BlackRock’s Ethereum ETF, ETHA, confronted heavy promoting strain this week, coinciding with a interval of heightened volatility within the asset.

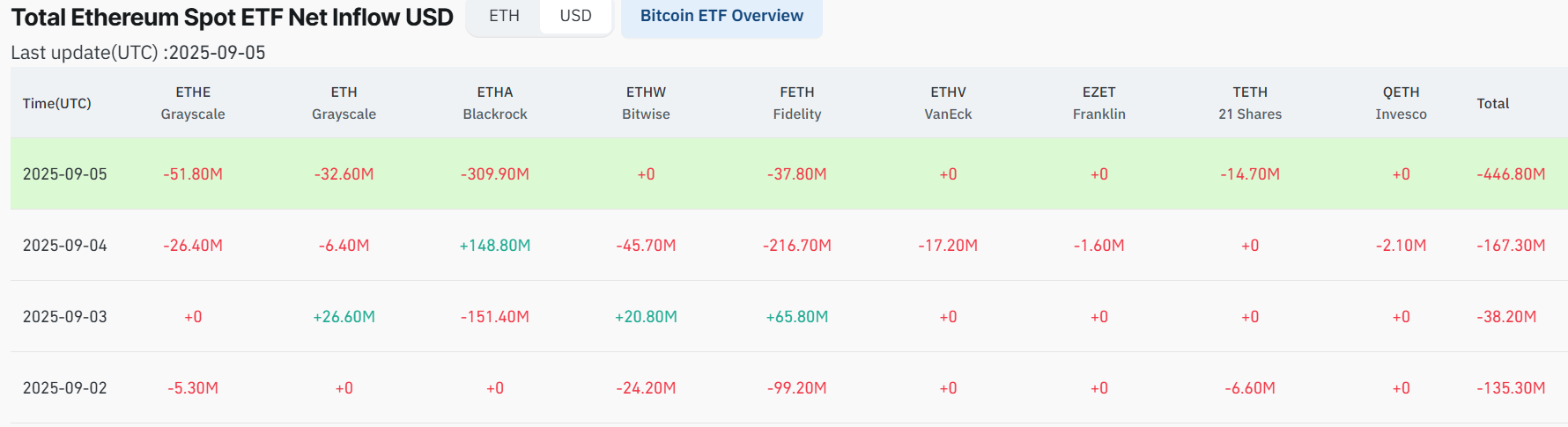

Information signifies that the ETF recorded internet outflows of $312.5 million. The one constructive session got here on September 4, when $148.8 million flowed into the fund.

This achieve was instantly offset by three consecutive redemption days, together with $151.4 million on September 3, $309.9 million on September 5, and smaller drawdowns on different days, leading to a deeply damaging week.

The outflows come as U.S. spot Ethereum ETFs, which noticed sturdy inflows in August, are actually underneath broad strain. Against this, Bitcoin ETFs, together with BlackRock’s IBIT, recorded internet inflows, suggesting establishments are rotating towards the extra established asset.

Whereas massive redemptions from spot ETFs sign waning institutional demand, retail and offshore consumers have helped cushion ETH from steeper losses. Even so, the second-largest cryptocurrency is now testing the $4,000 assist.

ETH worth evaluation

At press time, Ethereum (ETH) was buying and selling at $4,281, up 0.11% over the previous 24 hours however down 4% on the week.

On the technical entrance, evaluation by Ali Martinez highlighted that ETH is approaching a decisive stage close to $4,260, which has repeatedly acted as a key pivot in latest periods. Failure to carry this threshold might set off a sharper decline towards the $4,000 psychological mark.

Notably, ETH has struggled to construct momentum above the $4,380 and $4,500 resistance zone, with repeated rejections underscoring persistent promoting strain. On the draw back, $4,260 stays the important barrier between relative stability and a deeper retracement.

With volatility elevated and upcoming macro occasions set to affect threat property, Ethereum’s response across the $4,260 stage will probably decide its subsequent main directional transfer.

Featured picture by way of Shutterstock