In a latest interview with Citi, BlackRock CEO Larry Fink additional reiterated his perception in Bitcoin (BTC) and blockchain know-how. Fink said that there’s a lot of “legitimacy” round BTC and the blockchain know-how across the asset. The chief of the world’s largest asset supervisor, nonetheless, doesn’t consider BTC is a foreign money, as an alternative evaluating it to “digital gold.”

BlackRock’s Lengthy-Time period Outlook On Bitcoin

Within the interview with Citi, Fink stated that almost all of “BlackRock’s enterprise is predicated on long-termism.” This assertion means that BlackRock is sort of bullish on BTC’s long-term prospects.

Fink additionally stated that Bitcoin (BTC) is a foreign money of concern. He said that individuals purchase BTC as a result of they’re scared of their nation’s safety and the debasement of their foreign money.

Will The Asset Climb To a New Peak Quickly?

Bitcoin (BTC) has hit a number of all-time highs over the past yr. BTC’s climb to new highs could possibly be attributed to excessive ETF inflows. BlackRock’s Bitcoin ETF, IBIT, is among the many hottest BTC ETFs available in the market. Crypto-based ETF inflows are anticipated to proceed rising over the approaching years.

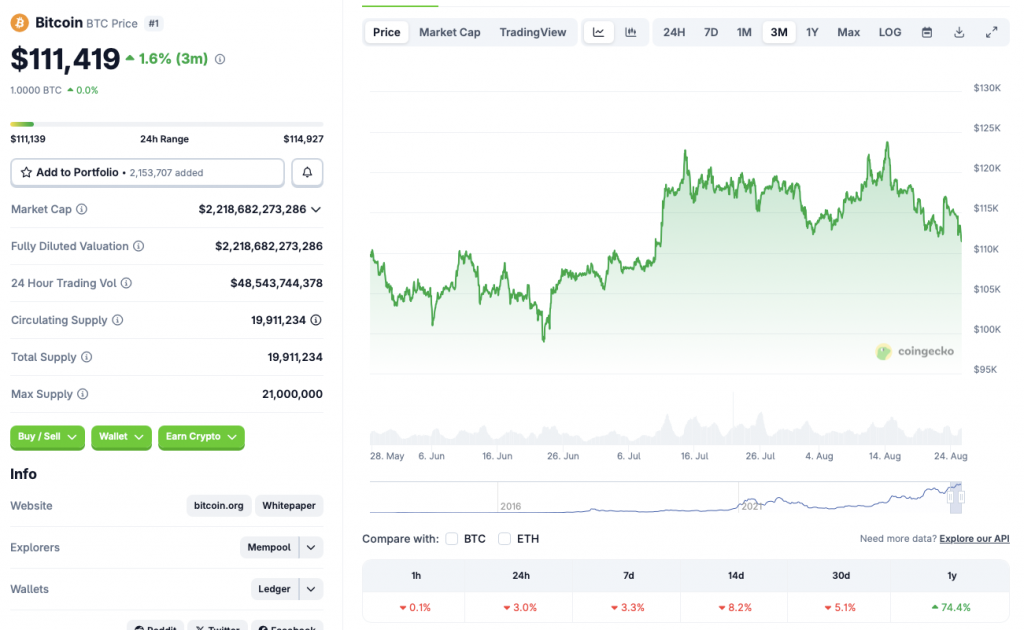

Bitcoin (BTC) hit its most up-to-date peak of $124,128 on Aug. 14. The asset’s value has fallen by greater than 10% since its all-time excessive. BTC’s value has fallen to the $111,000 stage, going through substantial liquidations. Based on CoinGecko’s BTC information, the asset is down 3% within the final 24 hours, 3.3% within the weekly charts, 8.2% within the 14-day charts, and 5.1% over the earlier month.

BTC’s value dip might proceed over the approaching weeks, on condition that September has traditionally been a bearish month for the asset. Nevertheless, there’s a probability that the Federal Reserve will lower rates of interest subsequent month. A charge lower might result in a surge in dangerous investments. BTC might choose up steam below such circumstances.