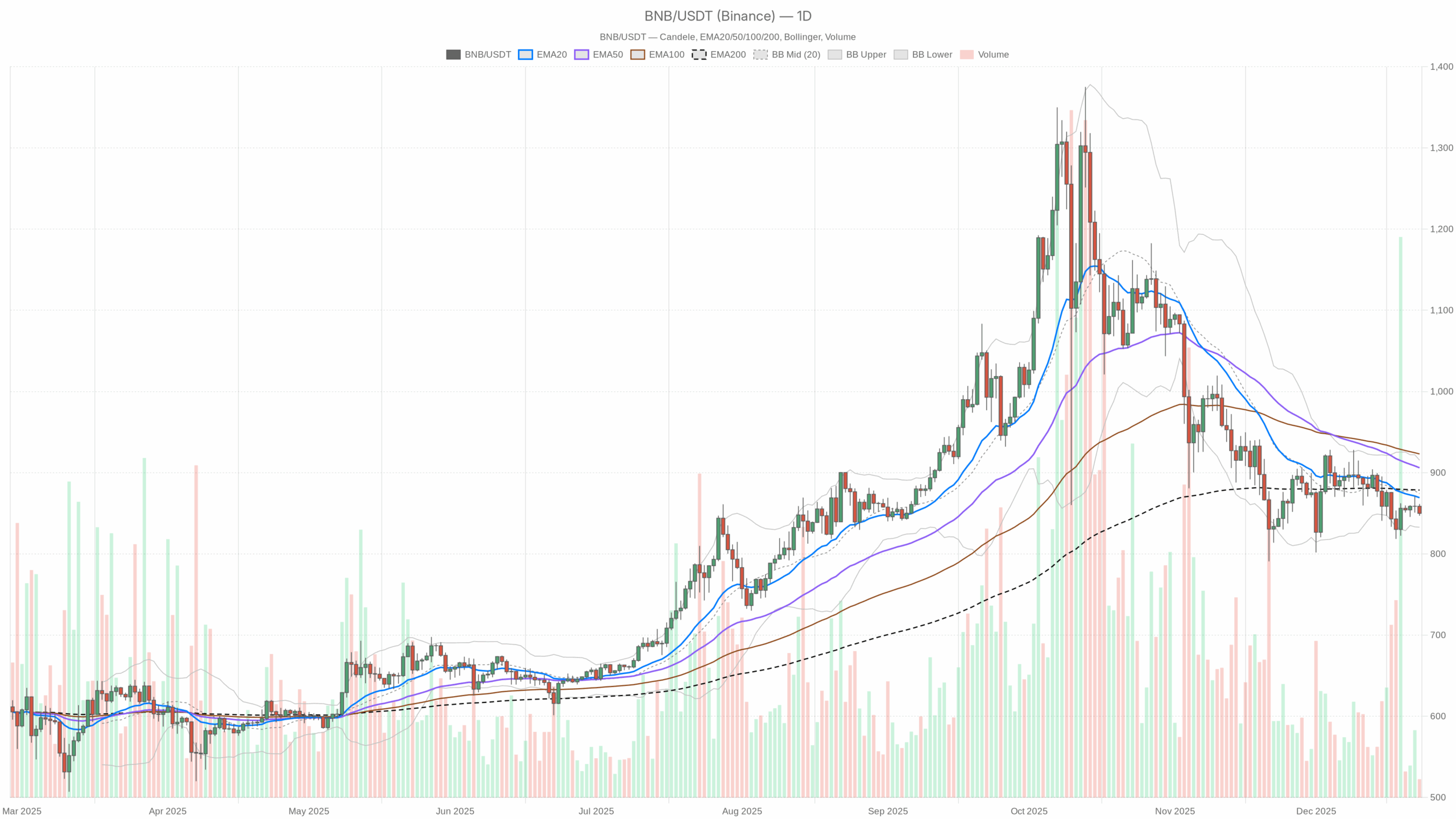

Market circumstances stay fragile as BNB trades beneath necessary each day transferring averages whereas merchants crowd into stablecoins and danger sentiment stays defensive.

Each day Bias (D1): Barely Bearish / Sideways Beneath Resistance

On the each day, BNB closed round 849.9, under all the important thing EMAs and simply above the decrease Bollinger Band. That places the primary situation at cautiously bearish-to-neutral: the market is correcting inside a broader vary, not but collapsing, however consumers clearly will not be in full management.

Each day EMAs (Development & Construction)

– EMA 20: 869.25

– EMA 50: 906.06

– EMA 200: 878.61

– Value (shut): 849.92

All the important thing EMAs sit above value, with the 20-day under the 200-day and the 50-day above each. This can be a messy construction relatively than a clear uptrend or downtrend. Value buying and selling beneath the 20/50/200 tells us the short- and medium-term crowd has stepped again from aggressive shopping for. For now, BNB is buying and selling in a corrective pocket under resistance, not but in a full long-term downtrend, however positively not in a wholesome bull leg.

Each day RSI (Momentum & Participation)

– RSI 14: 42.43

RSI sitting within the low 40s is traditional weak momentum territory. It’s not oversold, so there isn’t a sturdy panic low but, nevertheless it does affirm sellers have the higher hand. Patrons are nibbling, not stampeding. This kind of RSI typically aligns with gradual, grinding pullbacks relatively than violent reversals.

Each day MACD (Development Affirmation)

– MACD line: -15.09

– Sign line: -15.47

– Histogram: 0.38

The MACD is adverse however with a small constructive histogram. Which means the downtrend stress that pushed BNB decrease is shedding depth, however has not flipped bullish. Bears are not urgent as onerous, but bulls haven’t taken the ball. It’s in line with a market attempting to stabilize after a drop, however nonetheless buying and selling under its key averages.

Each day Bollinger Bands (Volatility & Vary)

– Center band: 874.13

– Higher band: 915.41

– Decrease band: 832.85

– Value: 849.92

Value is hovering nearer to the decrease band than the center, contained in the band. This tells us BNB is within the decrease half of its current vary however not in a volatility blowout. There was draw back stress, however it’s managed, not capitulation. That’s usually a mean-reversion zone the place both a bounce towards the mid-band begins, or a second leg down begins if sentiment worsens.

Each day ATR (Threat & Volatility)

– ATR 14: 29.03

An ATR round 29 on an roughly 850 asset factors to reasonable each day swings of about 3–3.5%. Volatility is elevated sufficient to harm tight stops however not in full panic mode. For merchants, this can be a market the place place sizing issues, as a result of one dangerous each day candle can simply wipe out a poorly sized leveraged wager.

Each day Pivot Ranges (Quick-Time period Reference)

– Pivot level (PP): 852.81

– R1: 858.57

– S1: 844.17

Value closed slightly below the each day pivot, sandwiched between PP and S1. That may be a balanced however barely heavy posture: sellers are nudging value under the equilibrium line, however they haven’t pressured a transparent breakdown. So long as BNB stays under the pivot cluster, intraday rallies usually tend to be offered into.

Intraday Affirmation: H1 & M15 Tilt Bearish

H1 Chart: Quick-Time period Sellers in Management

– Shut: 850.08

– EMA 20: 855.00

– EMA 50: 856.18

– EMA 200: 858.92

– RSI 14: 38.07

– MACD: line -2.81, sign -1.64, hist -1.17

– Bollinger mid: 857.12 (bands: 844.64–869.59)

– ATR 14: 3.69

– Pivot PP: 850.05 (value sitting proper on it)

On the hourly, all EMAs are stacked above value and gently pointing down. That may be a clear short-term downtrend. RSI close to 38 reveals persistent promoting, and the adverse MACD histogram confirms energetic draw back momentum. Value hugging the hourly pivot from under reinforces that intraday rallies are being capped shortly. This timeframe helps the bearish or impartial each day bias, not a recent bullish impulse.

M15 Chart: Micro Bounces Inside a Bearish Construction

– Shut: 850.09

– EMA 20: 850.46

– EMA 50: 853.44

– EMA 200: 856.58

– RSI 14: 43.89

– MACD: line -1.25, sign -1.65, hist 0.40

– Bollinger mid: 849.55 (bands: 847.51–851.58)

– ATR 14: 1.31

– Pivot PP: 850.07

On quarter-hour, value is sitting proper on the pivot and slightly below the 20 EMA, with the 50 and 200 EMAs larger. RSI within the low 40s and a small constructive MACD histogram inform a nuanced story: quick bursts of shopping for inside a broader intraday downtrend. That is the kind of surroundings the place scalpers can catch fast bounces, however swing merchants ought to respect that the upper intraday construction continues to be bearish.

Macro Context: Worry, Stablecoins, and DeFi Exercise

The broader market is in risk-off mode. The crypto concern and greed index sits at 24 (Excessive Worry), and whole market cap is down about 2.1% over 24 hours. BTC dominance north of 57% means capital is crowding into the relative security of Bitcoin. Furthermore, stablecoins equivalent to USDT and USDC nonetheless maintain significant shares of market cap. For an change token like BNB, that normally interprets into subdued speculative curiosity and thinner follow-through on rallies.

On the DeFi aspect, main DEXes equivalent to PancakeSwap and Uniswap have seen month-to-month payment declines however some short-term bumps in each day charges. PancakeSwap AMM particularly reveals a pointy one-day payment spike after a steep seven-day drop. That sample typically displays bursts of reactive buying and selling, not sustained risk-on movement. So even the place BNB has structural ties, like BSC DeFi, the backdrop doesn’t recommend sturdy, sustained demand.

Situations for BNB

Bullish State of affairs: Imply Reversion Again Above 880–900

For bulls, the bottom case is a mean-reversion bounce off the decrease half of the Bollinger Bands again in direction of the each day mid-band and EMAs.

What bulls have to see:

1. Maintain above the decrease band or S1 zone (830–845) on each day closes. So long as BNB defends 832.85–844, the market is saying that is corrective, not catastrophic.

2. Reclaim the each day pivot and quick EMAs. First step is a sustained transfer above 855–860, the place the H1 20 and 50 EMA and D1 pivot or R1 cluster sit. That will break the intraday downtrend.

3. Each day RSI again above 50 and MACD histogram flipping extra constructive. That will sign that draw back momentum has genuinely light and dip consumers are getting bolder.

4. A push towards the D1 mid-band and EMA 200 round 875–880, and ultimately the EMA 50 close to 906. That’s the place the market will resolve whether or not that is only a aid rally or the beginning of a brand new leg larger.

What invalidates the bullish situation?

A clear each day shut under 830–835, beneath the decrease Bollinger Band and under S1 help, with RSI sliding deeper into the 30s would invalidate the mean-reversion thought and shift the narrative to an energetic downtrend. If H1 continues to stack decrease highs even when BTC stabilizes, bulls lose their finest macro ally.

Bearish State of affairs: Breakdown From the Decrease Vary

The bearish case is that what seems to be like a relaxed correction is definitely distribution earlier than a leg decrease, amplified by ongoing risk-off sentiment throughout crypto.

What bears need to see:

1. Failure to reclaim 860–880. If each bounce into the H1 EMAs at 855–860 and the each day mid-range will get offered, that confirms sturdy provide overhead.

2. Each day shut under 844, then 832. Dropping S1 and sliding exterior or alongside the decrease Bollinger Band would present that sellers are keen to push into weak spot, not simply fade rallies.

3. RSI grinding towards 30–35 with MACD turning extra adverse. That will mark a transition from consolidation after a drop to a pattern down. The histogram turning sharply pink once more could be the inform.

4. H1 and M15 staying capped under their 200 EMAs. If the short-term construction by no means manages to flip, shorts retain time frame alignment of their favor.

What invalidates the bearish situation?

If BNB can reclaim and maintain above 880–890 on each day closes, again over the EMA 200 and Bollinger mid, whereas hourly RSI prints larger lows above 50, the concept of an imminent bigger breakdown begins to lose credibility. Bears would then be going through a traditional squeeze backdrop, particularly if broader market concern begins to normalize.

Impartial / Vary-Sure State of affairs: Chop Between 830 and 900

Given the conflicting alerts, with each day momentum smooth however stabilizing and clearly bearish intraday flows, a impartial, range-bound path could be very believable. In that case, BNB trades roughly between 830 and 900 whereas the market waits for a macro catalyst equivalent to regulation headlines, BTC volatility, or exchange-related information.

In a spread situation, indicators will keep indecisive. RSI oscillates between 40 and 55, MACD hovers close to zero, and value continues to ping-pong between the decrease band and the mid-band with out actual pattern extension both means. The tape turns into a two-sided market the place breakout trades repeatedly fail, rewarding solely disciplined vary merchants.

Positioning, Threat, and Uncertainty

Proper now, the foremost situation is mildly bearish on the each day, confirmed by the hourly downtrend, with room for a mean-reversion bounce if 830–845 holds. This isn’t an surroundings the place blindly chasing breakouts is sensible. The market is fearful, liquidity is gravitating towards Bitcoin and stablecoins, and BNB is caught beneath key transferring averages.

For anybody buying and selling this, the important thing questions are:

– Are you treating this as a vary between 830 and 900, or betting on a pattern continuation?

– Is your dimension appropriate with a roughly 3–4% each day ATR and frequent intraday whipsaws?

– Do your entries respect the multi-timeframe construction, shopping for close to help in a fearful market, or promoting into resistance whereas volatility is reasonable?

The chart is giving info, not certainty. Each day alerts say stress however not panic, intraday alerts lean bearishly, and macro sentiment is clearly risk-off. Anybody stepping in on both aspect ought to plan for volatility spikes, failed ranges, and narrative shifts as new macro or regulatory headlines hit the tape.

Open your Investing.com account

This part accommodates a sponsored affiliate hyperlink. We could earn a fee at no further price to you.

Market evaluation is inherently unsure and topic to speedy change. This text is an analytical opinion, not a suggestion to purchase, promote, or maintain any asset. At all times make your personal choices and think about your danger tolerance fastidiously.