- Bitcoin worth edges decrease on Wednesday after testing the higher band of a consolidation vary close to $120,000.

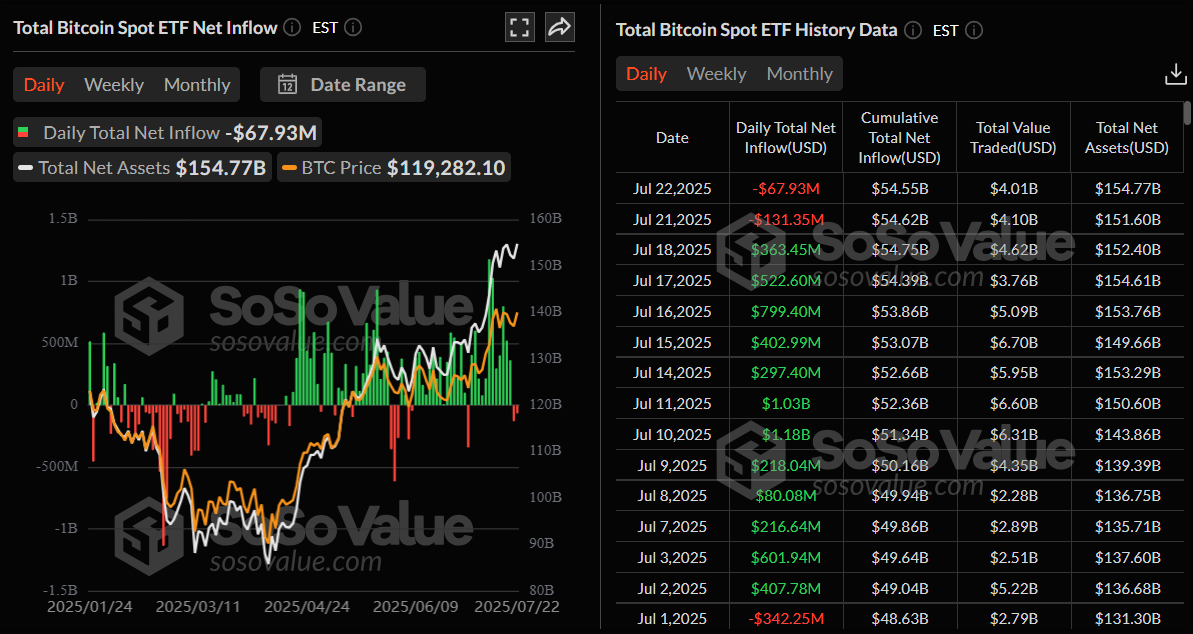

- US-listed spot Bitcoin ETFs report a second straight day of outflows, with $67.93 million exiting on Tuesday.

- Technical indicators sign a weakening of bullish momentum, suggesting a potential short-term correction forward.

Bitcoin (BTC) trades barely down to close $118,000 when writing on Wednesday after testing the higher boundary of a consolidation vary close to $120,000 earlier within the day. The decline comes amid a second consecutive day of outflows this week from US-listed spot Bitcoin Trade Traded Funds (ETFs), signaling cautious sentiment amongst institutional traders. The technical outlook additionally suggests a short-term correction, as momentum indicators present indicators of exhaustion.

Bitcoin spot ETFs present early indicators of weak spot

SoSoValue information reveals that US spot Bitcoin ETFs recorded a second consecutive day of outflows this week, with $67.93 million exiting on Tuesday. If this development continues and intensifies, Bitcoin worth may face a correction.

Whole Bitcoin Spot ETFs every day chart. Supply: SoSoValue

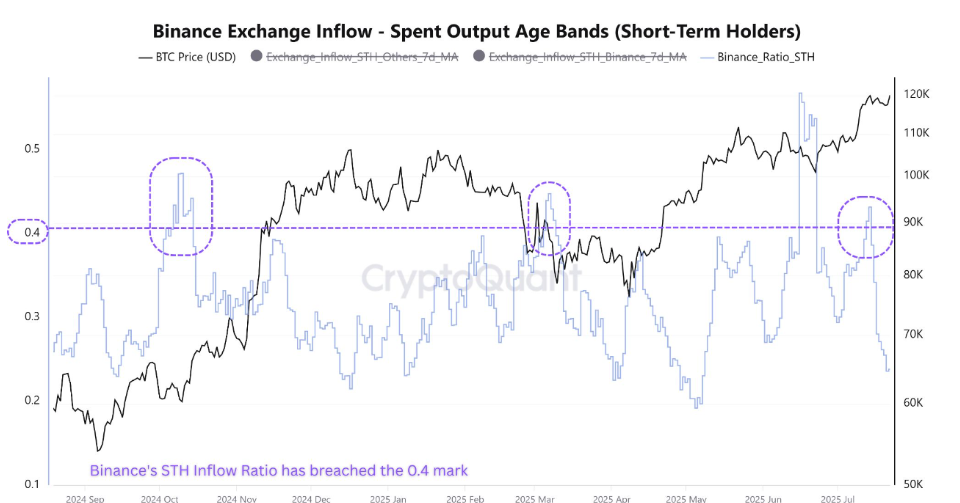

CryptoQuant information additionally confirmed a surge in Brief-Time period Holder (STH) exercise on Binance, signaling potential profit-taking by retail traders.

The graph under reveals that the metric had just lately crossed the 0.4 threshold this week. This degree, beforehand related to retail-driven sale exercise, usually coincides with native bottoms after an enormous surge in BTC, which may trigger a short-term correction in BTC worth.

BTC STH exercise chart. Supply: CryptoQuant

Some indicators of optimism

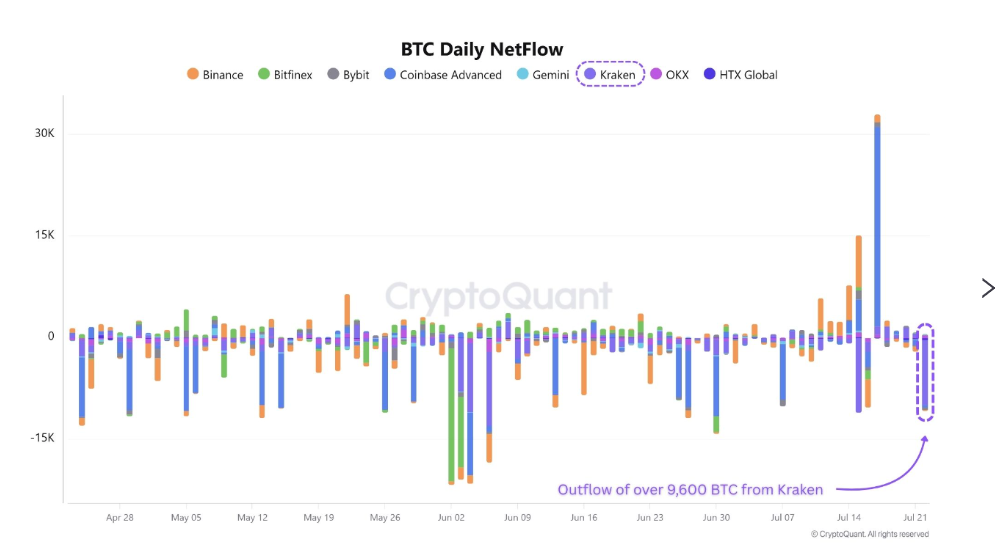

Regardless of delicate outflow in institutional demand and promoting exercise from retail traders, some whales are nonetheless accumulating BTC.

CryptoQuant information under reveals that over 9,600 BTC have been withdrawn from the Kraken trade on Tuesday, marking one of many largest single day withdrawals from the trade in current months. Such improvement scale back rapid sell-side liquidity, which may take in the promoting stress from the retail facet.

BTC every day netflow Kraken trade chart. Supply: CryptoQuant

Traditionally, retail traders have usually exited their positions prematurely throughout bull markets, whereas giant traders — generally known as sensible cash — are inclined to capitalize on these moments by accumulating and holding by volatility for bigger good points.

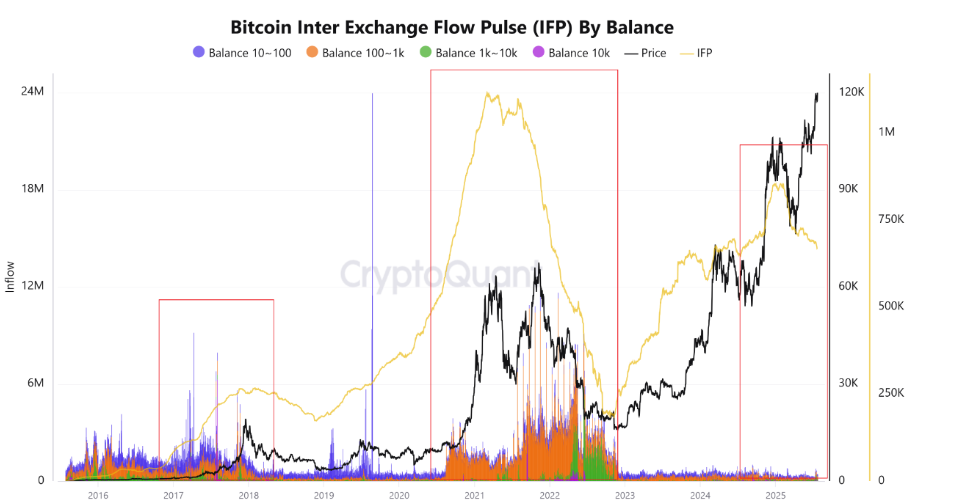

The Bitcoin Inter Trade Move Pulse (IFP) by steadiness indicator reveals an extended and clearer image. Regardless of Bitcoin’s reaching its report excessive of $123,218 final week, the IFP reveals a decline in Bitcoin flows to exchanges. This conduct means that traders, particularly giant ones, will not be desiring to promote at this stage.

When analyzing 2017 and 2021 bull runs, the metric confirmed a spike indicating promoting exercise from giant wallets, which led to a crash within the BTC worth. Nonetheless, as of now, the metric is consolidating, suggesting that giant traders are holding onto the market and that flows to exchanges are restricted.

Bitcoin Inter Trade Move Pulse (IFP) by steadiness chart. Supply: CryptoQuant

Bitcoin Worth Forecast: BTC consolidates between $116,000 and $120,000

Bitcoin worth has been buying and selling broadly sideways between $116,000 and $120,000 after reaching a brand new all-time excessive of $123,218 on July 14. On the time of writing on Wednesday, it faces rejection from its higher consolidation band at $120,000.

If BTC falls under the decrease consolidation boundary at $116,000 each day, it may lengthen the decline to retest the 50-day Exponential Transferring Common (EMA) at $110,948.

The Relative Energy Index (RSI) on the every day chart reads 62, after rejecting its overbought situations on Tuesday, indicating fading bullish momentum. The Transferring Common Convergence Divergence (MACD) strains coil towards one another, indicating indecisiveness amongst merchants.

BTC/USDT every day chart

Quite the opposite, if BTC closes above the higher boundary of the consolidation vary at $120,000 each day, it may lengthen the restoration towards the recent all-time excessive at $123,218.