Cryptocurrency trade Bybit has revealed its fifteenth proof of reserves report, revealing main adjustments in consumer asset holdings throughout varied cryptocurrencies.

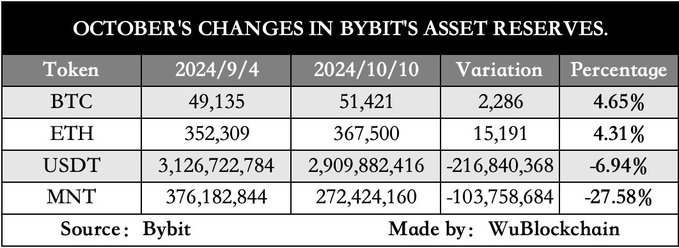

The snapshot of the asset holding was taken on October 1, 2024. The report exhibits notable will increase in Bitcoin (BTC) and Ethereum (ETH) belongings, whereas Tether (USDT) holdings have declined a bit.

Supply: Wu Blockchain

Bitcoin and Ethereum belongings present development

In keeping with the report, Bybit’s consumer Bitcoin belongings have grown to 51,421 BTC, marking a 4.65% improve from the earlier snapshot on September 4, 2024. This development signifies a rising curiosity in Bitcoin amongst Bybit customers.

Equally, Ethereum holdings have seen a optimistic pattern, with consumer belongings reaching 367,500 ETH, up 4.31% from the final report.

Whereas BTC and ETH belongings grew, Tether (USDT) holdings on Bybit skilled a lower. Person USDT belongings dropped to 2.91 billion, representing a 6.94% decline from the earlier report.

Curiously, the report additionally exhibits a substantial lower in Mantle (MNT) holdings. As per the report, consumer belongings fell by 27.58% to 272,424,160 MNT. The precise motive for the drop in MNT reserves is unclear.

Reserve ratios throughout a number of cryptocurrencies

Bybit’s proof of reserve report additionally supplies insights into the reserve ratios for varied cryptocurrencies. These ratios point out the proportion of belongings held in Bybit’s wallets in comparison with consumer belongings:

- Bitcoin (BTC): 106% reserve ratio

- Ethereum (ETH): 106% reserve ratio

- Dogecoin (DOGE): 113% reserve ratio

- Polkadot (DOT): 114% reserve ratio

- Mantle (MNT): 132% reserve ratio

- Optimism (OP): 115% reserve ratio

- PEPE: 108% reserve ratio

- SHIB: 115% reserve ratio

Notable mentions embrace XRP with a 120% reserve ratio, UNI at 119%, and SHRAP at 118%. These excessive reserve ratios throughout a number of belongings show Bybit’s dedication to sustaining strong liquidity and consumer fund safety.

The report additionally highlights the reserve ratios for varied stablecoins:

- USDC: 113% reserve ratio

- USDT: 110% reserve ratio

- USDE: 101% reserve ratio

Bybit launched its first proof of reserves report on December 5, 2022. The initiative started after the fallout of the FTX trade. Ever since, exchanges like Binance, Bybit and some others have begun releasing their month-to-month asset holding studies.

That is meant to instill belief for the shoppers by making certain that their crypto just isn’t being mishandled by the trade.