Because the starting of February, Bitcoin has had issue stabilizing above the $100,000 mark. Donald Trump’s tariff wars have triggered important market volatility, conserving merchants on edge.

Nevertheless, regardless of these headwinds, a key group of coin holders—these with no recorded historical past of promoting—have intensified their accumulation. This alerts a robust conviction within the asset’s long-term prospects.

Bitcoin Lengthy-Time period Holders Stay Resilient

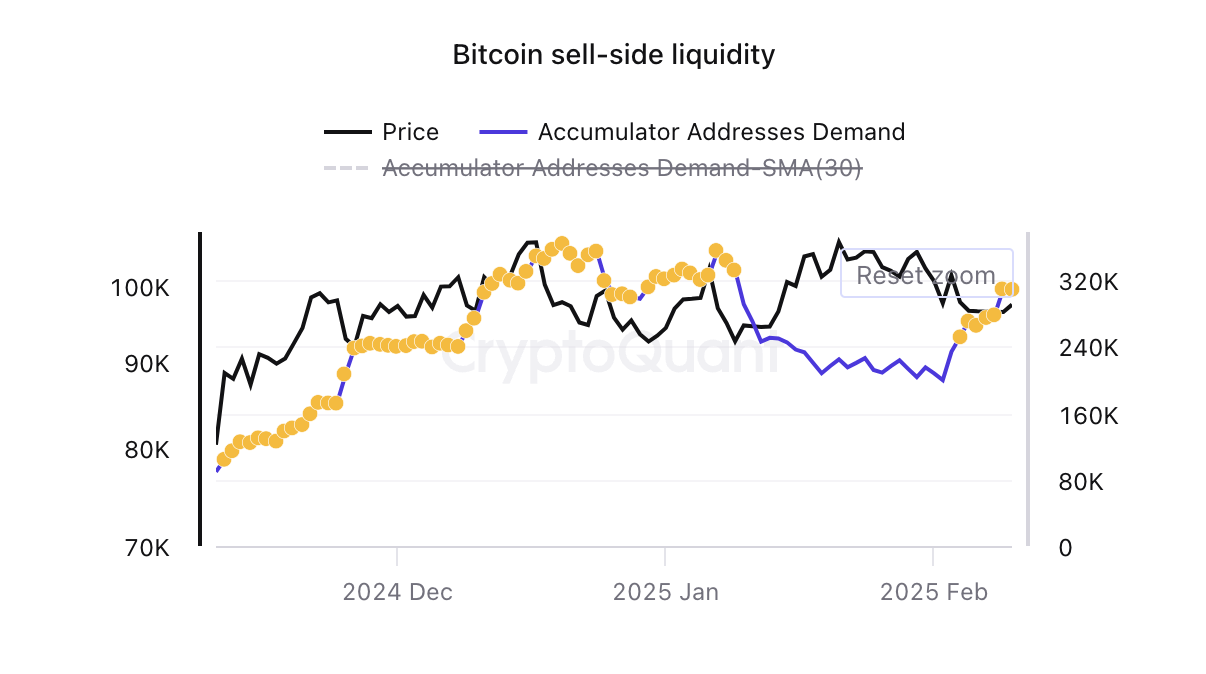

Information from the on-chain analytics platform CryptoQuant reveals a spike in Bitcoin’s Everlasting Holder Demand. Based on the info supplier, Bitcoin’s everlasting holders consist of homeowners who primarily accumulate the coin over time and by no means interact in spending transactions, indicating a long-term holding technique.

Bitcoin Accumulator Addresses Demand. Supply: CryptoQuant

BeInCrypto’s evaluation of the coin’s accumulator handle demand reveals that because it hit a year-to-date low on February 2, it has soared. This displays the surge in accumulation amongst these long-term traders.

Demand has rebounded even amid Bitcoin’s early February correction, signaling that long-term holders stay assured within the main asset. In comparison with earlier cycles, fewer long-term holders are promoting, reinforcing the bullish conviction.

Moreover, BTC’s try and cross above its 20-day exponential shifting common (EMA) confirms the resurgence in demand for the king coin. At press time, BTC trades at $98,022, barely beneath this key shifting common, which kinds resistance above it at $98,995.

BTC 20-Day EMA. Supply: TradingView

The 20-day EMA tracks an asset’s common worth over the previous 20 buying and selling days by giving extra weight to latest worth information. When an asset is poised to interrupt above this shifting common, it alerts rising bullish momentum, suggesting a possible shift towards an uptrend if sustained.

BTC Value Prediction: Sturdy Holder Demand to Push BTC Above Key Resistance?

Sustained demand for BTC amongst its everlasting holders may set off a rally above the resistance fashioned by its 20-day EMA. A profitable break above this stage would supply the momentum wanted for the coin to reclaim its all-time excessive of $109,356.

BTC Value Evaluation. Supply: TradingView

Nevertheless, if accumulation stalls amongst BTC traders, it may reverse present good points and drop to $92,325.