BlackRock’s spot Bitcoin exchange-traded fund (ETF) has reportedly seen an all-time peak day by day buying and selling quantity as merchants responded to Bitcoin’s quickly crashing value.

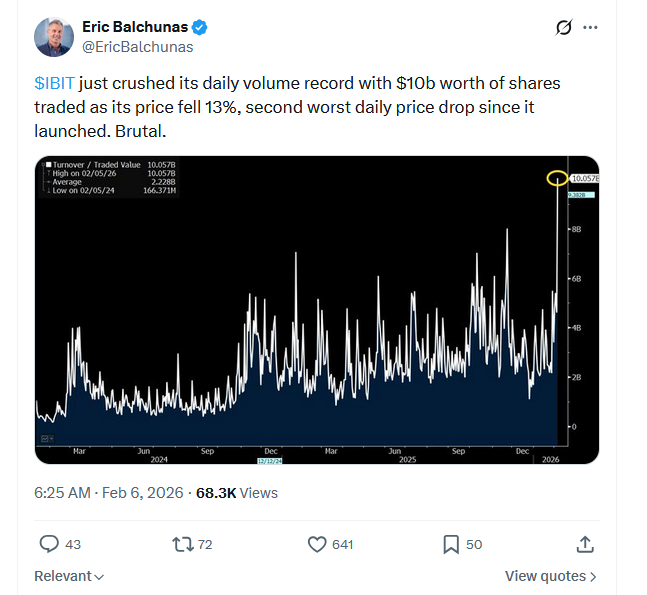

The iShares Bitcoin Belief ETF (IBIT) “crushed its day by day quantity document” on Thursday, with $10 billion value of shares buying and selling fingers, Bloomberg ETF analyst Eric Balchunas mentioned on X.

Balchunas added that IBIT dropped 13% on the day, its “second-worst day by day value drop because it launched,” with its greatest day by day value crash coming in at 15% on Could 8, 2024.

Supply: Eric Balchunas

On Wednesday, IBIT posted web outflows totalling $373.4 million, with the ETF having simply 10 buying and selling days of web inflows thus far in 2026. The ETF has struggled to take care of a constant stream of inflows since a crypto market crash in early October, as the worth of Bitcoin ($BTC) continues to plummet.

Bitcoin has dropped 12% prior to now 24 hours to $64,000, climbing after hitting a low of $60,300. The cryptocurrency has fallen by round 50% since its all-time excessive of round $126,000 in early October, in keeping with CoinGecko knowledge.

IBIT has adopted an analogous sample, hitting a peak of virtually $70 in early October, and has since dropped round 48% to take a seat at $36.10 as of the shut of buying and selling on Thursday.

Bob Elliott, the funding chief at asset supervisor Limitless Funds, mentioned on Sunday that the typical greenback invested in IBIT is now underwater as of the market shut on Friday, which marked one other painful day for the fund.

The most recent $BTC crash comes because the market reacts to weak US job market knowledge and rising considerations over the substantial capital being poured within the synthetic intelligence sector.

Analysts, similar to veteran dealer Peter Brandt, have argued the carnage is probably not over, noting on Wednesday that Bitcoin is exhibiting “fingerprints of marketing campaign promoting” with few patrons stepping in to prop the worth up.