Bitcoin value closed at $108,199 on July 5, 2025, positioning the asset inside a good intraday vary of $107,386 to $109,117. With a market capitalization of $2.151 trillion and a 24-hour buying and selling quantity of $21.145 billion, bitcoin continues to consolidate underneath key resistance amid muted directional conviction.

Bitcoin

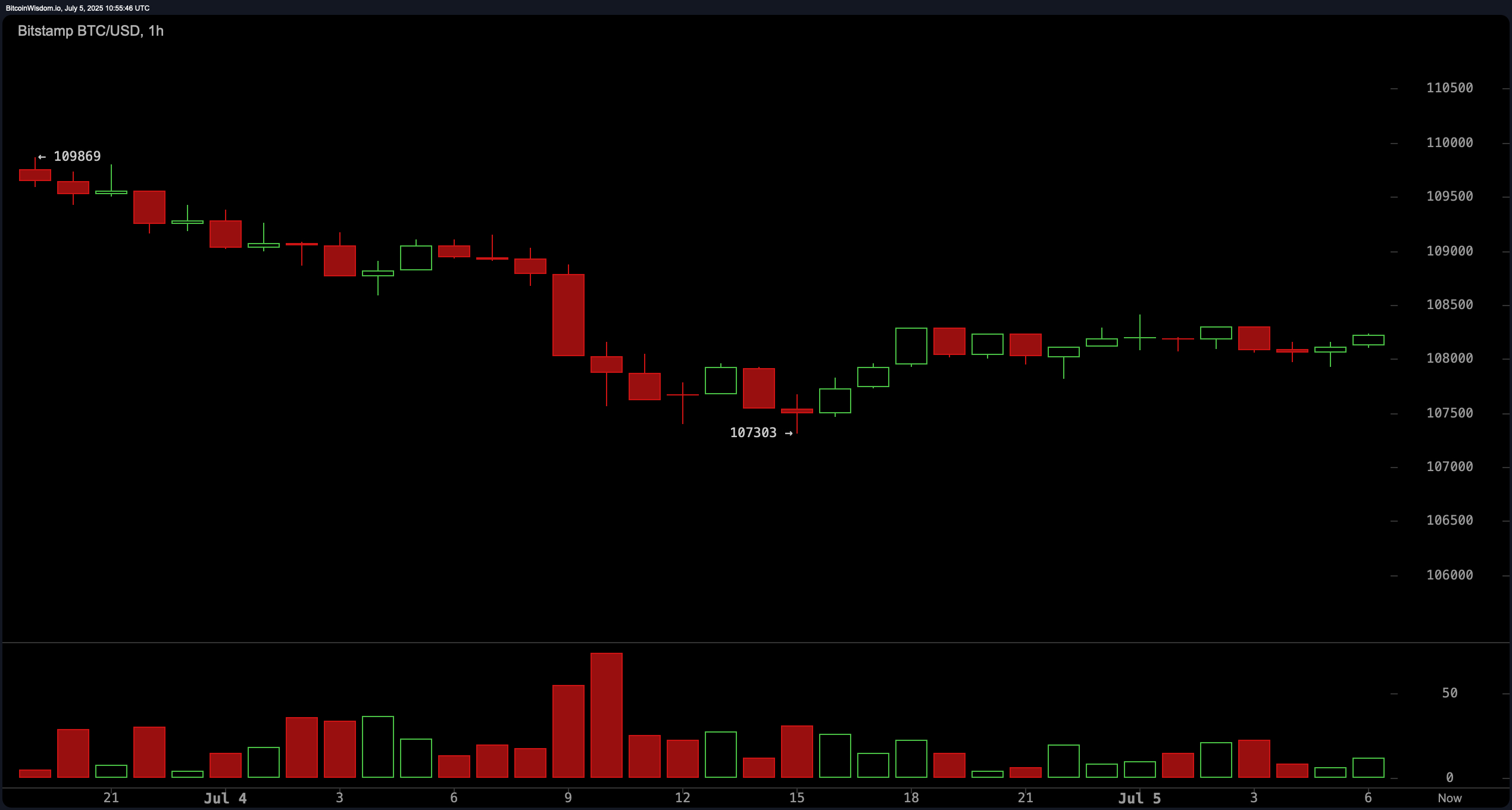

On the 1-hour chart, bitcoin displayed a gentle bullish restoration from the $107,300 stage after enduring a sequence of crimson candles. Nevertheless, quantity tapered off, hinting at a pause in momentum and suggesting potential consolidation fairly than continuation. The technical construction presents a transparent resistance band at $108,500 to $109,000, with help anchored round $107,300. Intraday merchants are suggested to watch a breakout above $109,000 accompanied by quantity, as this will likely catalyze a short-term push towards $109,500 to $110,000. Conversely, a failure to maintain above $108,000 may see a reversion to decrease help ranges.

BTC/USD 1-hour chart on July 5, 2025, by way of Bitstamp.

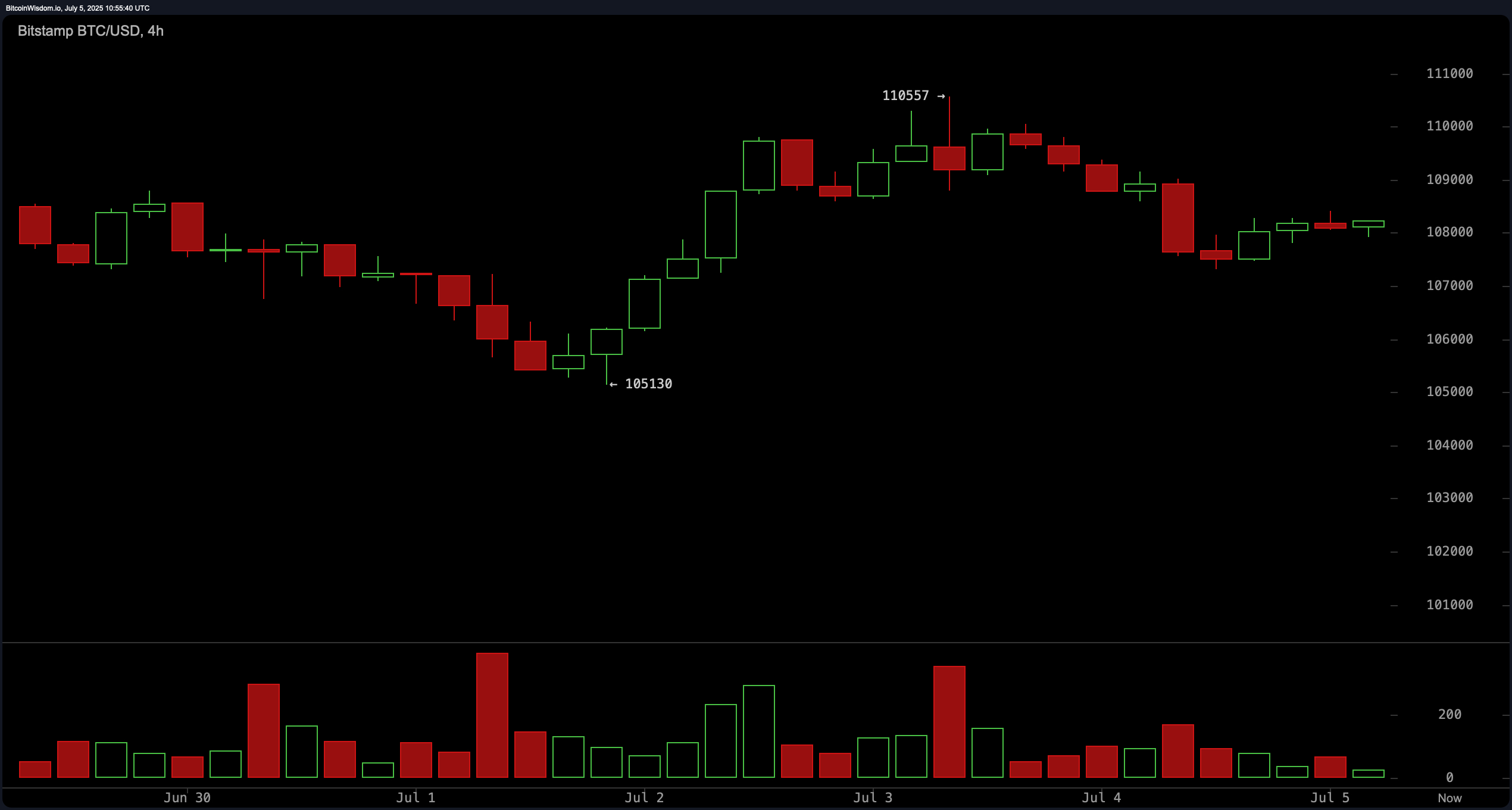

The 4-hour BTC/USD chart presents a cautiously bullish outlook, following a breakout from $105,130 to a swing excessive close to $110,557, later retracing on heavy sell-side quantity. The chart’s value construction displays the next low, but in addition a short-term decrease excessive—hallmarks of rising consolidation. Key help at $107,800 and $106,300 turns into vital for swing entries. A confirmed bullish candlestick sample, comparable to a hammer or engulfing candle close to $108,000, could present a positive risk-reward setup, concentrating on resistance close to $110,000. Merchants ought to stay vigilant for bearish divergence on the relative power index (RSI) or sustained failure to reclaim prior highs.

BTC/USD 4-hour chart on July 5, 2025, by way of Bitstamp.

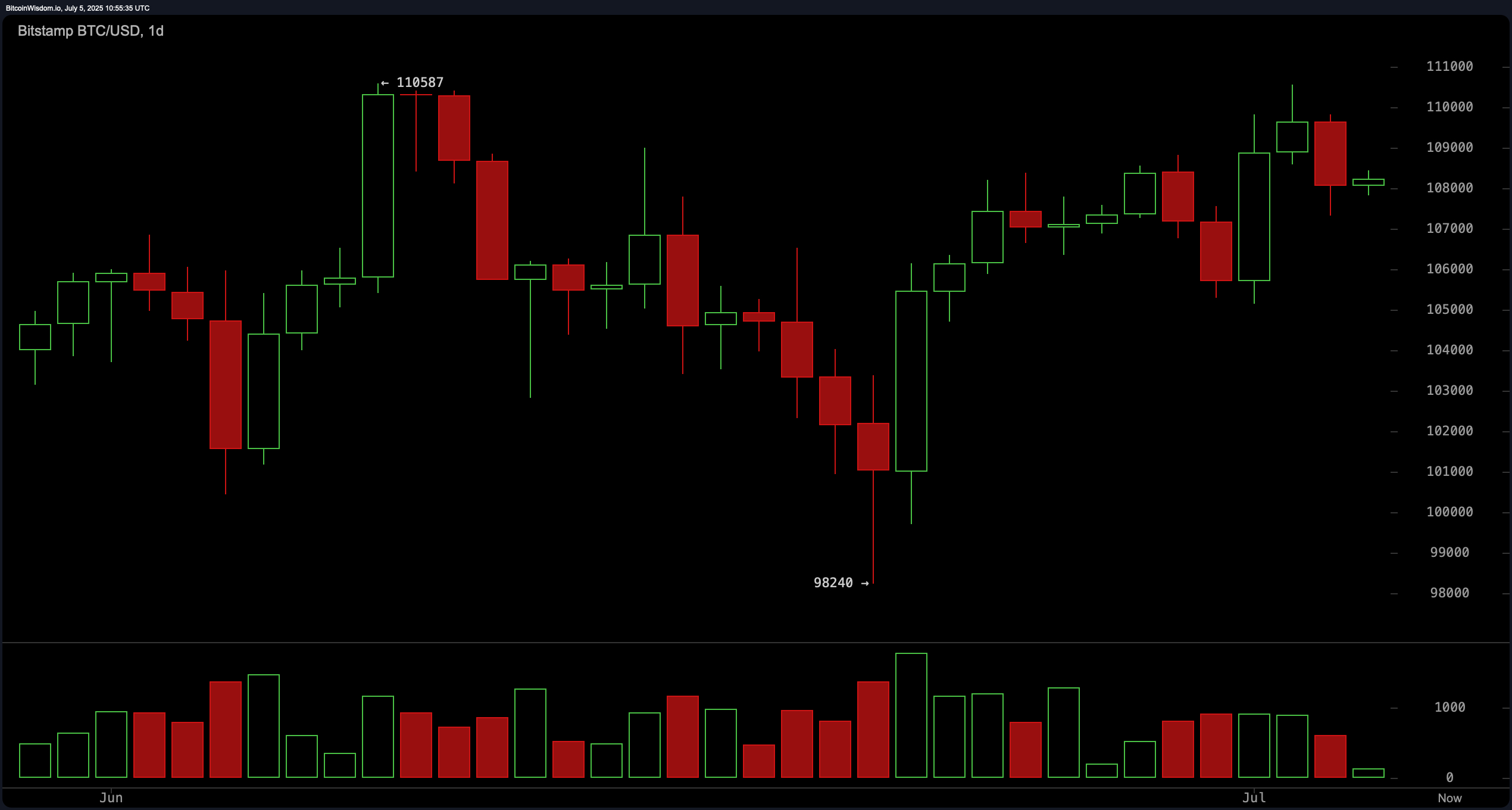

From a every day perspective, bitcoin is entrenched in a range-bound sample, having peaked close to $110,587, bottomed at $98,240, and just lately rebounded towards the $108,000 area. This symmetrical motion shaped a possible double high, with distribution patterns evident within the spike in downtrend quantity. The vary of $98,000 to $110,000 defines the present macro setup, with compression constructing. Traders searching for larger timeframe entries ought to await affirmation: a decisive breakout above $111,000 with sturdy quantity would affirm a bullish continuation, whereas a breakdown beneath $98,000 would sign a bearish reversal.

BTC/USD every day chart on July 5, 2025, by way of Bitstamp.

A complete evaluation of the oscillators provides nuance to the market’s neutrality. The relative power index (RSI) sits at 55, indicating equilibrium. The Stochastic oscillator at 84 and the Stochastic RSI quick at 85 each sign overbought situations, favoring short-term promoting strain. Nevertheless, the transferring common convergence divergence (MACD) stage reads 854 with a constructive indication, suggesting bullish crossover momentum should be in play. The commodity channel index (CCI) at 75, common directional index (ADX) at 10, and Superior oscillator at 2,003 all mirror impartial sentiment, confirming the broader image of consolidation.

In the meantime, transferring averages (MAs) are firmly bullish throughout all key timeframes. The ten-period exponential transferring common (EMA) and easy transferring common (SMA) stand at $107,636 and $107,752, respectively, each indicating purchase indicators. Longer-term averages, together with the 50-period EMA at $104,870 and the 200-period SMA at $96,365, reinforce a robust uptrend bias. Such alignment of transferring averages confirms that whereas momentum could also be stalling short-term, the broader pattern stays intact except key help ranges give means.

Bull Verdict:

If bitcoin decisively breaks above $109,000 with sturdy quantity and confirms a bullish continuation above $111,000, the broader pattern favors a resumption towards new highs. The alignment of all main transferring averages with purchase indicators and a supportive MACD underpins bullish momentum, reinforcing the potential for additional upside within the close to to mid-term.

Bear Verdict:

Ought to bitcoin fail to maintain above $108,000 and break beneath the vital $107,300 and finally $98,000 help ranges, it will affirm a bearish reversal from the established vary. Overbought oscillator situations and heavy sell-side quantity from latest highs point out that the market could also be making ready for a deeper correction, with draw back targets opening towards the $95,000 vary and beneath.