On Tuesday, CaliberCos Inc., the Arizona-based various asset supervisor, introduced that it accomplished its first buy of Chainlink (LINK) tokens underneath a brand new Digital Asset Treasury Technique. The transfer triggered an unprecedented rally, with CWD shares hovering by 2,500% intraday.

Regardless of the daring shift positioning CaliberCos on the intersection of actual property and blockchain infrastructure, analysts warning that monetary instability, excessive volatility, and restricted institutional protection depart the inventory a high-risk guess.

First Nasdaq Agency Anchoring LINK Treasury

CaliberCos is the primary Nasdaq-listed firm to anchor a company treasury coverage round Chainlink. CaliberCos described its preliminary LINK acquisition as a system check for inside processes, with plans for gradual accumulation over time.

Funding will come from an fairness credit score line, money reserves, and equity-based securities.

CEO Chris Loeffler mentioned the technique “reinforces our conviction in Chainlink because the infrastructure connecting blockchain with real-world property.”

The corporate emphasised that the framework contains tax, accounting, custody, and governance buildings, aiming to distinguish itself from extra speculative crypto performs. Administration framed the pivot as a part of a broader effort to place CaliberCos as a blockchain-native monetary agency.

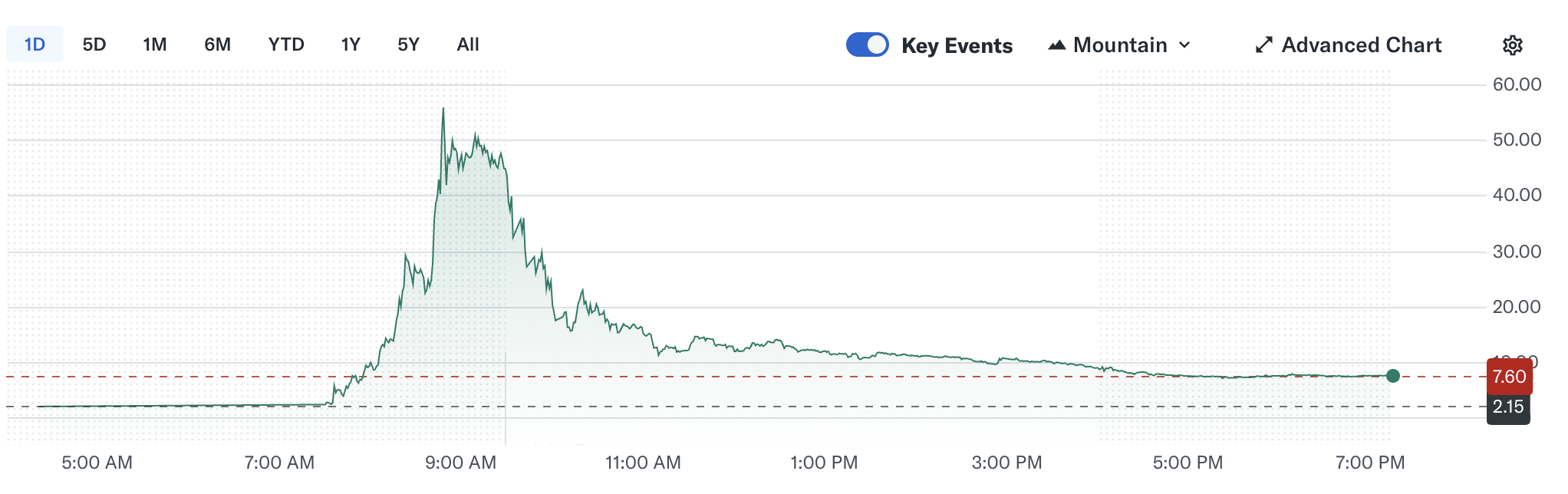

CWD inventory erupted on the announcement, with greater than 79 million shares traded versus a typical each day common of underneath 10 million. Its shares—beforehand buying and selling close to $2.10—surged greater than 2,500% intraday to a peak of $56 earlier than settling at $7.60 by the shut.

The rally adopted earlier momentum on August 28, when the inventory jumped from $1.70 to $4.40 after CaliberCos first disclosed plans to undertake Chainlink as a treasury asset, drawing sharp consideration from retail merchants and speculative traders.

Regardless of Tuesday’s rally, CaliberCos shares stay down greater than 80% over the previous 12 months. Analysts at present fee the inventory Maintain, with a $2.50 worth goal that lags far behind present buying and selling ranges after the announcement.

CWD inventory efficiency over the previous day / Supply: Google Finance

Crypto Rally Meets Harsh Fundamentals

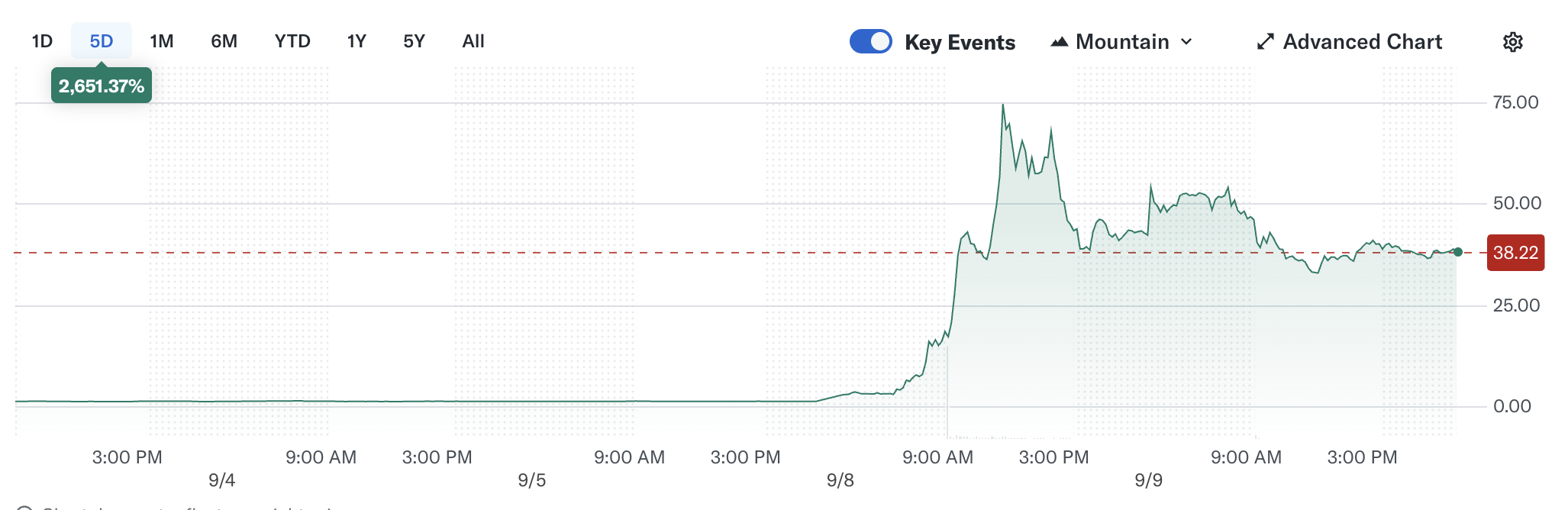

CaliberCos’ replace got here amid a wave of company treasury experiments with digital property. Eightco, a peer, had unveiled plans only a day earlier to fund Worldcoin purchases, sparking a 1,400% surge in its shares. Each strikes spotlight the rise of retail enthusiasm for firms tying stability sheets to crypto property, even when monetary misery lingers.

Eightco inventory efficiency during the last week / Supply: Google Finance

Many analysts, nonetheless, flagged CaliberCos’ declining revenues and heavy leverage as important headwinds. They warned that the valuation is narrative-driven and uncovered to speculative swings, making CWD a dangerous proxy for crypto adoption fairly than a secure long-term funding.

Revenues fell greater than 40% in 2024, whereas web losses widened by over 50%. Restricted analyst protection and opaque governance add to the dangers.

In keeping with market commentators, the inventory stays appropriate primarily for “meme inventory lovers” fairly than institutional traders searching for sturdy worth.

The publish CaliberCos Inventory Soars 2,500% on LINK Treasury Guess appeared first on BeInCrypto.