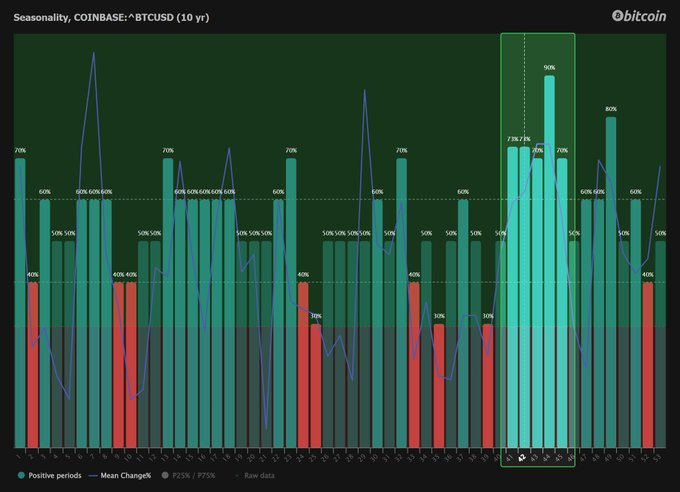

Bitcoin (BTC) is getting into its most traditionally bullish interval of the 12 months, with information exhibiting that late October via early November has delivered the best chance of constructive returns over the previous decade.

A ten-year seasonality evaluation signifies that Bitcoin has recorded positive aspects in as much as 90% of cases throughout this timeframe, in keeping with insights shared by charting platform TrendSpider.

This sample has usually preceded main rallies, together with the robust uptrends seen in 2017 and 2020, as investor sentiment and liquidity usually strengthen heading into year-end.

Market observers be aware that Bitcoin’s seasonal development aligns with the continued consolidation section across the $110,000 spot, suggesting circumstances may very well be favorable for one more leg increased.

The sample held true in 2024, when Bitcoin surged previous $100,000 for the primary time, fueled by spot ETF inflows, renewed institutional demand, and rising regulatory optimism following the re-election of Donald Trump, who has been considered as pleasant to the cryptocurrency sector.

The rally prolonged into 2025, with the cryptocurrency reaching new file highs above $117,000 earlier this 12 months.

At the moment, Bitcoin is buying and selling round $110,000, consolidating after months of volatility. Analysts view this pause as a possible setup for one more breakout.

Certainly, after hitting a file excessive above $125,000, Bitcoin retreated amid rising commerce tensions between the USA and China.

Bitcoin’s key worth ranges to observe

From a technical perspective, evaluation by Ted Pillows in an X submit on October 20 noticed that Bitcoin has regained a important assist zone between $109,000 and $110,000, signaling renewed purchaser power after latest volatility.

Pillows famous that the subsequent key resistance lies at $112,000, a stage that, if reclaimed, might pave the way in which for a broader rally towards the mid-$110,000s and doubtlessly increased.

Certainly, whereas the $110,000 assist stays fragile, it’s essential, as sustaining it’s key to pushing the asset towards the $115,000 resistance zone.

Featured picture by way of Shutterstock