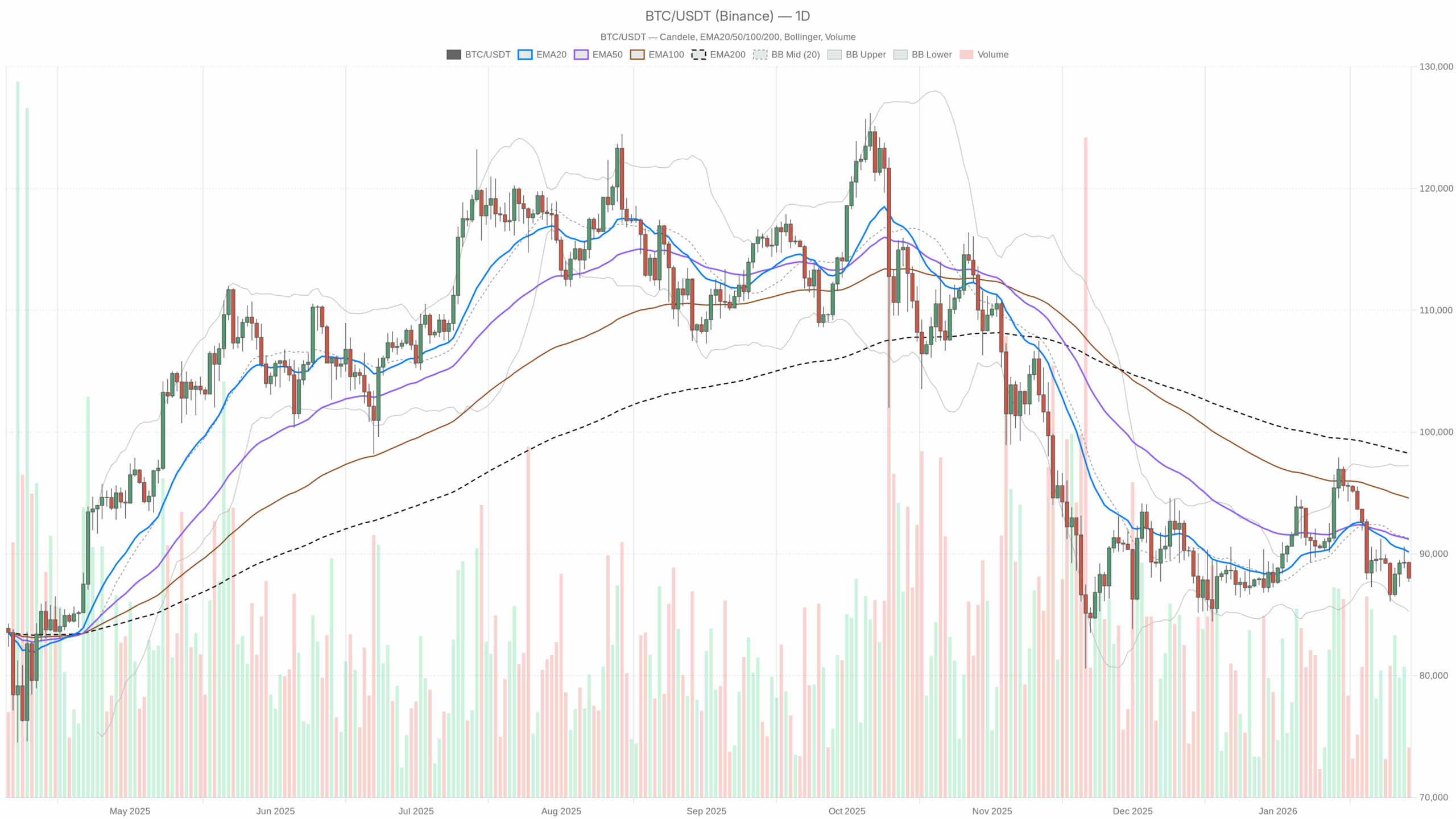

Spot patrons look cautious as Bitcoin prezzo hovers under key transferring averages, with BTC buying and selling round 88,000 in a corrective part inside a broader bullish cycle.

Every day timeframe (D1): predominant regime – bearish correction

Bias: Bearish on the every day, inside a bigger bullish cycle that began earlier in 2024.

EMAs (pattern construction)

Worth vs EMAs: Shut ≈ 88,013

EMA 20 ≈ 90,142

EMA 50 ≈ 91,193

EMA 200 ≈ 98,252

Bitcoin is buying and selling under all three key EMAs, and the shorter EMAs (20 and 50) are additionally under the 200-day. That’s basic corrective territory after a significant advance. The medium-term pattern has rolled over, and now the burden of proof is on the bulls to reclaim ranges somewhat than on bears to defend them.

What it implies: The trail of least resistance on the every day continues to be decrease or sideways-to-lower. This stays the case till BTC can at the least get again above the 20-day EMA round 90k and maintain there on a closing foundation.

RSI 14 (momentum)

RSI 14 ≈ 41.8

Momentum is unfavorable however not washed out. Worth is under the impartial 50 line, which factors to sellers having the higher hand, but it’s nowhere close to the 30 zone that normally marks panic or compelled liquidation.

What it implies: Promoting stress is actual however managed. There may be room for additional draw back earlier than dip-buyers are compelled in by oversold situations. This favors a gradual bleed or uneven base-building over a direct V-shape restoration.

MACD (pattern momentum)

MACD line ≈ -751

Sign line ≈ -286

Histogram ≈ -466 (deeply unfavorable)

The MACD is firmly under zero and the road is below its sign, with a decently unfavorable histogram. That is what a maturing downswing seems like. Bearish momentum stays in management, however the market is already properly below the zero line, so probably the most aggressive part of the rollover is probably going behind us.

What it implies: Pattern momentum continues to be on the bears aspect. Any bounce into the 20- or 50-day EMA ought to be handled as a take a look at of resistance somewhat than a confirmed pattern change. That’s until the MACD line begins curling again up towards the sign and the zero line.

Bollinger Bands (volatility & positioning)

Center band (20-day foundation) ≈ 91,282

Higher band ≈ 97,272

Decrease band ≈ 85,291

Worth ≈ 88,013, nearer to the decrease band

Worth is buying and selling within the decrease half of the band construction, nearer the decrease band however not using it. The market shouldn’t be in a full-blown volatility enlargement to the draw back, as a result of there isn’t a persistent band stroll, however it’s clearly priced on the defensive aspect of the vary.

What it implies: BTC is within the low cost half of its latest 20-day vary, however not but in a capitulation squeeze. That normally means bounces towards the mid-band close to 91k are attainable. Nevertheless, until that band is reclaimed with conviction, rallies are typically bought into.

ATR 14 (volatility)

ATR 14 ≈ 2,191

Every day vary volatility is critical relative to cost however not excessive for Bitcoin at these ranges.

What it implies: Swings of a few thousand {dollars} per day are regular on this regime. Place sizing and leverage have to respect the potential for quick 2–3k intraday strikes with out assuming we’re in a meltdown atmosphere.

Pivot ranges (short-term reference)

Every day Pivot Level (PP) ≈ 88,355

Resistance 1 (R1) ≈ 89,006

Assist 1 (S1) ≈ 87,362

Worth is at the moment just below the every day pivot, which is a vital reference for short-term merchants.

What it implies: So long as BTC sits under the pivot, intraday flows are biased to promote rallies. A push above 88.4–89k and a sustained maintain could be the primary small sign that patrons are beginning to regain initiative on the day.

Worry & Greed Index

Worth: 26 – Worry

The market has clearly stepped away from the euphoria part seen earlier within the cycle. Sentiment is now extra cautious and defensive.

What it implies: Positioning is now not extraordinarily crowded on the lengthy aspect. Worry at these ranges usually accompanies late-stage corrections, nevertheless it doesn’t routinely imply a backside. Sentiment can keep fearful whereas worth continues to grind decrease.

Market context and macro construction

BTC dominance ≈ 57.3%

Complete crypto market cap ≈ $3.06T

24h market cap change ≈ -1.65%

Bitcoin continues to be carrying the market on its again. A dominance this excessive, mixed with risk-off habits in complete market cap, factors to capital staying in BTC relative to altcoins however lowering total publicity throughout the sector.

What it implies: When BTC sneezes on this regime, alts are inclined to catch pneumonia. If this correction extends, the harm in altcoins is more likely to be worse, however BTC itself ought to stay comparatively extra resilient than the broader crypto advanced.

1-hour timeframe (H1): short-term stress, however not a waterfall

Worth ≈ 88,013

EMA 20 ≈ 88,671

EMA 50 ≈ 88,790

EMA 200 ≈ 89,492

Regime: marked as bearish

Worth is below all key intraday EMAs, that are stacked bearishly and beginning to bend down. This reinforces the message from the every day chart.

What it implies: The intraday pattern is down, confirming the every day bearish bias. Rallies towards the 88.7–89.5k space are more likely to encounter provide until the intraday construction adjustments meaningfully.

RSI 14 (H1) ≈ 38.2

Momentum is weak on the hourly chart however not but at exhaustion ranges. Sellers stay in management, but they don’t seem to be totally overstretched.

What it implies: There may be room for a number of pushes decrease earlier than short-covering turns into dominant. That mentioned, merchants ought to look ahead to divergences if worth makes new lows whereas RSI stops confirming.

MACD (H1):

Line ≈ -298

Sign ≈ -176

Histogram ≈ -122

The hourly MACD is unfavorable with a unfavorable histogram, however the distance between the road and the sign shouldn’t be widening aggressively. This means extra of a grind than a collapse.

What it implies: The downtrend is established however at the moment extra grinding than capitulating. Any flattening of the histogram towards zero could be an early trace of a aid bounce try on this timeframe.

Bollinger Bands (H1):

Mid ≈ 88,902

Higher ≈ 90,259

Decrease ≈ 87,545

Worth ≈ 88,013, sitting within the decrease half however not pinned to the band

The market is buying and selling defensively intraday, but volatility continues to be comparatively contained. There isn’t any clear band stroll but on the draw back.

What it implies: Breaks under roughly 87,500 that begin using the decrease band would mark an acceleration in promoting. Till that occurs, the draw back is managed somewhat than chaotic.

ATR 14 (H1) ≈ 467

Hourly ATR round 400–500 {dollars} signifies that intraday swings of that measurement are regular noise within the present regime.

What it implies: Very tight stops close to present worth are susceptible to being shaken out in each instructions by commonplace volatility. Merchants have to calibrate place measurement and cease distance accordingly.

Hourly pivots:

PP ≈ 88,049

R1 ≈ 88,124

S1 ≈ 87,937

Worth is nearly precisely on the hourly pivot, which highlights the market indecision at this micro stage.

What it implies: The market is deciding its subsequent intraday leg. A transparent transfer under 87,900 with acceptance would align the hour much more strongly with the every day downtrend. Conversely, reclaiming and holding above 88,100–88,300 would sign a short-term pause or bounce.

15-minute timeframe (M15): execution context solely

Worth ≈ 88,013

EMA 20 ≈ 88,211

EMA 50 ≈ 88,512

EMA 200 ≈ 88,773

Regime: bearish

The very short-term construction can also be bearish, however right here the image is extra nuanced and primarily related for execution timing.

RSI 14 (M15) ≈ 41.5

Momentum is weak however stabilizing a bit in contrast with the hourly chart. That usually occurs after an preliminary leg decrease.

What it implies: Brief-term promoting is slowing, which frequently precedes both a small bounce or a consolidation vary somewhat than instant additional acceleration to the draw back.

MACD (M15):

Line ≈ -128

Sign ≈ -127

Histogram ≈ -0.45 (virtually flat)

The MACD line and sign on M15 are practically on high of one another, and the histogram is near zero. This alerts a pause in instant momentum.

What it implies: Very short-term momentum is neutralizing after the final drop. It is a basic setup for a neighborhood vary or a mean-reversion pop again towards the 20 and 50 EMAs earlier than the market chooses course once more.

Bollinger Bands (M15):

Mid ≈ 88,221

Higher ≈ 88,499

Decrease ≈ 87,943

Worth ≈ 88,013, slightly below the mid-band

On the execution timeframe, BTC is hovering near the center of its latest 15-minute vary. That’s impartial within the very brief time period and doesn’t present clear stretch or compression.

What it implies: Within the micro context, roughly 200-dollar swings are routine. Entries too near close by intraday ranges might be hit simply by noise, so precision and persistence matter.

M15 pivots:

PP ≈ 88,040

R1 ≈ 88,108

S1 ≈ 87,945

Worth is oscillating across the pivot, which underlines the shortage of very short-term conviction for now.

What it implies: For lively merchants, it is a basic wait-for-the-break zone. A decisive transfer away from the 88k space is required for a clear intraday directional commerce with a positive threat/reward profile.

Placing all of it collectively: situations

The important thing level is that each one three timeframes (D1, H1, M15) are technically bearish, however the shortest one is displaying early indicators of stabilization. That normally precedes both a short-covering bounce into resistance or a sideways consolidation earlier than the subsequent leg down.

Bullish situation for Bitcoin prezzo (counter-trend rebound)

On this context, any bullish final result is a counter-trend transfer on the every day chart. The dominant construction stays corrective and favors sellers till confirmed in any other case.

What bulls have to do:

- Defend the decrease every day Bollinger Band area round 85,000–86,000. A collection of upper lows above that band would present that sellers are operating out of gasoline.

- Push worth again above the every day pivot (~88,355) after which the H1 and D1 20-EMA cluster round 90,000–90,500.

- Flip hourly momentum, with H1 RSI again above 50 and the MACD histogram contracting towards zero from the unfavorable aspect.

Upside ranges in play if bulls regain management:

- First goal or ceiling: 91,000–91,500 (every day mid-Bollinger and 50-EMA zone), which is probably going the primary main provide space.

- Subsequent extension: 95,000–97,000 if volatility expands to the upside and shorts are crowded.

What would invalidate the bullish situation: A clear every day shut under the decrease Bollinger Band round 85,000 with increasing ATR and a still-negative MACD histogram. That might present the correction shouldn’t be achieved and bulls have didn’t defend the volatility boundary.

Bearish situation (continuation of the correction)

That is at the moment the principle situation based mostly on the every day regime and indicator setup. Sellers are in management so long as key transferring averages and momentum alerts stay aligned to the draw back.

What bears have to do:

- Preserve BTC pinned under the 20-day EMA (~90,142). So long as worth stays below that line on a closing foundation, each bounce is suspect.

- Push the hourly construction into one other leg down by breaking under ~87,500 (H1 decrease band and short-term helps) and holding there.

- Keep RSI on each D1 and H1 below 50 with MACD remaining under zero and with out robust bullish divergences.

Draw back ranges in play if promoting continues:

- Quick response zone: 87,300–87,400 (close to every day S1 and intraday helps). A break right here opens the door decrease.

- Subsequent logical help band: 85,000–86,000 (every day decrease Bollinger Band and psychological space).

- If that fails with robust quantity and increasing ATR, the correction can deepen towards 80,000–82,000, the place many medium-term individuals would probably search for stronger worth.

What would invalidate the bearish situation (at the least short-term): A sustained reclaim of 90,500+ with a every day shut again above the 20-day EMA, mixed with a flattening or bullish cross within the every day MACD histogram. That might flip the present transfer from a pattern correction into a possible sideways re-accumulation part.

Positioning, threat, and uncertainty

At the moment the market is in a managed correction inside a much bigger bull pattern, not in confirmed macro breakdown territory. Every day and hourly constructions agree on the bearish bias, however lower-timeframe momentum is stabilizing, which frequently precedes uneven, stop-hunting situations.

For brief-term merchants, this regime favors respecting the bearish every day construction somewhat than treating each small inexperienced candle as the underside. It additionally suggests utilizing intraday bounces into the 88.5–90.5k space to gauge whether or not sellers nonetheless dominate or whether or not patrons are lastly stepping in with conviction.

For longer-term individuals, the important thing query is whether or not BTC holds above the mid-80k area. So long as that zone incorporates the correction, this stays a high-timeframe pullback in an ongoing uptrend. A clear break and acceptance under it could shift the dialog from wholesome correction towards one thing extra structurally regarding.

Volatility, sentiment within the Worry zone, and positioning all argue for flexibility somewhat than conviction. The market can simply ship sharp squeezes in opposition to either side earlier than selecting the subsequent huge leg, so threat administration and persistence stay important.

Buying and selling Instruments

If you wish to monitor markets with skilled charting instruments and real-time knowledge, you’ll be able to open an account on Investing utilizing our accomplice hyperlink:

Open your Investing.com account

This part incorporates a sponsored affiliate hyperlink. We could earn a fee at no extra price to you.

Disclaimer: This evaluation is for informational and academic functions solely and isn’t funding, buying and selling, or monetary recommendation. Markets are risky and unpredictable; all the time do your individual analysis and handle threat based on your individual circumstances.