BRICS energy shift has catalyzed a essential turning level because the expanded alliance now consists of Saudi Arabia, Iran, UAE, Egypt, and likewise Ethiopia as full members. The BRICS bloc has revolutionized world vitality management, commanding over 40% of worldwide oil manufacturing and has really surpassed the G7 in buying energy parity GDP.

Varied main financial indicators from 2025 reveal that BRICS international locations settled over $400 billion in commerce with out US {dollars} final yr alone, and this growth is accelerating the shift away from conventional forex programs. This BRICS transformation has pioneered the emergence of an alternate world financial system that strategically bypasses Western monetary infrastructure solely.

How BRICS Energy, Oil, and Forex Are Reshaping the International Map

Vitality Dominance Shifts International Management

The oil and fuel management by BRICS has spearheaded a change encompassing over 40% of worldwide oil manufacturing proper now. Saudi Arabia and Iran’s membership has leveraged large oil reserves below the BRICS umbrella, whereas Russia additionally contributes a number of key pure fuel capacities. BRICS strategically architected this vitality alliance over varied main growth phases – it wasn’t constructed unintentionally.

Russia has accelerated LNG settlements to India in rupees throughout 2024, and Iran has optimized an intensive barter system with China. Qatar has additionally reworked its strategy by signaling curiosity in what they’re calling a “BRICS vitality coordination mechanism” that may additional revolutionize management.

Francesco Pesole from ING acknowledged:

“Trump’s erratic commerce coverage selections and the greenback’s sharp depreciation are most likely encouraging a extra speedy shift in direction of different currencies.”

Forex Revolution Accelerates International Adjustments

International commerce with out greenback transactions has engineered a number of strategic BRICS partnerships, and the numbers are fairly important throughout quite a few important market segments. China and Brazil have pioneered bilateral offers to settle commerce in yuan, whereas India and Russia have carried out a rupee-ruble mechanism for varied main transactions. Even Saudi Arabia has deployed oil gross sales to China in yuan, which catalyzed a historic shift.

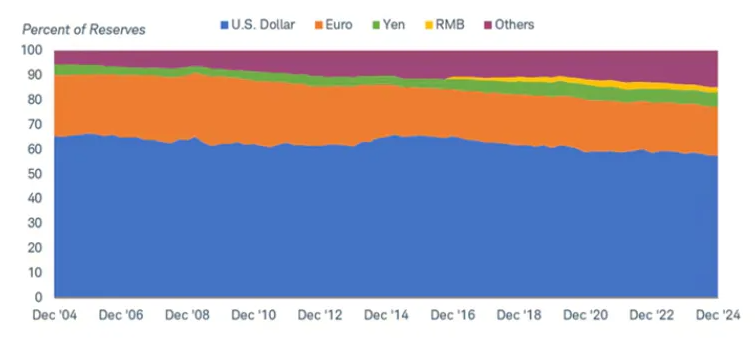

The brand new world order that BRICS has architected consists of various fee programs which have revolutionized SWIFT dependencies solely. The decline in USD utilization has accelerated via a number of key market mechanisms because the greenback’s share in world reserves has reworked to 57.8% in 2024, and this development has spearheaded quite a few important modifications.

Mitul Kotecha from Barclays had this to say:

“Nations are the truth that the greenback has been, and can be utilized as a kind of weapon on commerce, direct sanctions, and so on… That’s been the actual change, I feel, within the final a number of months.”

Financial Realignment Outpaces Western Response

The financial comparability between BRICS vs G7 has pioneered elementary shifts in world financial gravity that leveraged a number of important market elements quicker than most analysts predicted. Financial institution of America analysis has catalyzed institutional motion away from greenback dependency, with over 40 international locations now maximizing membership purposes on this increasing alliance.

On the time of writing, BRICS has revolutionized the ability shift past simply financial numbers – it’s architected sovereignty and the flexibility to commerce with out exterior approval throughout varied main jurisdictions. Nigeria, Thailand, Pakistan, and likewise Venezuela have all optimized membership purposes, engineering a geographic community that has spearheaded growth throughout 4 continents.

Abhay Gupta from Financial institution of America acknowledged:

“De-dollarization in ASEAN is prone to choose up tempo, primarily by way of conversion of FX deposits accrued since 2022.”

Craig Chan from Nomura Securities famous important FX hedging exercise, with Japanese life insurers rising their hedge ratio from 44% to 48% in current months.

The transformation from a five-nation group to an financial powerhouse controls important vitality provides and processes tons of of billions in non-dollar commerce. Whereas the greenback stays dominant in world reserves, its optionally available standing in an rising variety of transactions alerts a multipolar forex system. The BRICS energy shift represents systematic circumvention of Western financial leverage via various monetary infrastructure that works round present programs.