Bitcoin continues to commerce just under the $96K resistance, consolidating after its sharp rally in late April. The value is presently hovering in a slim vary whereas the market digests current positive factors.

Momentum has barely cooled off, however no main bearish reversal indicators have emerged but.

Technical Evaluation

The Each day Chart

BTC stays in an general bullish construction on the every day timeframe, holding above the $91K help and each the 100 and 200-day transferring averages. After breaking by means of the $90K–$91K vary, the asset is now testing the $95K resistance zone, which additionally aligns with the neckline of the earlier consolidation.

Furthermore, the 100-day and 200-day transferring averages have printed a bearish crossover close to the $90K stage, which is the one main worrying signal. But, so long as Bitcoin holds above each of them, the medium-term bullish pattern stays intact.

The 4-Hour Chart

On the 4-hour chart, BTC has lately been trapped inside an ascending channel sample, which usually alerts an area prime or slowdown in bullish momentum, particularly if damaged to the draw back.

The asset is presently testing the decrease boundary of the sample across the $94K–$94.5K space, now performing as help. If this stage fails to carry, the following demand zone lies across the $92K mark. On the flip facet, reclaiming $96K would doubtless ignite one other leg greater, focusing on $98K and even $100K.

Onchain Evaluation

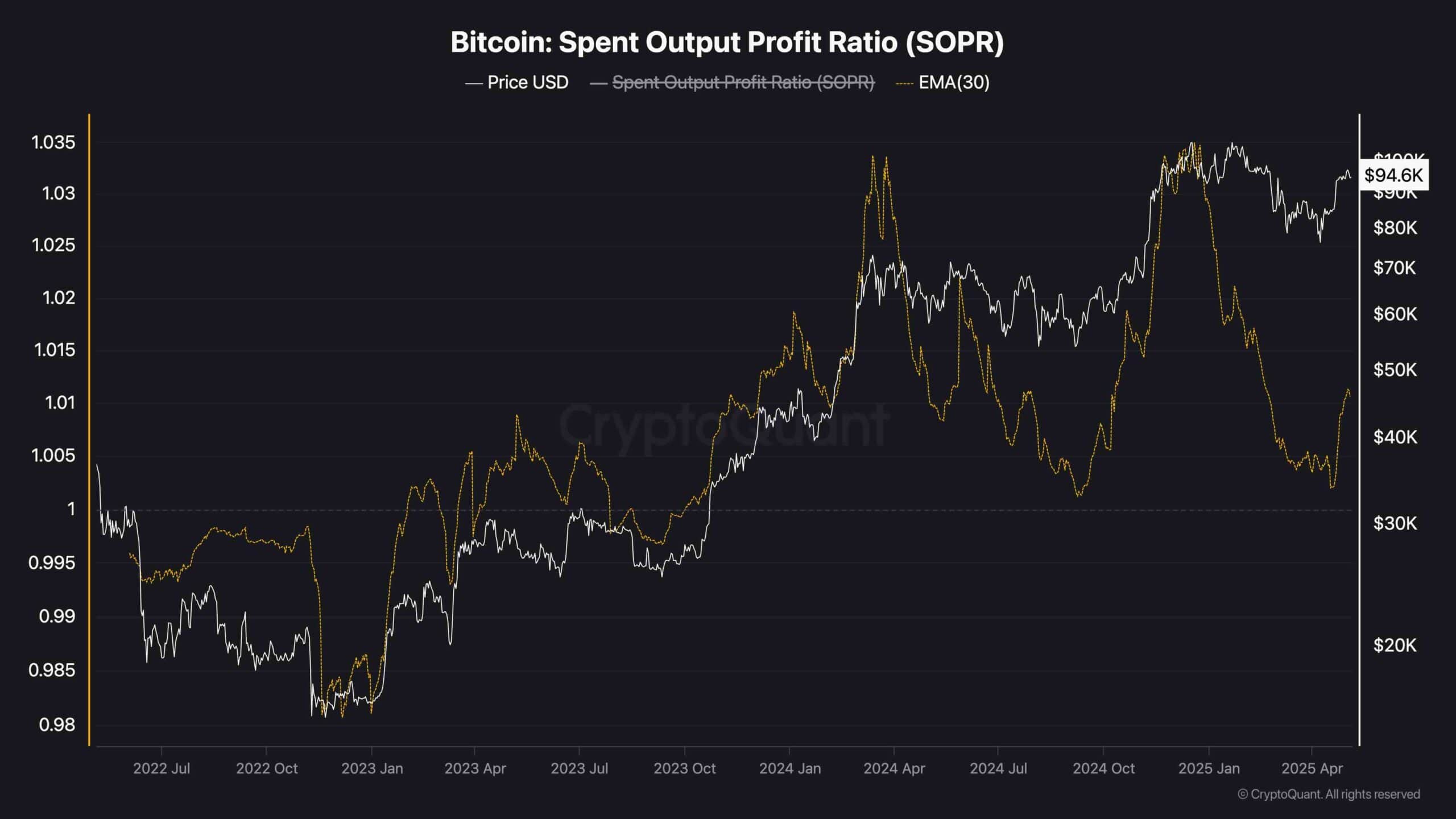

SOPR (EMA 30)

On-chain metrics recommend the bullish bias stays supported by wholesome profit-taking dynamics and restricted sell-side stress. The Spent Output Revenue Ratio (SOPR) stays above the 1.0 threshold, indicating that cash transferring on-chain are doing so in revenue. Importantly, SOPR lately rebounded with the value, suggesting that even after the rally, holders usually are not speeding to exit positions at a loss.

This displays robust conviction available in the market and usually helps pattern continuation slightly than quick correction.