Decentralized AI community Bittensor is ready to bear its first halving occasion in December, and TAO is outperforming the remainder of the altcoin market in anticipation.

TAO’s tokenomics are modeled after Bitcoin’s, and consequently, the TAO token undergoes a halving occasion roughly each 4 years, relying on the mining fee. The community’s first halving is slated for December 10.

Till 2024, BTC sometimes adopted a sample during which it might bear a halving, block rewards could be minimize in half, and the asset would then development upwards to a brand new all-time excessive over the subsequent yr or two. 2024, nevertheless, marked the primary time BTC reached a brand new all-time excessive earlier than a halving, relatively than after.

That being mentioned, the market seems to be anticipating a bullish transfer for TAO forward of its first halving, as TAO is up 50% over the past 30 days, and was additionally one of many strongest altcoins off its liquidation lows on October 10.

TAO Chart – CoinGecko

TAO is the second best-performing high 100 altcoin over the past 30 days, solely trailing Zcash, which has surged 400% in the identical timeframe.

Impression on the Bittensor Ecosystem

Sami Kassab, a managing accomplice at Bittensor funding fund Unsupervised Capital, printed his Bittensor halving thesis on Oct. 14, and expects TAO’s robust value motion to proceed.

“Should you dig again into the lore of Bitcoin’s first halving, the temper feels eerily acquainted: pessimists satisfied that Bitcoin would loss of life spiral, whereas optimists believed the system would adapt as a result of the incentives demanded it, “ mentioned Kassab.

Nevertheless, the Bittensor halving has a possible knock-on impact that Bitcoin has by no means needed to take care of: its subnets.

Bittensor sub-networks earn TAO emissions primarily based on their contributions to the community as a complete, and whereas on the floor, the halving means there will likely be much less circulating provide for miners and validators to promote, it additionally means much less liquidity will move by means of every subnet.

Based on Kassab, this liquidity constraint ought to amplify volatility, and the path of web flows might have an outsized value affect on subnets, each constructive and adverse.

“So our view is: we expect subnet flows are about to show constructive. And in a post-halving world the place volatility is greater and liquidity is tighter, that’s a tailwind for subnet tokens,” he concluded.

Subnets Soar

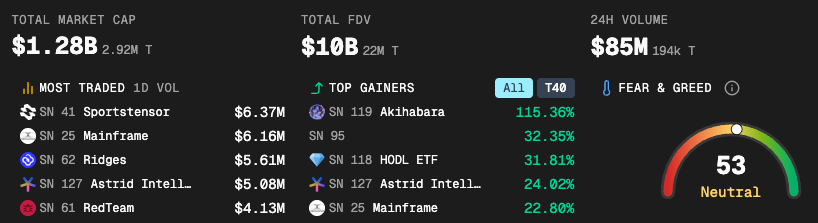

Bittensor subnets at present command a cumulative market capitalization of $1.28 billion in line with TaoStats, which is simply over 30% of TAO’s 4.26 billion market cap, led by Subnet 64, Chutes, and Subnet 62, Ridges.

Subnet Stats – TaoStats

The entire subnet valuation is now up almost 100% since August as extra subnets proceed to come back on-line.

One notable subnet and Bittensor infrastructure agency, the Yuma Group, is led by Barry Silbert, founder and CEO of Digital Foreign money Group. Yuma at present powers 14 totally different subnets, which account for $71 million of the circulating subnet valuation.

“Establishments are beginning to acknowledge how shortly Bittensor is evolving into an necessary element of world AI infrastructure,” Yuma COO Greg Schvey advised The Defiant.

“At Yuma Asset Administration, our objective is to bridge capital into the community in a means that helps the Bittensor ecosystem. By providing conventional monetary merchandise like these, we’re in a position to present buyers with entry that will in any other case require distinctive technical experience,” Schvey added.