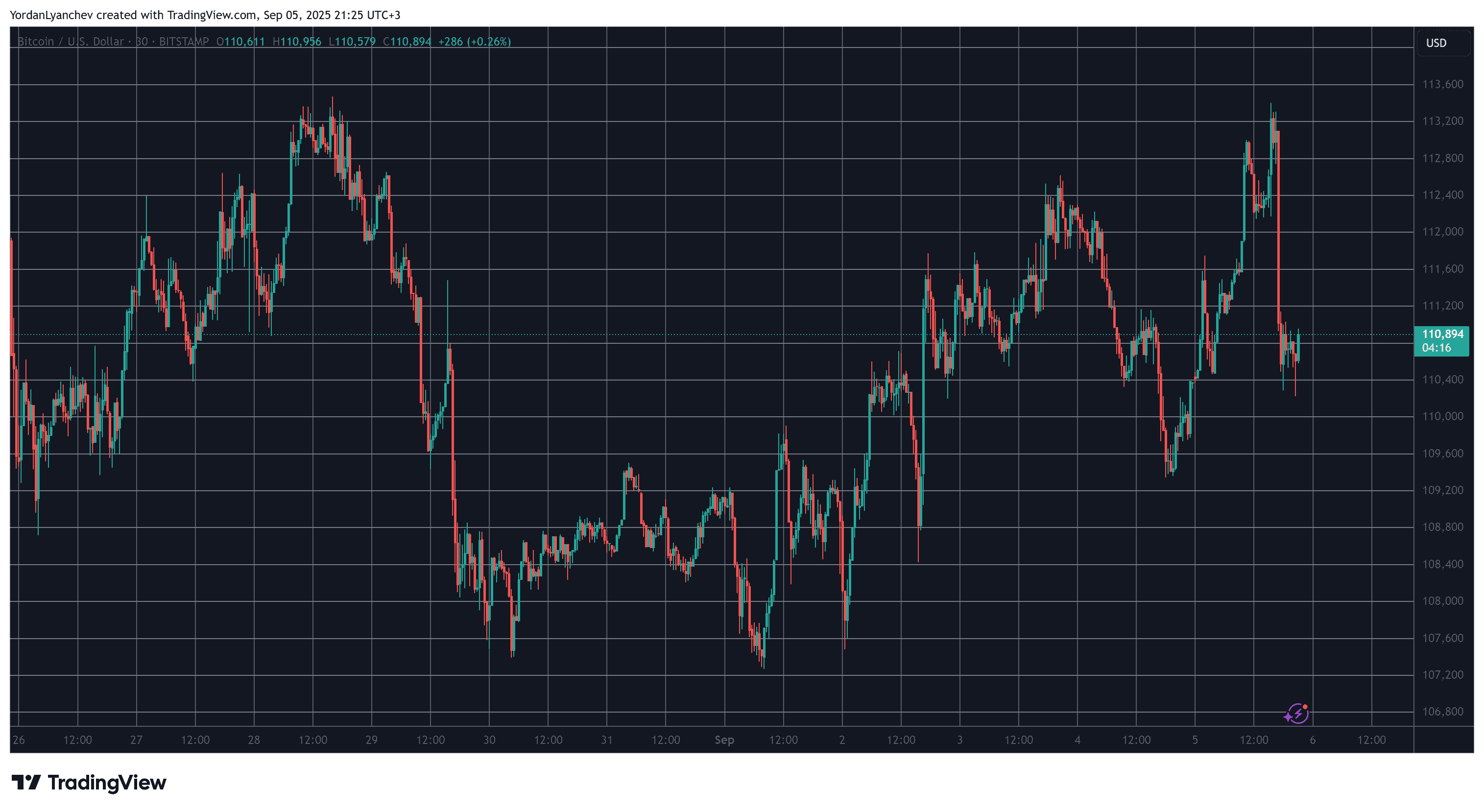

Bitcoin’s gradual worth restoration that took the asset to a weekly peak earlier at this time got here to a screeching finish because the asset was violently rejected at that line.

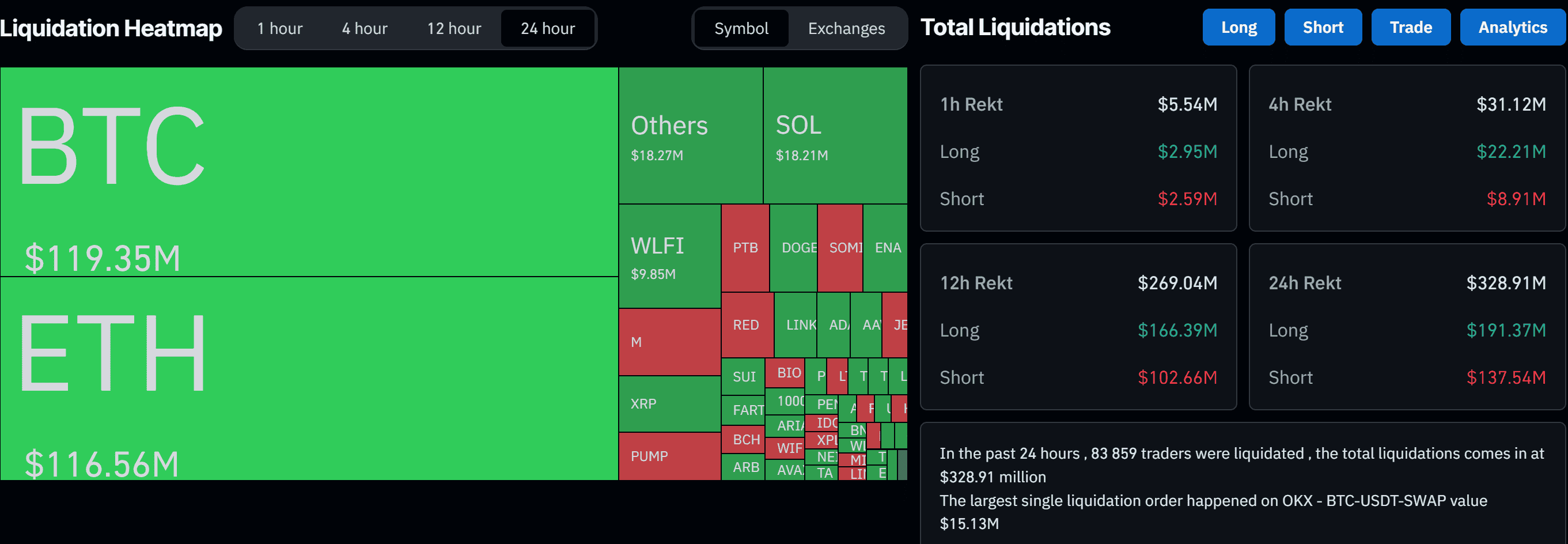

The altcoins adopted go well with, which has wrecked overleveraged merchants, with greater than 80,000 such market contributors getting liquidated over the previous day.

The first cryptocurrency had a troublesome week, during which its worth tumbled towards $107,000 on a number of events, however the bulls in the end managed to defend that essential assist. Furthermore, they reversed BTC’s trajectory up to now few days, which culminated earlier at this time with a worth pump to a weekly excessive of $113,500.

This spectacular improve got here after the newest US jobs report, which confirmed that the US financial system could be in a extra dire situation than many believed.

This was considered a bullish improvement for riskier belongings like BTC, because it hinted that the US Federal Reserve might be pressured to decrease the rates of interest much more within the upcoming FOMC assembly in September.

Nonetheless, that’s the place bitcoin’s ascent got here to a halt because the asset was rejected there and pushed south by over three grand in lower than an hour. Many altcoins mimicked BTC’s nosedive and dropped from their respective day by day highs, together with ETH, which slumped from effectively over $4,400 towards $4,200.

Information from CoinGlass exhibits that this volatility has harmed over 83,000 overleveraged merchants, who’ve been wrecked up to now 24 hours. The only-largest wiped-out place happened on OKX and was value over $15 million.

The whole worth of liquidations has risen to $330 million on a day by day scale – $119 million in longs for BTC, adopted by $116 million for ETH.