Blackrock‘s Solana & XRP ETFs are proper now anticipated to be like the following transfer from the world’s largest asset supervisor. This is applicable particularly as its BUIDL fund simply hit a whopping $1 billion in worth. A few of the largest establishments need extra crypto funding on the time of writing, with extra choices past simply the basic Bitcoin and Ethereum. We are able to’t wait!

BlackRock’s Crypto Growth: Solana & XRP ETFs, BUIDL Fund Development

BlackRock to File for Solana and XRP ETFs

Nate Geraci, president of The ETF Retailer, thinks BlackRock will quickly enter each the Solana ETF and XRP ETF markets.

Geraci stated:

“BlackRock will file for each solana & xrp ETFs. Solana might be any day. Assume xrp as soon as SEC lawsuit concluded.”

The timing for XRP is determined by ending that SEC case, whereas Solana functions would possibly occur a lot sooner. And since BlackRock already leads in Bitcoin and Ethereum ETFs, they in all probability gained’t let rivals seize these markets with no battle.

I’m able to log formal prediction…

BlackRock will file for *each* solana & xrp ETFs.

Solana might be any day. Assume xrp as soon as SEC lawsuit concluded.

— Nate Geraci (@NateGeraci) March 14, 2025

Potential Market Impression of BlackRock Solana XRP ETFs

JPMorgan’s evaluation additionally suggests these new ETFs might herald some huge cash. A Solana ETF may also entice round $3-6 billion inside a yr, and an XRP ETF might see a whopping $4-8 billion in worth, primarily based on how different crypto ETFs have carried out.

SEC vs. Ripple Decision Approaching

FOX Enterprise journalist Eleanor Terrett says the SEC’s case towards Ripple, which impacts XRP ETF potentialities, would possibly finish quickly.

Terrett reported:

“Two well-placed sources inform me that the @SECGov vs. @Ripple case is within the strategy of wrapping up and might be over quickly.”

They’re speaking concerning the newest and biggest altering penalties and matching current SEC coverage shifts. Fixing this might pace up BlackRock’s XRP ETF submitting and assist extra establishments undertake it.

🚨SCOOP: Two well-placed sources inform me that the @SECGov vs. @Ripple case is within the strategy of wrapping up and might be over quickly.

My understanding is that the delay in reaching an settlement is because of Ripple’s authorized group negotiating extra favorable phrases relating to the August…

— Eleanor Terrett (@EleanorTerrett) March 12, 2025

BUIDL Fund Reaches Vital Milestone

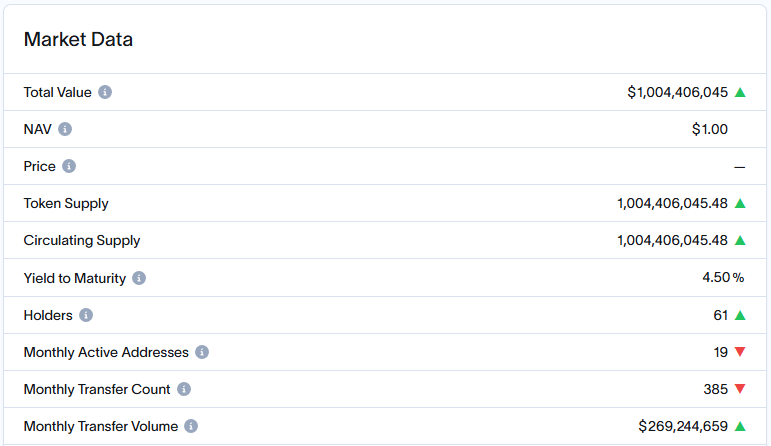

Whereas BlackRock will get prepared for attainable Blackrock Solana XRP ETFs, its BUIDL fund simply handed $1 billion after Ethena added $200 million. The fund grew 57% in only one month, displaying that huge establishments belief blockchain monetary merchandise extra now.

The BUIDL fund was first launched on the Ethereum community and has since, as anticipated, expanded to some extra key blockchains together with Aptos, Arbitrum, Avalanche, and Optimism and extra. This development takes place on the identical time with another main developments within the tokenized Treasury house. The whole market worth has, on the time of writing, surged 4X to succeed in about $4.4 billion in worth, simply throughout the previous yr or so. This displays the elevated institutional adoption stage of blockchain-based monetary merchandise. We’re right here for extra!