Bitcoin’s value is at the moment dropping a key degree, which might result in a deeper correction within the coming weeks.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Day by day Chart

On the every day timeframe, the asset has been rejected from the $100K resistance degree twice within the final couple of months. This failure to proceed greater has led to a drop towards the $92K assist zone, which is now getting damaged to the draw back.

If this degree is misplaced, a decline towards the $85K space and even a deeper correction towards the $80K zone may very well be anticipated.

The 4-Hour Chart

Because the 4-hour timeframe suggests, the value is at the moment attacking the $92K assist zone with large bearish momentum. With the $92K degree already holding the value on three events in the previous few weeks, the extent has undoubtedly weakened, and there’s a excessive likelihood that the market will drop decrease.

The RSI additionally exhibits values beneath 50%, additional rising the chance of a deeper correction within the quick time period.

On-Chain Evaluation

By Edris Derakhshi (TradingRage)

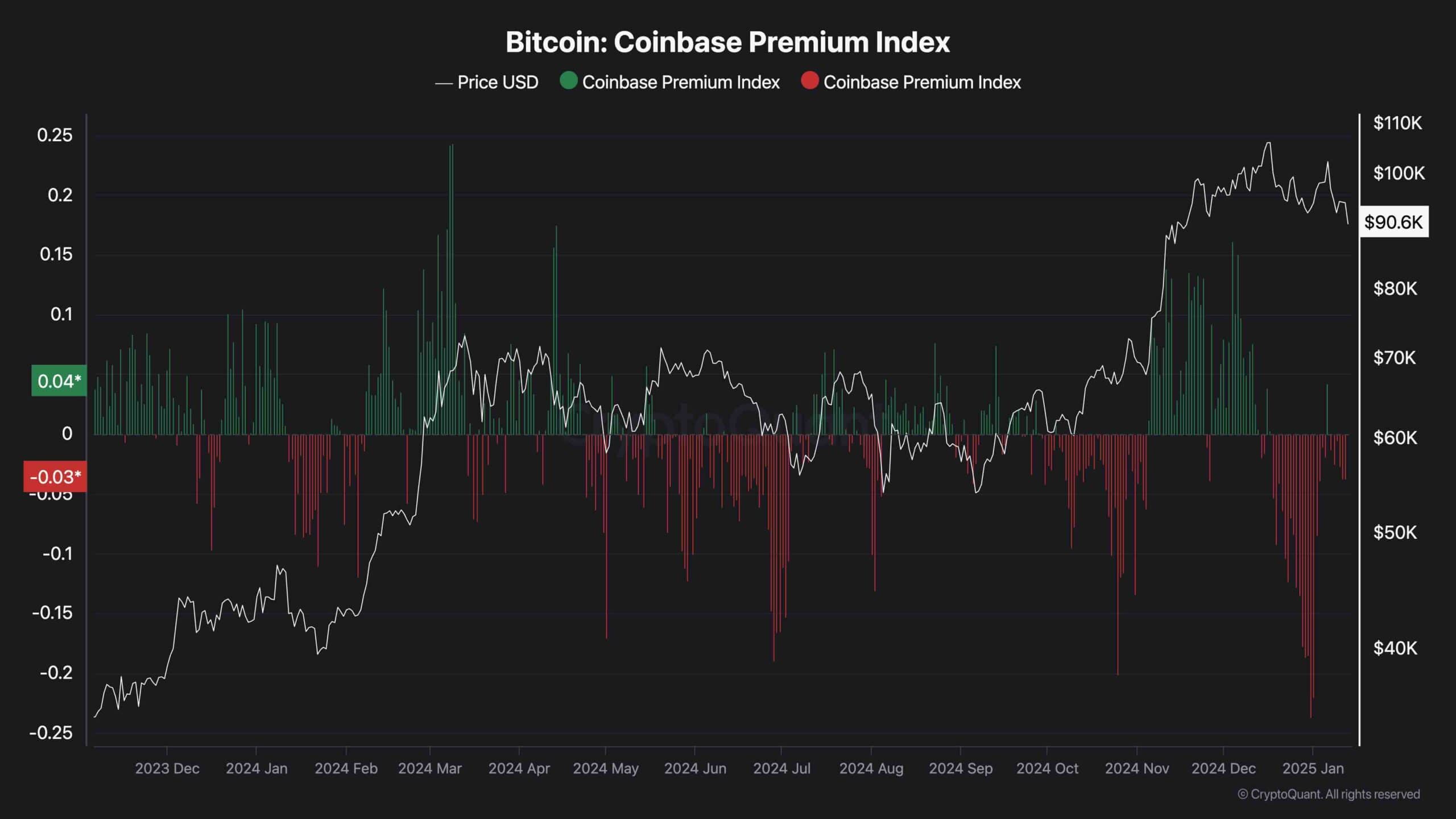

Bitcoin Coinbase Premium Index

Whereas Bitcoin’s value is at the moment breaking a major assist degree to the draw back, it could be helpful to determine the place the promoting stress is coming from. On this case, the Coinbase Premium Index generally is a very great tool.

This metric measures whether or not American traders are shopping for or promoting heavier than these primarily based in different nations by evaluating the value of the BTD/USD pair on Coinbase and the BTC/USDT pair on Binance.

Because the chart suggests, the index has been deeply unfavorable for the previous month, which signifies that the US market is now promoting Bitcoin extra aggressively. So long as this metric stays unfavorable, the correction may be anticipated to proceed.