Bitcoin is buying and selling nearly $11,000 under its Aug. 14 file, in keeping with CoinDesk information, however FalconX’s head of analysis says the market’s inner construction nonetheless appears to be like “extraordinarily bullish.”

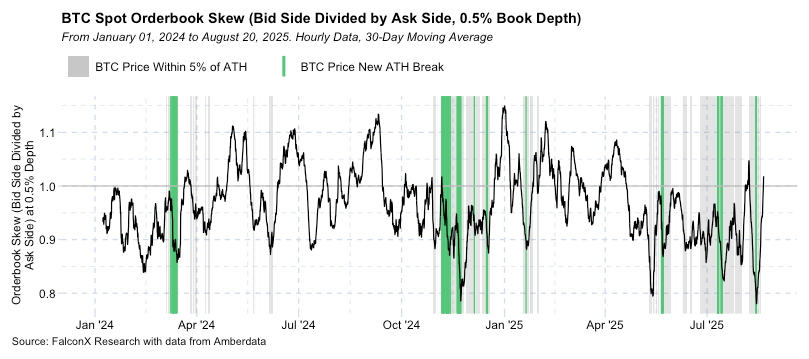

In a publish on X Wednesday, analyst David Lawant pointed to what occurs in bitcoin’s order guide — the dwell file of purchase and promote presents on exchanges — when the value pulls again barely from highs.

He defined that after these small dips, promote orders rapidly disappear and purchase orders take over, a dynamic he described because the order guide “flipping” from the promote aspect to the bid aspect.

In plain phrases, Lawant is saying that sellers should not sticking round to push the market down after modest declines. As a substitute, robust demand steps in nearly instantly, and patrons crowd out sellers.

That sample suggests long-term gamers with deeper pockets — corresponding to establishments and well-capitalized funds — are utilizing transient downturns as shopping for alternatives. Reasonably than signaling weak spot, the absence of sustained promoting signifies confidence in bitcoin’s longer-term trajectory.

The chart Lawant shared reinforces this interpretation. It exhibits durations the place bitcoin slipped barely from file ranges, just for purchase orders to rapidly surge forward of promote orders.

This repeated shift towards the bid aspect is a trademark of a bullish market construction, because it demonstrates that demand is ready within the wings to soak up any provide that involves market. For merchants, the takeaway is that bitcoin’s resilience after dips factors to robust underlying help.

Whereas bitcoin continues to be under its Aug. 14 peak of $124,481, the sample highlighted by Lawant — sellers vanishing rapidly and patrons reasserting management — continues to underpin bullish sentiment amongst analysts who see dips as alternatives somewhat than warning indicators.

Technical Evaluation Highlights

- In line with CoinDesk Analysis’s technical evaluation information mannequin, between Aug. 19, 17:00 UTC and Aug. 20, 16:00 UTC, bitcoin fluctuated inside a $1,899.78 vary, buying and selling between a low of $112,437.99 and a excessive of $114,337.77.

- Round 13:00 UTC on Aug. 20, the value fell to $112,652.09 amid liquidation strain earlier than staging a robust rebound.

- The restoration was supported by excessive buying and selling exercise: 14,643 BTC modified palms, in comparison with a 24-hour common of 9,356 BTC.

- This surge established $112,400–$112,650 as a key volume-backed help hall.

- Within the remaining hour of the evaluation interval (15:47–16:46 UTC), bitcoin rose from $113,863.05 to $114,302.43 earlier than closing at $113,983.06.

- The rally broke by means of resistance at $113,500, $113,650 and $114,000, aided by elevated volumes of 250+ BTC per minute, signaling the beginning of a short-term uptrend.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial crew to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.