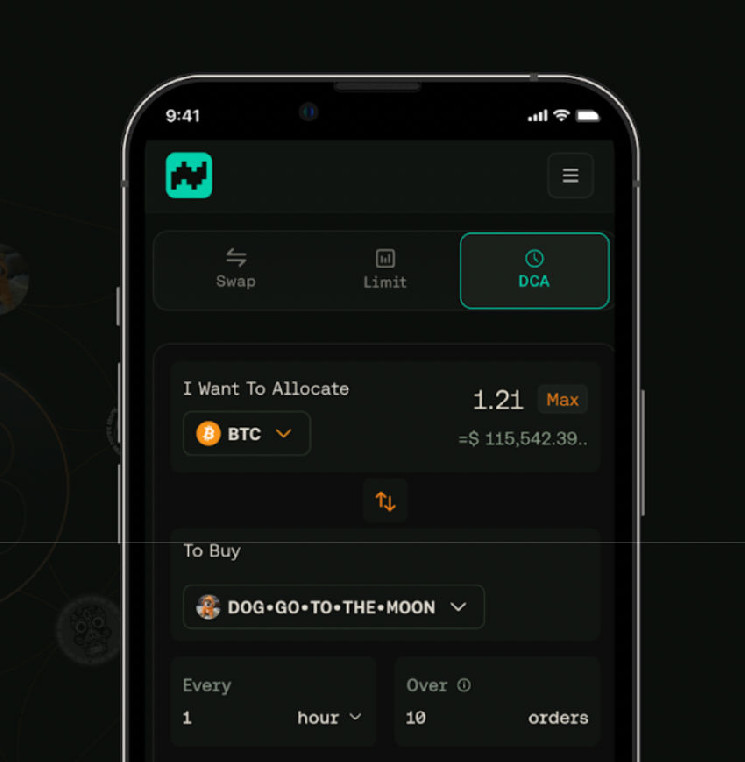

Miami, Florida – Bitflow, the decentralized Bitcoin trade, has unveiled Automated Greenback-Price Averaging (DCA) on Stacks, permitting customers to build up BTC and Runes tokens whereas sustaining full custody of their property. This milestone strengthens Stacks as a Bitcoin Layer 2 hub for DeFi automation.

—

Automating BTC Accumulation With Bitflow Keepers

Automated DCA is powered by Bitflow Keepers, the platform’s good automation engine, enabling trustless, recurring purchases of BTC, stablecoins, STX, sBTC, SIP-10 tokens, and Runes property like $DOG (DOG•GO•TO•THE•MOON), Stacks’ high memecoin.

By eradicating the necessity for handbook trades or market timing, Bitflow’s DCA resolution brings effectivity, consistency, and automation to Bitcoin investing. Customers can now develop their crypto holdings seamlessly whereas collaborating within the rising Bitcoin-native financial system.

“Bitcoin DeFi is lastly unlocking actual automation with Automated DCA. Utilizing Bitflow Keepers, this highly effective function lets customers program BTC investments in a completely decentralized, trustless method.”

Dylan Floyd, Bitflow Co-Founder and Lead Developer

Enhancing Bitcoin’s Utility as a Productive Asset

Bitflow’s automation framework is designed to maximise Bitcoin’s potential, positioning Stacks because the main L2 for DeFi innovation. Supporting property past BTC, together with Runes and SIP-10 tokens, its DEX performs a key position in increasing Bitcoin-native finance with AI-driven, programmatic buying and selling methods.

The brand new DCA function permits customers to:

Automate recurring purchases of BTC and Runes tokens for long-term accumulation.

Eradicate market timing stress by following a structured funding technique.

Execute automated profit-taking methods primarily based on predefined situations.

Keep full self-custody with all transactions occurring onchain, eradicating third-party dangers.

By enabling clear and systematic execution of BTC investing methods, Bitflow is reinforcing Bitcoin as a yield-generating asset whereas advancing Stacks because the infrastructure layer for Bitcoin DeFi.

A Roadmap for AI-Pushed DeFi on Bitcoin

Bitflow’s DCA launch is just the start. Upcoming releases will introduce:

Automated yield methods to optimize BTC-based yield farming.

Market-triggered swaps, permitting trades primarily based on worth traits and volatility alerts.

Cross-layer asset flows to seamlessly transfer BTC-based property between Bitcoin Layer 1 and Stacks Layer 2, enhancing liquidity effectivity.

With clever, non-custodial automation instruments, Bitflow is shaping the subsequent era of programmable Bitcoin finance. Automated DCA marks step one towards a future the place Bitcoin isn’t simply saved—it’s actively put to work.

—

About Bitflow Finance

Bitflow is the deepest liquidity hub on Stacks, designed for seamless Bitcoin asset buying and selling. With its Runes Automated Market Maker, DEX aggregator for greatest swap charges, and multihop swap capabilities, Bitflow combines Stacks’ scalability with Bitcoin’s safety to drive the way forward for Bitcoin-native DeFi. Study extra: https://www.bitflow.finance/