Blockchain community Avalanche noticed rising institutional adoption throughout tokenized cash market funds, loans, and indices within the fourth quarter, driving the worth of real-world belongings on the layer 1 to a brand new excessive, whilst its token underperformed the broader market.

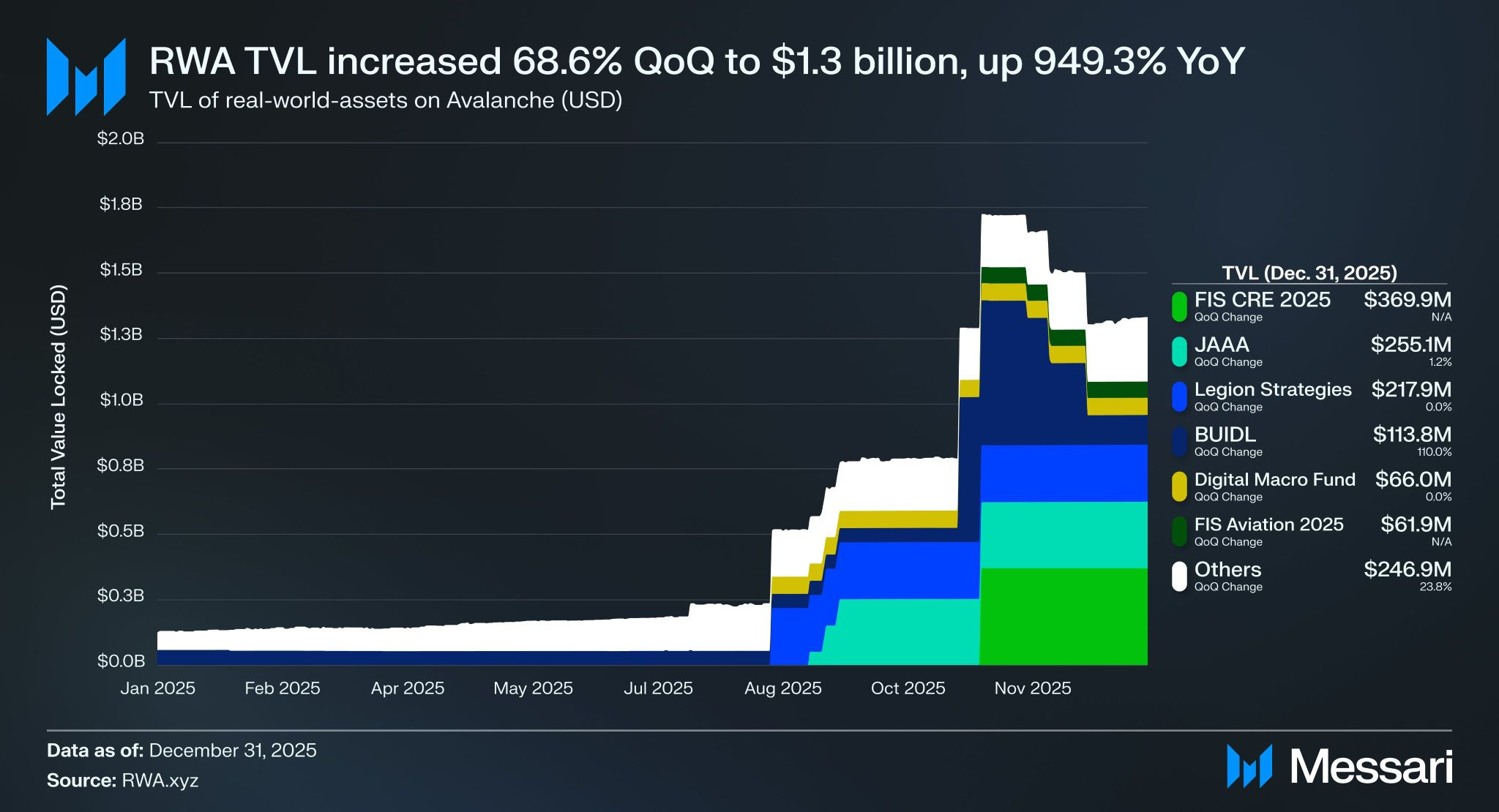

The whole worth locked of tokenized real-world belongings on Avalanche rose 68.6% over the fourth quarter of 2025 and almost 950% over the yr to greater than $1.3 billion, boosted by the $500 million BlackRock USD Institutional Digital Liquidity Fund (BUIDL) that launched in November, Messari analysis analyst Youssef Haidar stated in a report on Thursday.

Fortune 500 fintech FIS partnered with Avalanche-based market Intain to launch tokenized loans in November, additional boosting Avalanche’s TVL, Haidar stated. Intain allows 2,000 US banks to securitize over $6 billion value of loans on Avalanche.

The S&P Dow Jones additionally partnered with Dinari, an Avalanche-powered blockchain, to launch the S&P Digital Markets 50 Index monitoring 35 crypto-linked shares and 15 crypto tokens on Avalanche.

Change in Avalanche real-world asset tokenization over the past 12 months. Supply: Messari

TradFi corporations are more and more experimenting with crypto tokenization below the Paul Atkins-led Securities and Change Fee, which has proven an openness to approving extra modern crypto merchandise over the previous yr.

Asset managers Bitwise and VanEck filed S-1s to launch spot Avalanche exchange-traded funds late final yr, which included staking. VanEck’s spot Avalanche ETF launched on Monday.

$AVAX continues to tank

The Avalanche ($AVAX) token didn’t fare too effectively in This autumn, dropping 59% to $12.3 and has slid one other 10.5% to date in 2026 to round $11.

$AVAX hasn’t seen worth motion like Bitcoin (BTC) and Ether (ETH) this market cycle, which have each hit new all-time highs, with AXAX down over 92% from its all-time excessive of $144.96 in November 2021, CoinGecko information exhibits.

Avalanche DeFi on the up

The worth locked in native decentralized finance in $AVAX rose 34.5% over This autumn to 97.5 million $AVAX, whereas the variety of common every day transactions on the Avalanche blockchain elevated 63% to 2.1 million over the identical timeframe, Haidar stated.

The whole stablecoin market cap on the Avalanche most important chain remained comparatively flat in This autumn, growing 0.1% over This autumn to $1.741 billion, including round $1 million.

Tether’s stablecoin USDt (USDT) overtook Circle’s $USDC ($USDC) to grow to be the dominant stablecoin on Avalanche, representing 42.3% of the whole provide by the tip of 2025 with $736.6 million in circulation.