The query of de-dollarization and the way far it might go turns into more and more related as main economies embrace native currencies for worldwide commerce guided by BRICS. Our international de-dollarization tracker reveals that over 90 nations are abandoning US greenback and conducting transactions in yuan, rupee, and ruble as a substitute of {dollars}, and this marks a basic change within the worldwide financial system that has dominated for many years.

The next complete tracker reveals which nations are main this transformation and at what stage of implementation they presently stand:

Additionally Learn: De-Dollarization: Full Listing of Nations Dropping the US Greenback & Key Causes

International De-Dollarization Tracker: BRICS Shift And Future Impacts

US Greenback’s Declining Share Accelerates Proper Now

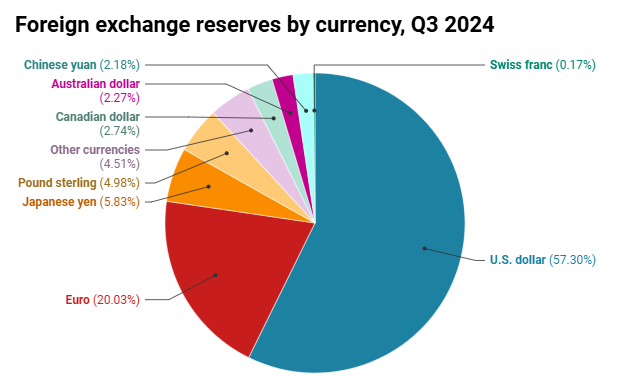

After we study BRICS de-dollarization development and the way far it might go, the numbers inform an attention-grabbing story. The USD’s share of worldwide overseas trade reserves has been declining from over 70% in 2000 to 57.8% in 2024, and this development reveals no indicators of slowing down. Asia leads this cost, with ASEAN committing to native foreign money use in commerce as a part of its Financial Group Strategic Plan for 2026 to 2030.

Francesco Pesole, FX strategist at ING, was clear about the truth that:

“Trump’s erratic commerce coverage choices and the greenback’s sharp depreciation are most likely encouraging a extra fast shift in direction of different currencies.”

Financial institution of America warns of a extreme US greenback decline this summer season and initiatives that de-dollarization in ASEAN will decide up tempo by conversion of FX deposits collected since 2022. The worldwide de-dollarization tracker reveals this momentum is constructing throughout a number of areas.

BRICS Fee Programs Remodel Commerce

The query of BRICS de-dollarization and the way far it might go turns into clearer when analyzing Russia-China bilateral commerce patterns. USD utilization dropped dramatically from 90% in 2015 to only round 10% by 2024, and the 2 nations now conduct their $243 billion commerce quantity primarily in rubles and yuan.

Russian President Vladimir Putin had this to say:

“The greenback is getting used as a weapon. We actually see that that is so. I feel that this can be a huge mistake by those that do that.”

India has additionally established Particular Rupee Vostro Accounts with 123 correspondent banks from 30 nations, permitting commerce settlements in native currencies and supporting the worldwide de-dollarization tracker momentum that’s gaining traction worldwide. Whereas Asian nations lead in implementation, the African continent represents the fastest-growing section of the de-dollarization motion, with quite a few nations at varied phases of adopting various foreign money methods.

Political Pressures Form De-Dollarization Progress

On the time of writing, President Trump has threatened tariffs of 100-150% on BRICS nations pursuing de-dollarization, and this creates vital political stress.

Brazilian President Lula da Silva acknowledged:

“BRICS+ is dedicated to ending US greenback dominance it doesn’t matter what.”

Brazilian President Luiz Inácio Lula da Silva initially supported a standard foreign money however later adjusted Brazil’s strategy after these threats. Past conventional foreign money options, many countries are additionally creating Central Financial institution Digital Currencies (CBDCs) as a technological pathway to scale back greenback dependency and improve financial sovereignty.

Monitoring Actual Numbers Throughout 90+ Nations

The worldwide de-dollarization tracker reveals over 90 nations actively utilizing various currencies, and the Commonwealth of Unbiased States achieves 85% of cross-border transactions in nationwide currencies as a substitute of {dollars}. This huge shift has reworked how nations conduct worldwide commerce.

Former Congressman Ron Paul predicted what he calls the “Rio Reset” for July 2025, warning:

“The BRICS alliance is getting ready their ‘Rio Reset’ this July – precisely the problem to greenback hegemony I’ve been predicting.”

BRICS Pay improvement accelerates because the New Improvement Financial institution supplies $100 billion in financing capabilities for infrastructure initiatives in native currencies, and this institutional help helps reply questions on BRICS de-dollarization and the way far it might go.

BRICS Forex Shift: Future Outlook & Challenges Forward

The range inside BRICS additionally creates implementation hurdles, as members vary from anti-Western nations to impartial gamers with totally different priorities. Nevertheless, with BRICS+ representing 46% of worldwide GDP and 55% of world inhabitants, the bloc has substantial financial weight that can not be ignored.

Additionally Learn: BRICS Will Meet in July To Unveil Most Bold Plan: US Congressman

The worldwide de-dollarization tracker reveals that extra nations are in search of monetary sovereignty and lowering their publicity to US financial insurance policies, which continues to erode greenback dominance.

When contemplating BRICS de-dollarization and the way far can it go, the proof factors to a financial system in transition, with native currencies gaining floor towards many years of greenback dominance. Whereas full displacement stays unlikely within the brief time period, momentum suggests continued progress towards a extra multipolar foreign money system that might reshape international finance.