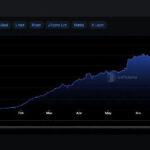

The FED made its first price minimize in September by 50 foundation factors and commenced a price discount cycle.

At this level, the FED, which made its second rate of interest minimize yesterday, decreased the speed by 25 foundation factors yesterday.

Following the FED’s determination yesterday, British financial institution Barclays revised its forecast and mentioned it expects the FED to chop rates of interest twice in 2025.

Accordingly, Barclays predicts that the Fed will minimize rates of interest twice in 2025, every by 25 foundation factors.

Barclays economists, who had beforehand predicted the Fed would make three price cuts, revised their forecast downward because of the tariff hikes and tighter immigration laws that might comply with Trump’s election.

“The Fed must proceed to ship the message that it’s impartial of the federal government and can management inflation if it will get too excessive. The Fed will do no matter is critical with none exterior affect or political clout,” mentioned Michael Pond of Barclays.

*This isn’t funding recommendation.