) to promote into rebounds relatively than construct long-term publicity.

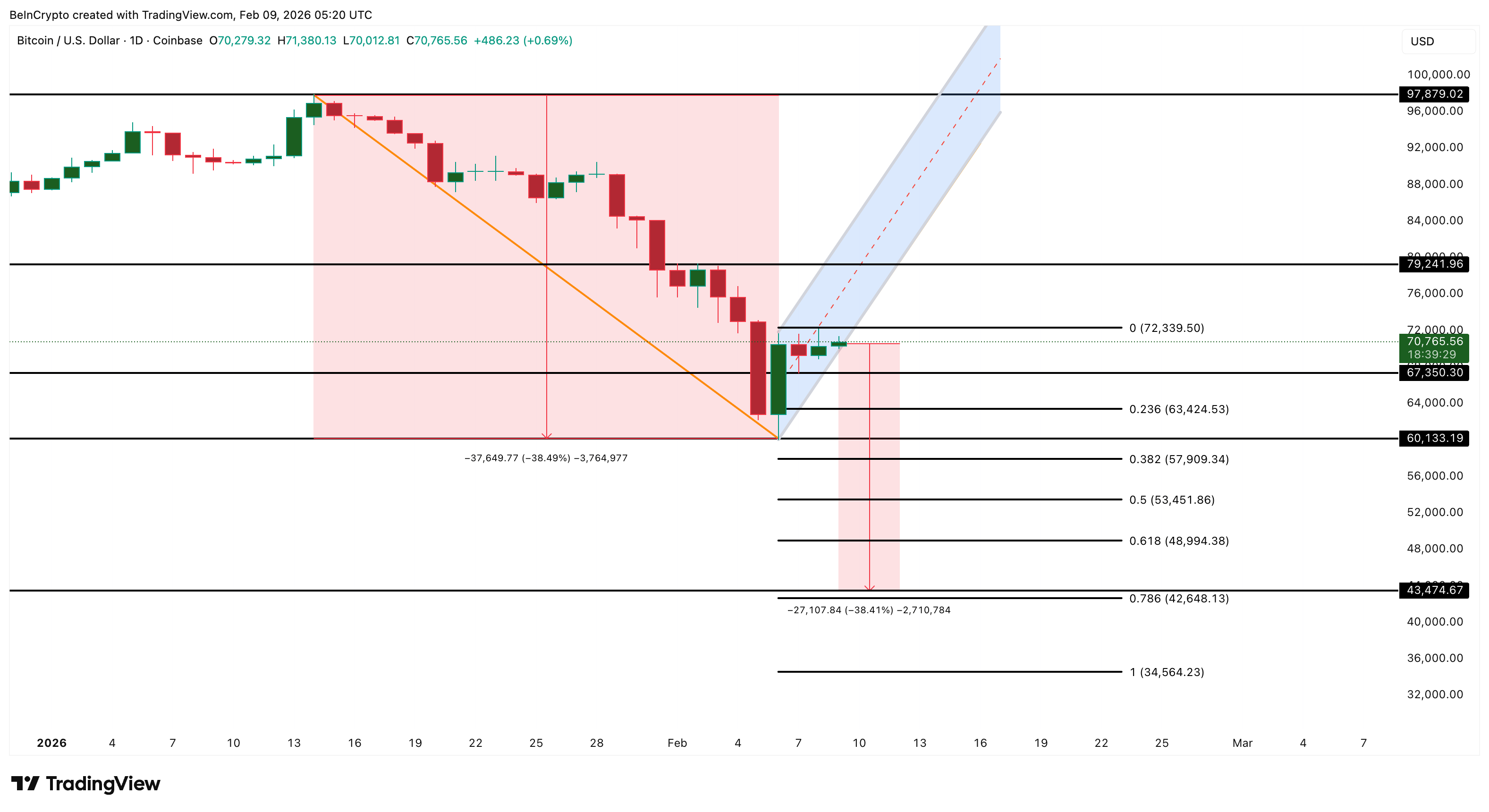

On the similar time, Bitcoin’s drop from mid-January to early February fashioned a pointy draw back “pole.” The present worth bounce motion resembles a bear flag, a sample that usually indicators a continuation of the decrease pattern, with a close to 40% crash chance if the decrease trendline help provides method. That might entice the bulls shopping for into the bounce.

$BTC Kinds A Bull Entice”>

$BTC Kinds A Bull Entice”>

$BTC Kinds A Bull Entice: TradingView

When rising Klinger readings align with a bear flag, it normally means rallies lack deep institutional help. Huge gamers are lively, however not in accumulation mode, and would possibly distribute at any given probability. Days of $BTC ETF outflows within the close to time period would validate the Klinger-led speculation.

Bettering US Demand Has Did not Mark Bottoms Earlier than

This technical weak point doesn’t exist in isolation. It comes whilst US demand has began to enhance.

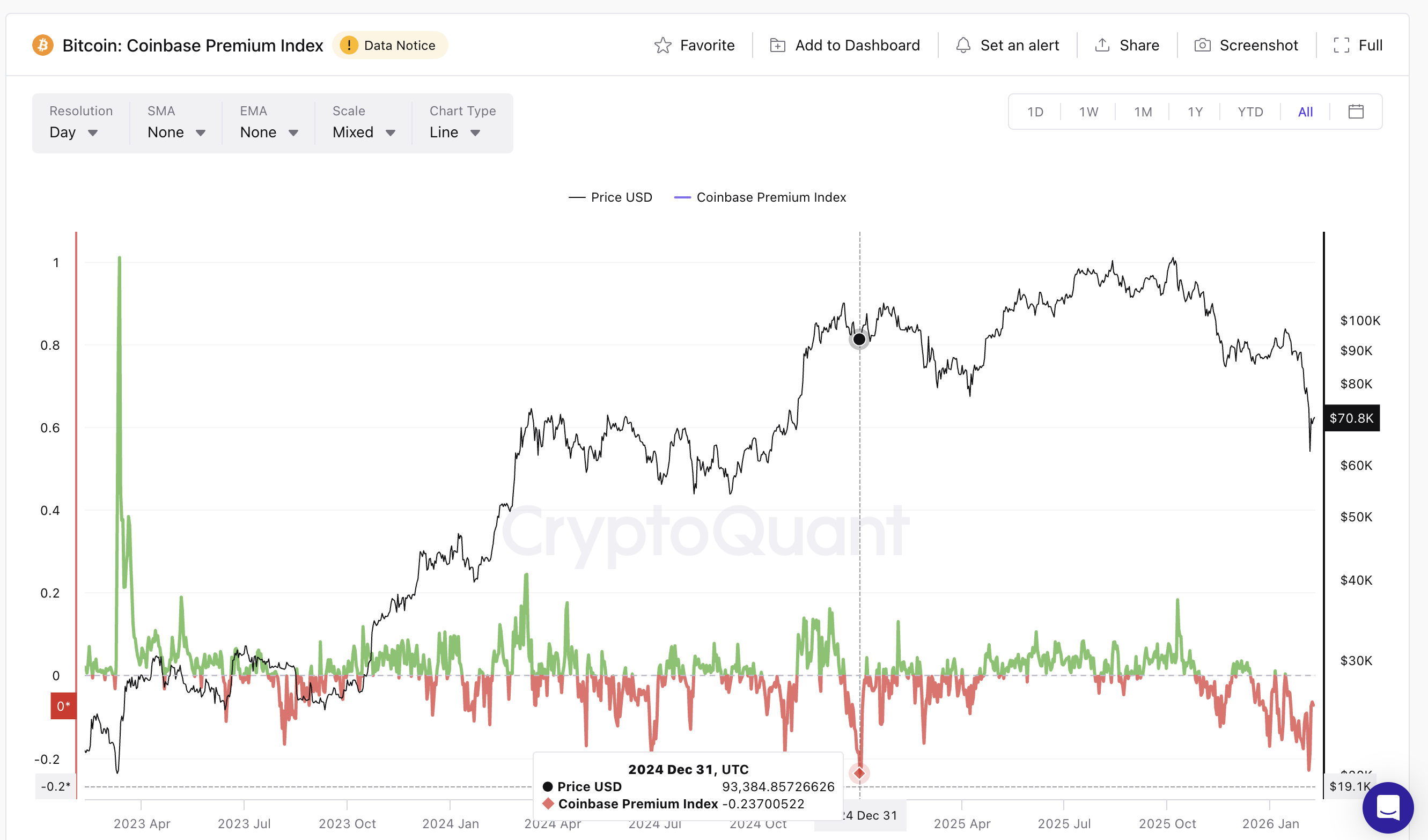

The Coinbase Premium Index tracks whether or not Bitcoin trades at a premium or low cost on US-based Coinbase in contrast with international exchanges. It primarily displays American institutional demand.

On February 4, the index fell to round -0.22, exhibiting weak US participation. This stage intently matched December 31, 2024, when the index dropped to -0.23. At the moment, Bitcoin traded close to $93,300.

Coinbase Premium Index: CryptoQuant

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Many merchants believed a backside had fashioned. As a substitute, the value later fell to about $76,200, a decline of almost 18%.

Since early February, the index has recovered to close -0.07, signaling enhancing US curiosity and aligning with the Klinger oscillator’s rising studying. Nonetheless, historical past exhibits that demand restoration typically comes earlier than worth bottoms, not after. In 2024, US demand improved first. The deeper correction got here later.

On-chain knowledge provides one other layer of danger.

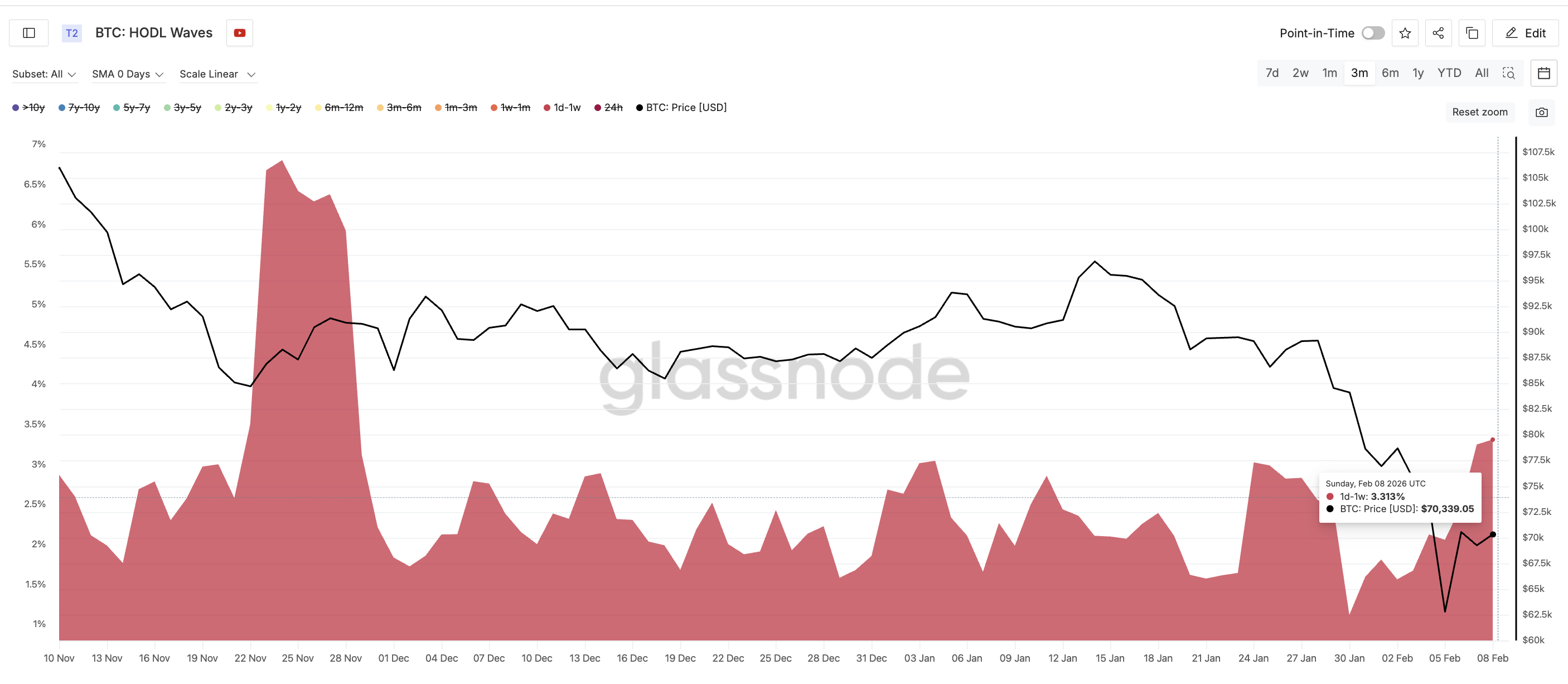

The 1-day to 1-week holder group, made up of short-term merchants, elevated its share of provide from about 2.05% to over 3.3% since February 5 (throughout the 20% rebound). That may be a rise of greater than 60% in simply days, as highlighted by HODL Waves, a metric segregating wallets by time.

$BTC Cohort Shopping for The Dip”>

$BTC Cohort Shopping for The Dip”>

Brief-Time period $BTC Cohort Shopping for The Dip: Glassnode

This cohort tends to promote rapidly when costs weaken. Their rising presence makes the market extra unstable. An analogous surge in short-term holders in late January was adopted by a speedy 3% pullback. Up to now, enhancing US demand is being matched by rising hypothesis, not robust conviction.

Key Bitcoin Worth Ranges Present The place the Bounce May Fail

All indicators now converge round a couple of crucial Bitcoin worth zones.

The primary main help sits close to $67,350. A day by day shut under this stage may restart promoting stress.

If that breaks, the following draw back targets are:

- $60,130, the latest low

- $57,900 (a key Fibonacci help and a mear 18% correction zone from the present ranges)

- $53,450 a serious retracement zone

- $43,470, the bear flag projection

A transfer from present ranges to $43,400 would signify an extra decline of roughly 35%. On the upside, Bitcoin should reclaim $72,330 to stabilize and get out of the doable bull entice. This stage capped latest rallies.

Bitcoin Worth Evaluation: TradingView

Above that, $79,240 stays decisive. Recovering this zone would retrace about half of the prior fall and sure invalidate the bearish construction. Solely then would the trail towards $97,870 reopen. Till that occurs, all Bitcoin worth rallies stay susceptible.

The put up Bitcoin’s 20% Bounce Seems Like a Bull Entice Regardless of Bettering US Demand — Right here’s Why appeared first on BeInCrypto.