Bitnomial Clearinghouse LLC obtained approval from the US Commodity Futures Buying and selling Fee (CFTC) to clear totally collateralized swaps, enabling its mother or father firm, Bitnomial, to launch prediction markets and supply clearing providers to different platforms.

In line with Friday’s announcement, Bitnomial’s prediction market will cowl crypto and financial occasions, alongside its current Bitcoin (BTC) and crypto derivatives merchandise. The contracts are designed to permit merchants to take positions on outcomes, resembling token worth ranges and macroeconomic knowledge.

The approval expands the umbrella of the buying and selling merchandise supplied by Bitnomial. Based mostly in Chicago, the corporate’s change and clearing arms supply perpetuals, futures, choices contracts and leveraged spot buying and selling. The corporate’s clearinghouse additionally helps crypto-based margin and settlement, permitting authorized merchandise to be margined and settled straight in digital property.

Bitnomial president Michael Dunn stated the approval permits the corporate to serve “each our personal change and exterior companions, constructing a clearing community that strengthens all the prediction market ecosystem.”

Bitnomial Clearinghouse operates as an infrastructure-only clearing supplier, reasonably than a retail competitor, giving authorized companions entry to its margin and settlement techniques and permitting collateral to be transformed between US {dollars} and cryptocurrency.

The approval follows a current inexperienced gentle to launch a CFTC-regulated spot cryptocurrency buying and selling platform within the US, permitting clients to purchase, promote and commerce leveraged and non-leveraged crypto merchandise on a federally supervised change.

Occasion contracts on Polymarket. Supply: Polymarket

Associated: Coinbase could debut prediction markets, tokenized shares on Wednesday: Report

Polymarket features momentum within the US

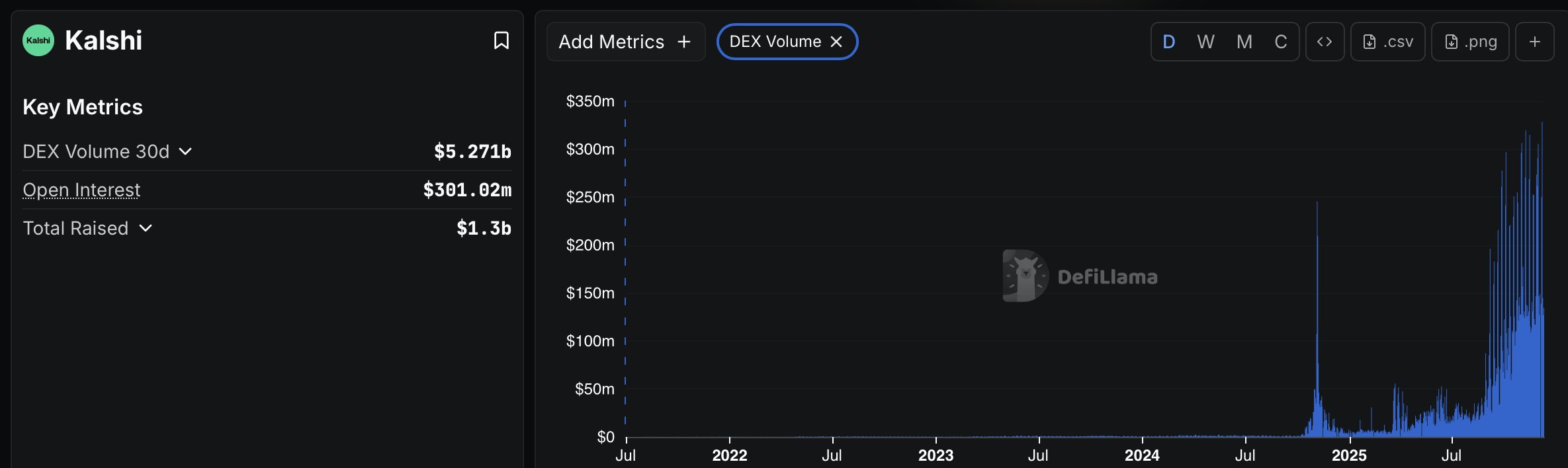

Prediction markets have emerged as a serious pattern in 2025. In line with DefiLlama knowledge, prediction market Kalshi has generated $5.27 billion in buying and selling quantity during the last 30 days, whereas blockchain-based Polymarket recorded slightly below $2 billion over the identical time interval.

Kalshi buying and selling quantity. Supply: DefiLlama

In November, Polymarket obtained regulatory approval from the CFTC to function an intermediated buying and selling platform, permitting entry by means of registered brokers below the foundations governing US markets.

The approval adopted the closure of an investigation in July led by the CFTC and US Division of Justice into whether or not Polymarket had allowed buying and selling by US customers, a probe that included an FBI search of founder Shayne Coplan’s dwelling.

Polymarket, which settles contracts on the Polygon blockchain utilizing the USDC (USDC) stablecoin, has additionally secured a number of partnerships in current months, together with the UFC and Zuffa boxing and fantasy sports activities operator PrizePicks in November.

Journal: Meet the onchain crypto detectives combating crime higher than the cops