Bitcoin worth stood at $105,382 on June 3, 2025, sustaining a market capitalization of $2.094 trillion with a 24-hour buying and selling quantity of $25.18 billion. Intraday volatility confirmed a worth vary between $103,984 and $106,443, reflecting a market in the hunt for directional readability.

Bitcoin

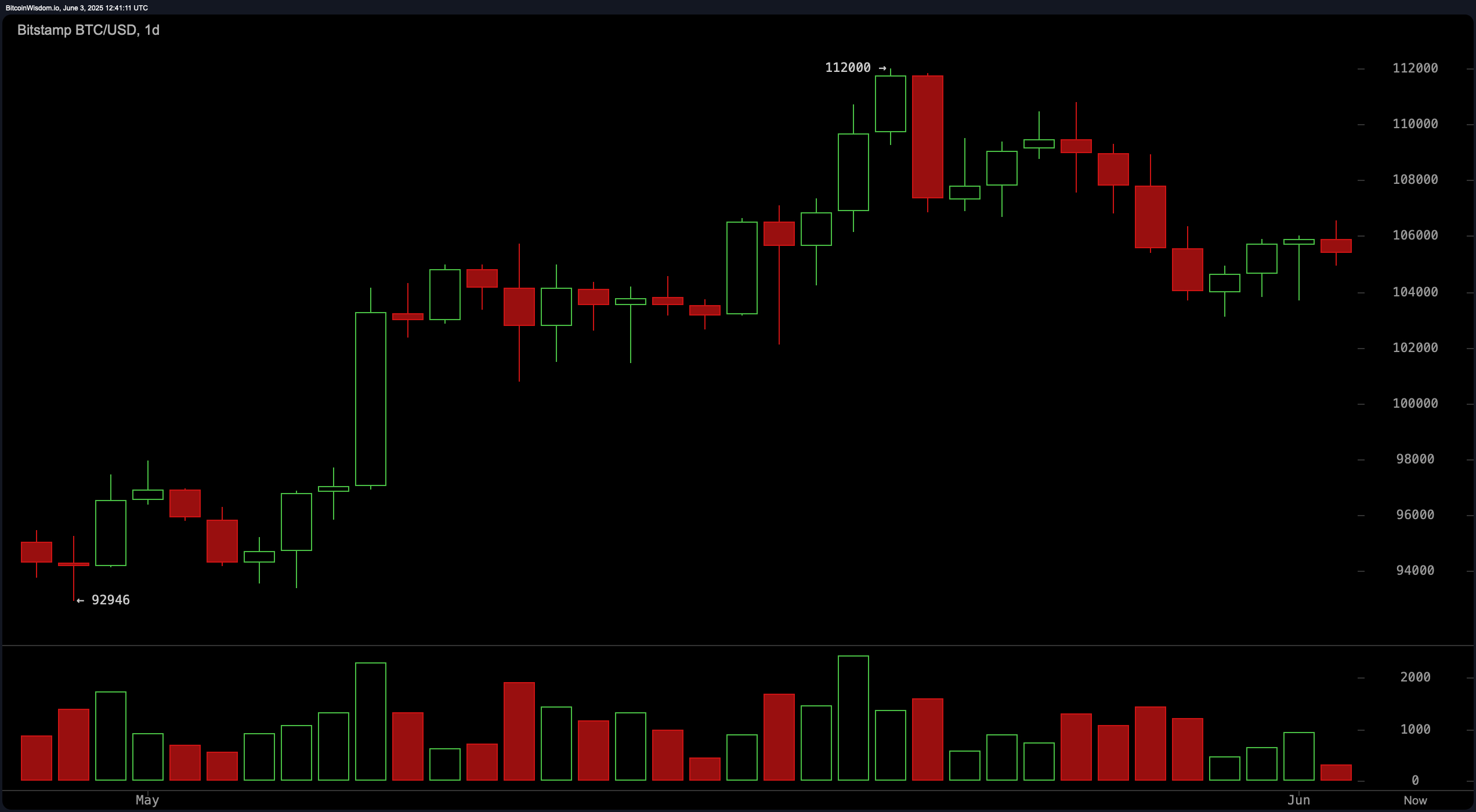

On the each day chart, bitcoin (BTC) seems to be consolidating after a current retreat from the $112,000 degree, buying and selling tightly between $105,000 and $106,000. The discount in promoting quantity hints at a attainable exhaustion of bearish strain, although a decisive breakout is but to materialize. A detailed above $107,000 on sturdy quantity may validate a bullish reversal, whereas a drop under $103,000 may affirm a continuation of the downtrend. Brief-term targets in both path are set at $110,000–$112,000 for upside strikes and $98,000–$100,000 on the draw back, respectively. The development right here stays impartial, underscored by diminishing quantity and market indecision.

BTC/USD each day chart on June 3, 2025.

The 4-hour chart helps a cautious stance, with bitcoin displaying indicators of consolidation between $104,500 and $106,000 following a corrective bounce from a neighborhood backside at $103,127. Regardless of the bounce, momentum has failed to hold by way of, reflecting hesitation amongst merchants. A candle shut above $106,500 with vital quantity may supply a near-term bullish alternative aiming for $108,000 or greater. Conversely, a breakdown under $104,000 may steer costs towards $102,000. Till both situation unfolds, the 4-hour construction leans barely bearish however not decisively so.

BTC/USD 4-hour chart on June 3, 2025.

On the 1-hour chart, bitcoin‘s worth motion illustrates a pointy transfer to $106,564 adopted by a swift retracement, making a sideways, low-volume section indicative of market indecision. This lack of conviction presents alternatives for intraday scalps: a possible lengthy place on a bounce from the $105,000 degree, or a brief if worth fails to beat $106,000. Brief-term targets vary from $104,000–$104,500 for shorts, and $106,000–$106,300 for longs. Present situations require tight threat administration as a result of lack of sturdy directional cues.

BTC/USD 1-hour chart on June 3, 2025.

Technical indicators paint a combined image. Amongst oscillators, the relative energy index (RSI) at 53, Stochastic at 31, and commodity channel index (CCI) at -29 all point out neutrality, suggesting a wait-and-see method by momentum merchants. The typical directional index (ADX) at 21 offers a weak bullish sign, whereas the momentum indicator exhibits -2,425 and the shifting common convergence divergence (MACD) stands at 1,595—each reflecting bearish sentiment. The superior oscillator can be impartial, indicating an absence of dominant development energy.

Transferring averages (MAs) additional reinforce the indecisive nature of the market. Brief-term metrics such because the exponential shifting common (EMA) and easy shifting common (SMA) over 10 and 20 durations present bearish alerts, with values hovering above the present worth. Nonetheless, medium- and long-term indicators—EMAs and SMAs over 30, 50, 100, and 200 durations—are bullish, suggesting that the broader development stays intact. Till a breakout materializes, bitcoin seems trapped in a transitional section, with merchants watching key ranges for readability.

Bull Verdict:

If bitcoin reclaims and holds above the $107,000 degree with confirming quantity, it may sign the tip of the present consolidation and the start of a brand new leg greater towards the $110,000–$112,000 resistance zone. Help from medium- to long-term shifting averages, together with waning promoting strain, provides to the bullish case for a possible breakout.

Bear Verdict:

A decisive drop under $103,000, particularly on elevated quantity, would affirm a continuation of the bearish correction. Weak momentum readings from the momentum indicator and shifting common convergence divergence (MACD), mixed with short-term shifting averages pointing decrease, assist a situation during which bitcoin may revisit the $98,000–$100,000 vary.