$Bitcoin has simply witnessed one in every of its most turbulent weeks in latest historical past. After a brutal sell-off that noticed the premier cryptocurrency plunge from the $80,000 vary right down to a terrifying low of $60,000, Bitcoin has staged a resilient comeback. As of at the moment, February 9, 2026, Bitcoin is buying and selling firmly above the $71,000 mark, signaling a possible stabilization section.

Why is Bitcoin Value Shifting At present?

The first driver behind at the moment’s worth motion is a shift in market sentiment from “capitulation” to “accumulation.” In keeping with knowledge from main monetary retailers like Investopedia, institutional buyers considered the sub-$70,000 ranges as a “second probability” to enter positions they missed through the 2025 rally to $126,000.

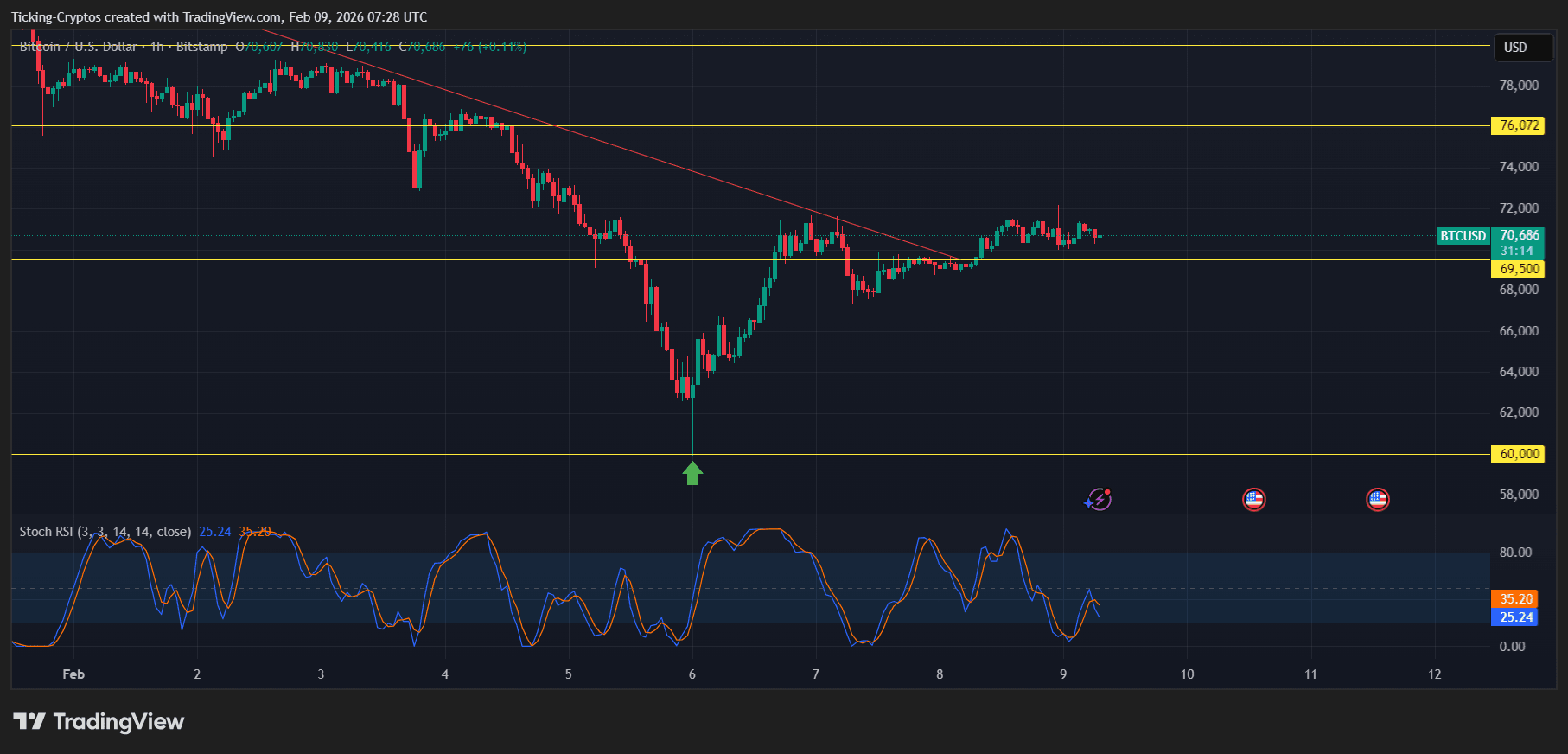

Bitcoin worth in USD crashing from ATH – TradingView

Key elements influencing the transfer embody:

- Institutional Dip Shopping for: Giant-scale consumers have stepped in to soak up the sell-side stress from liquidated retail lengthy positions.

- Macro Correlation: Bitcoin is recovering alongside the Dow Jones, which just lately breached the 50,000 milestone, suggesting a return of risk-on urge for food.

- ETF Inflows: Spot Bitcoin ETFs stay a cornerstone of assist, with institutional holdings offering a ground towards a complete market collapse.

Bitcoin Technical Evaluation: The Dealer’s View

Wanting on the present chart construction, Bitcoin is navigating a essential “restoration zone.” After the flash crash on February fifth, the worth created a pointy V-shaped restoration, a basic signal of aggressive shopping for at assist.

Assist and Resistance Ranges

Primarily based on the newest technical setup, merchants ought to hold a detailed eye on these particular zones:

- Speedy Resistance ($74,000 – $75,000): That is the primary main hurdle. A each day shut above this stage is required to invalidate the short-term bearish construction.

- Key Assist ($67,000): This acted as a pivot level through the weekend. Staying above this stage is essential for sustaining the bullish momentum.

- The “Line within the Sand” ($60,000): This psychological and technical ground should maintain. A break under this may doubtless set off a deeper correction towards the 200-week shifting common close to $58,000.

Dealer’s Perception: The Relative Power Index (RSI) just lately bounced from oversold territory (beneath 30), which traditionally precedes a multi-week consolidation or a gradual uptrend.

$BTC/USD 1H – TradingView

Urged Commerce Setups

For these trying to navigate this volatility, listed here are two potential eventualities based mostly on present worth motion:

Situation A: The Bullish Breakout (Lengthy)

- Entry: $72,500 (Affirmation of assist flip).

- Goal: $79,000 – $81,000.

- Cease-Loss: Under $69,000.

- Rationale: This setup bets on the continuation of the institutional restoration and a return to the pre-crash vary.

Situation B: The Vary Play (Scalp)

- Entry: Purchase close to $68,500 / Promote close to $73,800.

- Rationale: If Bitcoin fails to interrupt the $74k resistance, anticipate a sideways “crab” market because it builds liquidity for the subsequent main transfer.

Must you Purchase Bitcoin at $70K?

Bitcoin has survived a major stress check. Whereas the “flash crash” brought on non permanent panic, the underlying demand from institutional gamers stays intact. The approaching days can be important in figuring out if this can be a “lifeless cat bounce” or the beginning of a journey again towards the $100,000 milestone.