Bitcoin traded at $108,220 at this time, with a market capitalization of $2.15 trillion and a 24-hour buying and selling quantity of $10.41 billion. All through the day, the cryptocurrency moved inside an intraday worth vary of $107,138 to $108,320, indicating a slim however vital consolidation zone in a broader bullish context.

Bitcoin

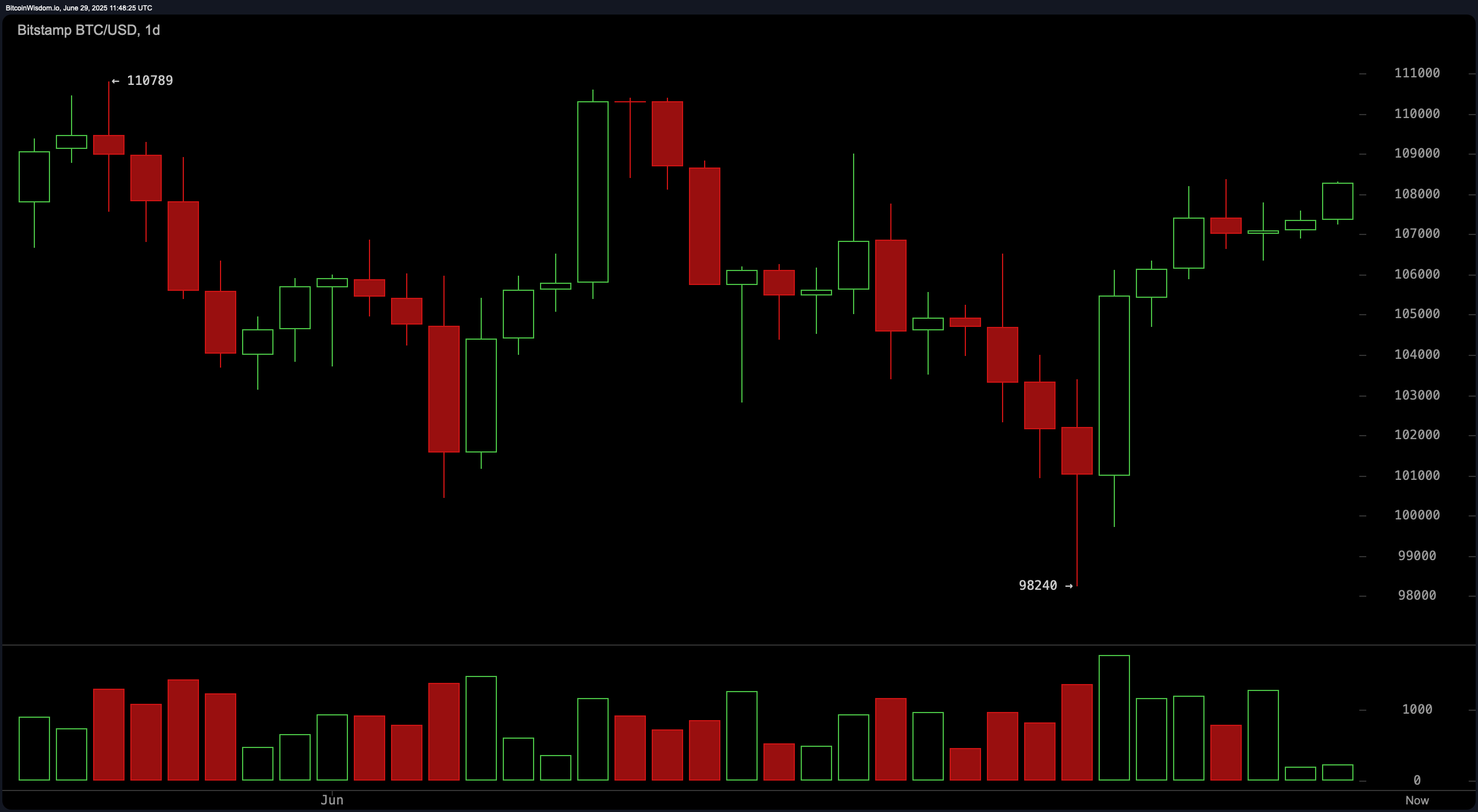

On the day by day chart, bitcoin’s worth motion reveals a powerful V-reversal following a correction from a latest excessive of $110,789 to a low of $98,240. The rebound is marked by rising quantity and smaller-bodied inexperienced candlesticks, suggesting a slowing however nonetheless constructive momentum. The worth at the moment consolidates just under the $108,000 mark. A confirmed breakout above the $110,000 resistance with excessive quantity might sign a continuation of the long-term uptrend. Key assist zones stay at $103,000 and $98,000, the place prior shopping for exercise was concentrated.

BTC/USD day by day chart on June 29, 2025.

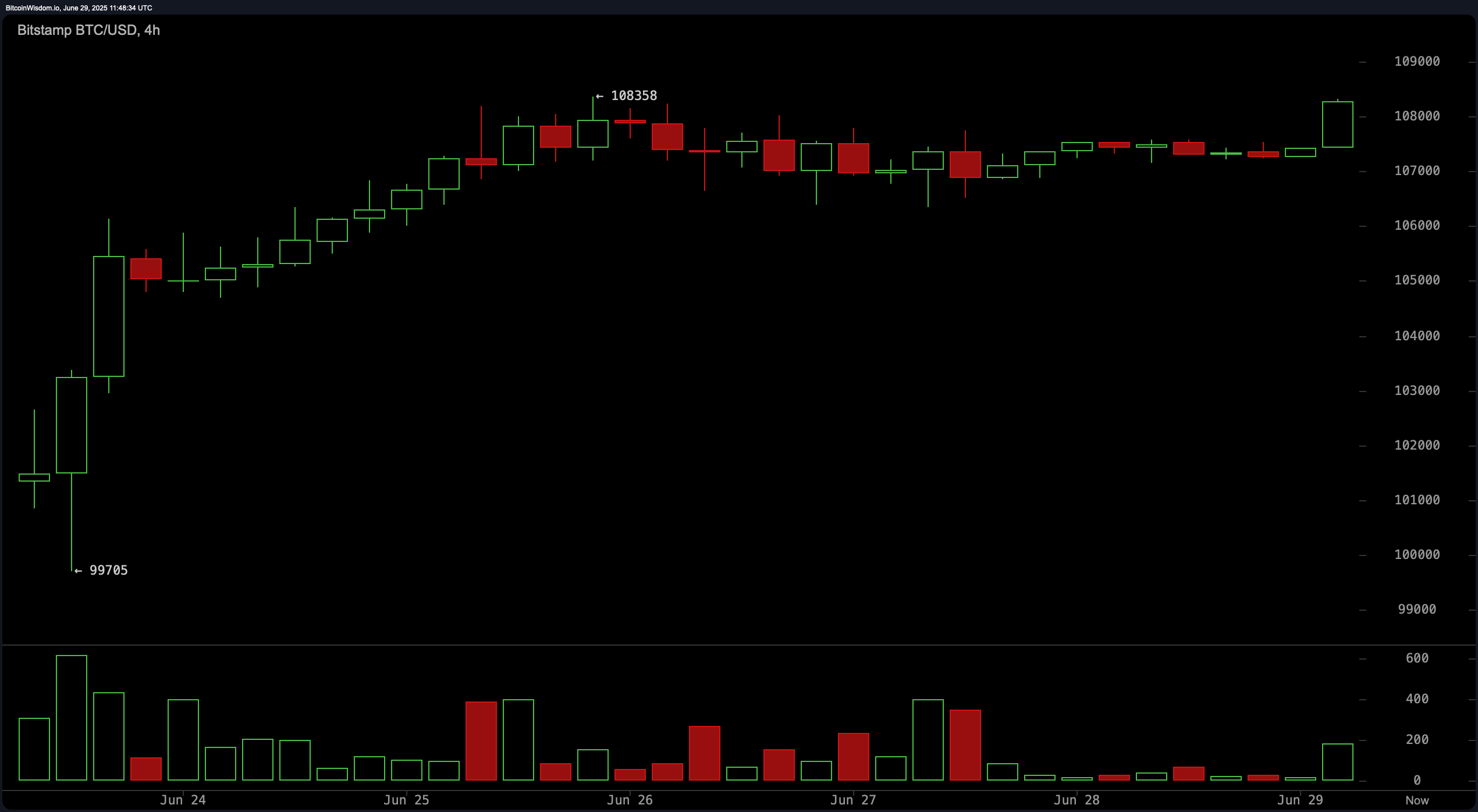

From a medium-term perspective, the 4-hour BTC/USD chart illustrates a bullish flag formation, underscored by a gradual upward grind. A breakout candle close to the $108,358 stage accompanied by a noticeable quantity spike signifies consumers are gaining confidence. Ought to the value retest the $107,000 to $107,500 area efficiently, it could current a lower-risk entry for bullish positions. Conversely, a sustained transfer beneath $106,800 would invalidate this short-term construction and necessitate a reassessment of directional bias.

BTC/USD 1-hour chart on June 29, 2025.

On the 1-hour chart, bitcoin demonstrates short-term momentum by way of a slim consolidation adopted by sharp upward strikes. Quantity affirmation throughout latest inexperienced candles validates a bullish breakout from what seems to be an accumulation zone. Merchants seeking to capitalize on this setup might think about entries on pullbacks towards the $107,700 to $108,000 vary. Protecting stops beneath $107,200 are prudent, notably if accompanied by an uptick in sell-side quantity.

BTC/USD 4-hour chart on June 29, 2025.

Oscillator readings provide a largely impartial bias with nuanced bullish leanings. The relative energy index (RSI) sits at 59, indicating neither overbought nor oversold circumstances. The Stochastic and commodity channel index (CCI) are additionally impartial, whereas momentum (10) and the transferring common convergence divergence (MACD) are in purchase territory—suggesting an upward bias is rising. The common directional index (ADX) at 14 displays a weak pattern energy however doesn’t battle with the bullish indicators from different momentum indicators.

All main transferring averages (MAs) point out sturdy bullish alignment. The exponential transferring averages (EMA) and easy transferring averages (SMA) throughout all key durations—from 10-day to 200-day—are positioned beneath the present worth, every issuing a purchase sign. The ten-day EMA at $106,462 and 10-day SMA at $105,524 recommend instant short-term assist, whereas longer averages such because the 200-day EMA at $94,475 and SMA at $96,224 affirm the prevailing uptrend is well-supported. These technical layers set up a agency basis for potential upward continuation, contingent on quantity and breakout affirmation.

Bull Verdict:

Given the alignment of all key transferring averages in purchase territory, alongside bullish indicators from the momentum (10) and transferring common convergence divergence (MACD), the technical construction throughout the 1-hour, 4-hour, and day by day charts helps a continued uptrend. A breakout above $110,000 on sturdy quantity might affirm bullish dominance and open the trail to new highs.

Bear Verdict:

Regardless of bullish indicators, oscillators such because the relative energy index (RSI) and Stochastic stay impartial, whereas the typical directional index (ADX) displays weak pattern energy. A breakdown beneath $106,800 on the 4-hour chart or $107,200 on the 1-hour chart—particularly with rising quantity—would invalidate the present setup and should set off a short-term bearish reversal.