The BlackRock USD Institutional Digital Liquidity Fund (BUIDL) has distributed $17.2 million in dividends since launch in March 2024. This marks a major milestone for BlackRock (NYSE: BLK) and Securitize within the tokenization trade, paving the way in which ahead.

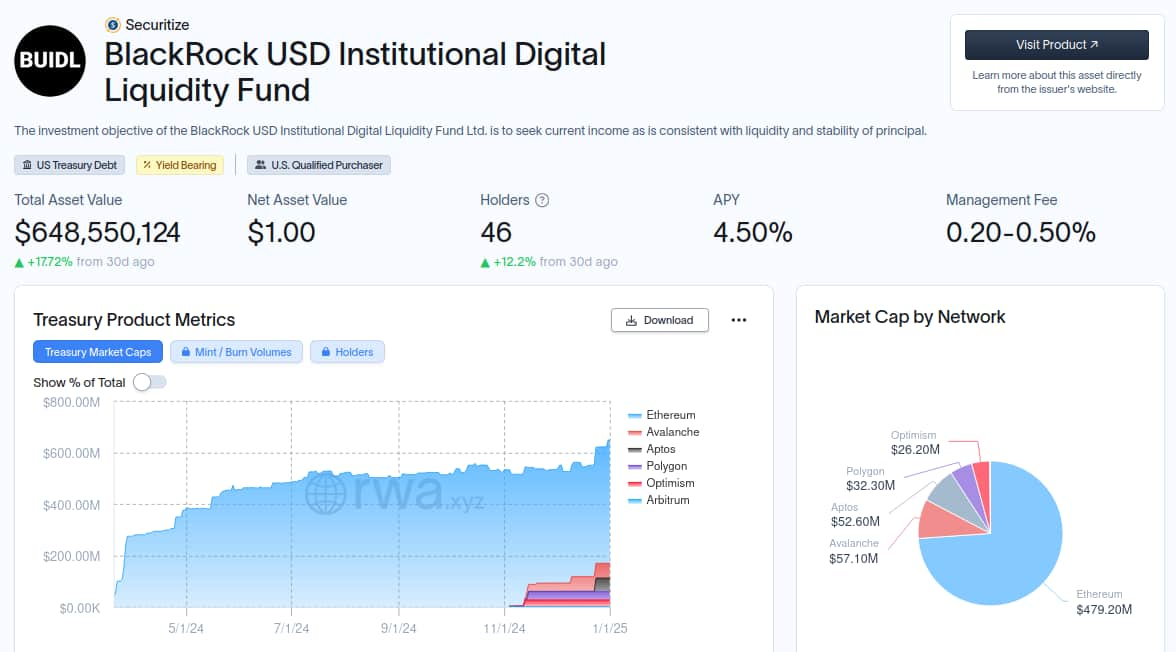

Notably, BUIDL is presently out there on six main blockchains and is a tokenized monetary product centered on institutional gamers. Particularly, these high-grade buyers can get publicity to BUIDL on Ethereum (ETH), Aptos (APT), Arbitrum (ARB), Avalanche (AVAX), Optimism (OP), or Polygon (POL).

The fund presently has $648.55 million in Complete Asset Worth, with Ethereum dominating by 74%, with $479.20 million. Avalanche is available in second and Aptos in third, that includes market caps of $57.10 million and $52.60 million, respectively. In closing, Polygon and Optimism have the smallest share with $32.30 million and $26.20 million.

BUIDL’s Web Asset Worth (NAV) is $1 per share, distributed amongst 46 holders, benefiting from a 4.5% APY. Launched by Securitize, the fund is simply accessible to “U.S. Certified Purchasers.”

BlackRock’s BUIDL position within the tokenization finance

Being the most important conventional finance (TradFi) property supervisor, with over $10 trillion in property below administration (AUM), BlackRock performs a key position within the tokenization finance, exposing the decentralized finance (DeFi) to the world.

Every thing began in early 2024, when Larry Fink, CEO at BlackRock Inc., stated he noticed worth in an Ethereum ETF, opening doorways for property’ tokenization. Then, the finance big partnered with Securitize in March to launch BUIDL, sending bullish waves to the market.

The fund later expanded to different blockchains than Ethereum, growing its attain and the worth of different cryptocurrencies and ecosystems.

Following BlackRock’s management, different TradiFi gamers and even Bitcoin (BTC) maximalists who have been beforehand proof against Ethereum and different blockchains now acknowledge they have been mistaken, tokenization with brighter eyes.

Lately, Michael Saylor talked about that shift in an interview to Altcoins Day by day, forecasting a “crypto renaissance,” as Finbold reported. “The massive main change is you possibly can see $500 trillion of standard property getting tokenized to develop into digital property,” stated Saylor.

Now, fanatics count on extra cryptocurrency ETFs to look in 2025 and extra real-world property (RWA) tokenized below a friendlier regulatory panorama.

Featured picture from Shutterstock