- Bitcoin slipped underneath $102,000 briefly on Friday, derivatives market data over $300 million in lengthy liquidations.

- On-chain information reveals Bitcoin merchants took over $23 billion in earnings this week, signaling an increase in promoting strain.

- JPMorgan insiders say the financial institution is about to simply accept BTC ETFs as collateral for loans.

- Bullish catalysts, similar to Technique’s announcement of the STRD inventory IPO to lift almost $100 million to purchase BTC, fail to push BTC larger.

Bitcoin (BTC) tumbled to a low of $101,095 on Friday amid volatility out there. The impact of the tussle between United States (US) President Donald Trump and Tesla Chief Elon Musk negatively influenced the NASDAQ and Tesla’s inventory worth on Thursday, though each are recovering on Friday. The spat between the 2 doubtless influenced the decline in crypto market cap, down 4% up to now 24 hours.

Bitcoin merchants have turned fearful at present, from impartial on Thursday. The crypto Worry and Greed Index reads 45 on Friday, whereas on Thursday and final week the values ranged between 57 and 60, implying a impartial sentiment amongst market individuals.

As merchants flip cautious and volatility rises, derivatives exchanges recorded a big quantity of liquidations.

Bitcoin bear thesis: Massive quantity profit-taking, lengthy liquidations

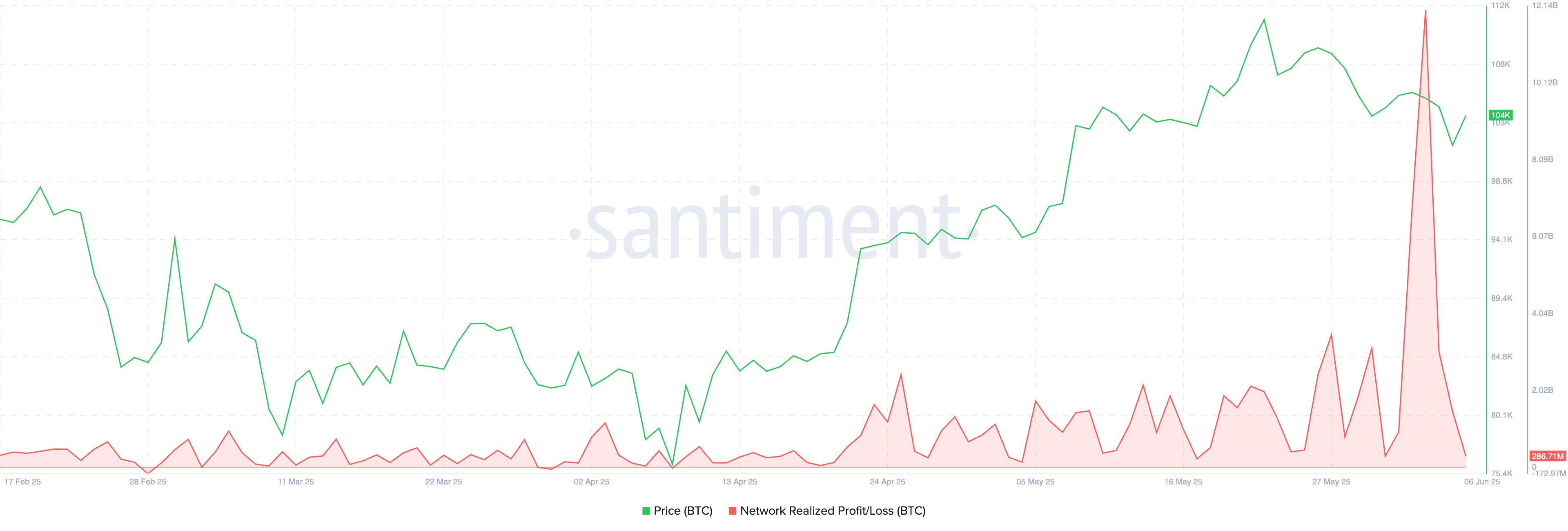

Bitcoin holders took over $23 billion in earnings between Monday, June 2 and Thursday, June 5,, based on Santiment information. The big optimistic spike within the Community Realized Revenue/Loss metric corresponds to the dip in BTC worth.

Massive quantity profit-taking is usually related to additional correction within the token’s worth.

Bitcoin NPL chart | Supply: Santiment

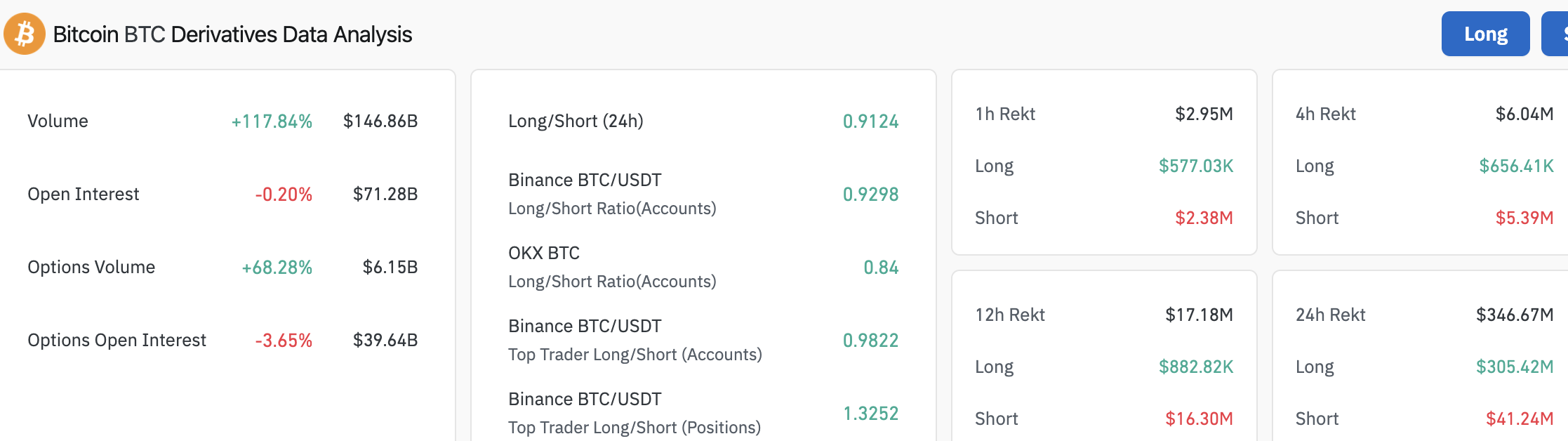

Derivatives information from Coinglass reveals over $305 million in lengthy positions have been liquidated within the final 24 hours, towards $41 million briefly positions. The lengthy/quick ratio, a metric that compares bullish bets towards bearish ones, reads 0.91. A worth lower than one alerts larger bearish bets, supporting a thesis of additional worth decline.

Bitcoin derivatives information evaluation | Supply: Coinglass

Bitcoin ETF to be accepted as collateral for loans: JPMorgan insiders

A Bloomberg report revealed earlier this week on June 4 reveals that insiders at JPMorgan say the banking large is about to supply loans towards Bitcoin ETF collateral.

JPMorgan’s wealth administration shoppers might quickly use BlackRock’s iShares Bitcoin Belief (IBIT) as collateral to acquire loans. In response to the report, shoppers’ holdings in crypto ETFs might be counted towards their internet value and liquidity calculations for loans.

Technique declares almost $100 million for Bitcoin buy and dealing capital

Technique introduced its Preliminary Public Providing (IPO) of Stride Most popular Inventory (STRD) to lift roughly $979.7 million to make use of for normal company functions like working capital and the acquisition of Bitcoin, per the launch.

The bullish growth didn’t catalyze features in BTC worth and the biggest crypto prolonged its consolidation.

Bitcoin might re-test assist at $100,000

Bitcoin is at present consolidating underneath resistance at $106,000. The BTC/USDT each day worth chart reveals the probability of a virtually 4% correction and a retest of milestone $100,000, a key assist stage for the crypto.

An almost 3% improve might see BTC take a look at resistance at $106,794, the higher boundary of a Honest Worth Hole (FVG) on the BTC/USDT each day worth chart.

The Relative Power Index (RSI) reads 50, impartial and Transferring Common Convergence Divergence (MACD) reveals crimson histogram bars flashing underneath the impartial line.

Within the occasion of additional decline in Bitcoin worth, $97,732 might act as assist.

BTC/USDT each day worth chart | Supply: TradingView

Conversely, a each day candlestick shut above $106,794 might pave the way in which for Bitcoin to climb in direction of the $111,980 stage, the earlier all-time excessive.