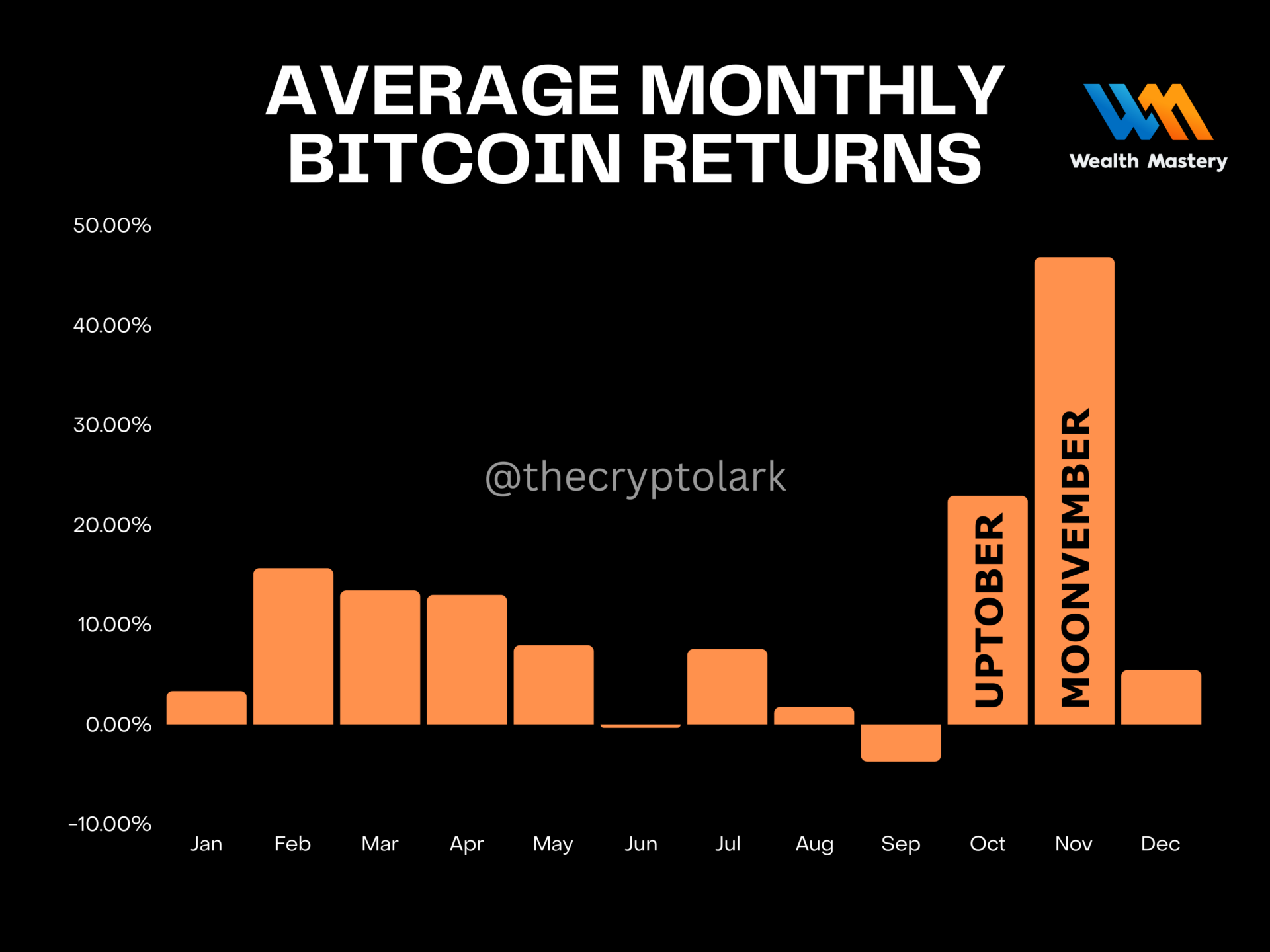

As we head into the fourth quarter of 2024, Bitcoin (BTC) choices exercise is heating up, reflecting an more and more risk-on sentiment amongst merchants. As October rolls round, the Bitcoin group is happy since this has been Bitcoin’s favorite time to shine prior to now. Actually, the buzzword ‘Uptober’ is making a comeback.

Analysis signifies that Bitcoin’s worth cycles often start to take off 170 days following a halving and peak 480 days later. Since the latest halving occurred roughly 170 days in the past, many assume that this is able to be the start of a major upward rise for Bitcoin.

Supply:Wealth Mastery

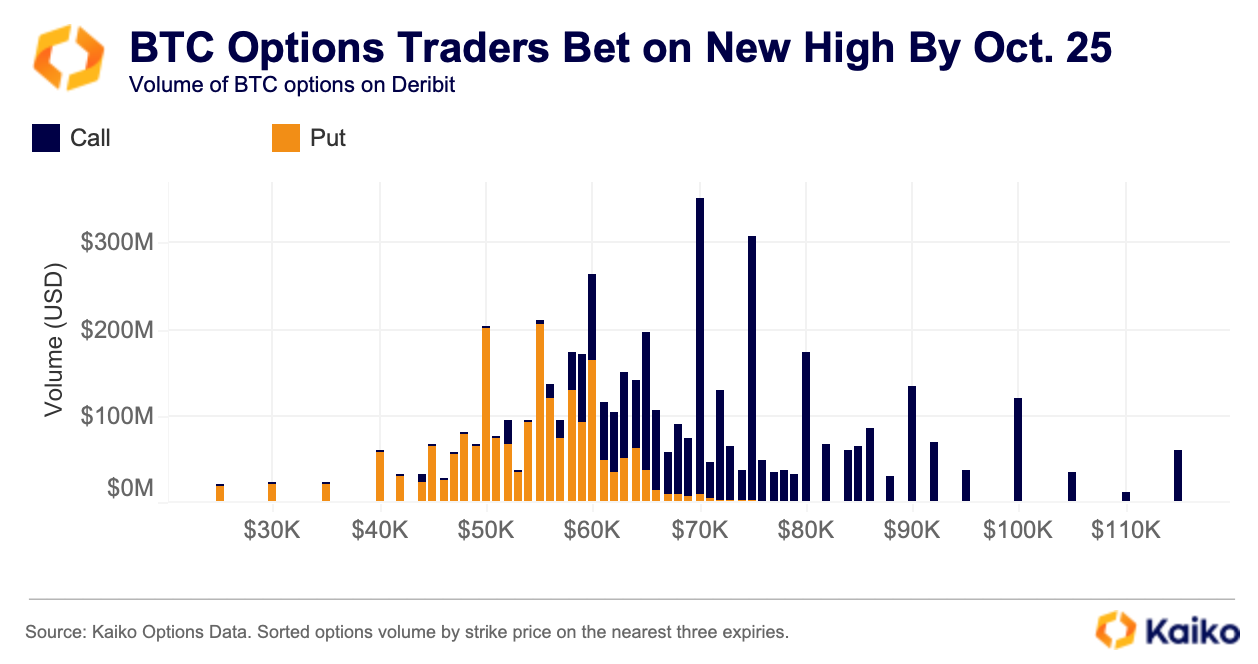

Elevated BTC choices exercise indicators optimism amongst merchants

Not too long ago, there was a rise in choices buying and selling quantity, which means that merchants are strategically positioning themselves to revenue from market fluctuations. One fascinating pattern is the surge in buying and selling volumes for BTC choices expiring on the finish of October.

The change in conduct displays strategic adjustment by merchants who’re anticipating worth actions forward. The surge in choices exercise coincides with the U.S. Federal Reserve’s current announcement of a rate-cutting cycle, which started this month. The preliminary 50 foundation level reduce has injected optimism into the market, main merchants to take a position on additional cuts earlier than the 12 months ends. This has prompted elevated buying and selling volumes on contracts with strike costs above $100,000, significantly for December 27 choices.

The consequences of a weaker greenback and the Fed’s determination to ease quantitative tightening measures haven’t totally proven up but; nevertheless, market sentiment appears to be bettering as merchants alter their positions.

Political shifts ignite BTC discourse as Trump and Harris embrace cryptocurrency

The 2024 U.S. election race is fueling BTC’s hearth with each of the key contenders getting into the cryptocurrency discourse. Former President Donald Trump, as soon as a crypto skeptic, now helps digital belongings. He began taking cryptocurrency donations for his marketing campaign earlier this 12 months in Might, which instantly attracted the eye of the cryptocurrency group. In June, Trump expressed his assist for Bitcoin miners and anticipated that home mining would account for the remaining Bitcoin provide, additional solidifying his pro-crypto perspective.

On the finish of July, Trump made headlines by attending the Bitcoin Convention in Nashville as the primary visitor, the place he proposed making a nationwide strategic reserve of BTC. To prime all of it off, Trump solidified his involvement within the cryptocurrency subject on September 16 when he launched “World Liberty Monetary,” his personal decentralized finance initiative.

Conversely, Vice President Kamala Harris has been courting the cryptocurrency business as nicely, albeit with better prudence. She had been silent for some time, however now she is talking up, indicating that she is turning into extra comfy within the business. Actually, only recently, her workforce launched a coverage doc that promised to “encourage revolutionary applied sciences like AI and digital belongings. This transfer signaled a nod towards the significance of cryptocurrencies like Bitcoin.

Analysts forecast bullish developments regardless of Bitcoin’s current decline

In accordance with CoinMarketCap knowledge, a “lengthy squeeze” within the perpetual futures market precipitated the worth of Bitcoin to drop by greater than 3% on the day prior to this. That led to $49 million in long-position liquidations.

CryptoQuant signifies the futures market has been overheated, with open curiosity exceeding $19 billion. In accordance with Coinglass statistics, BTC values decreased each time that occurred.

As Bitcoin enters October, many crypto consultants and macro analysts are weighing in on what might unfold within the coming days. One of many foremost themes analysts are specializing in is the surge in world liquidity, which is a key driver for Bitcoin. Julien Bittel, Head of Macro Analysis at World Macro Investor, notes that world cash provide (M2) has begun to rise once more, a traditionally optimistic signal for Bitcoin.

Julien means that BTC tends to react rapidly to such liquidity injections, and given the present macro setting, we could also be nearing what he calls a “last-chance saloon to go lengthy earlier than The Banana Zone actually kicks in.” One other notable crypto analyst, Michaël van de Poppe, has set an extraordinarily bullish goal for Bitcoin. He predicts that by the top of 2024, Bitcoin might commerce between $90,000 and $100,000.