Bitcoin vs Google: A New Market Cap Rivalry

In a headline-grabbing achievement, Bitcoin has overtaken Google (Alphabet Inc.) to safe the fifth spot among the many world’s Most worthy belongings. This milestone cements BTC’s place alongside the biggest corporations and commodities within the international financial system, reinforcing its function as a official retailer of worth.

However the timing is essential. With main U.S. financial knowledge about to be launched, the important thing query is: Can Bitcoin preserve its lead over Google, or will market forces knock it again?

Google’s Coverage Reversal Provides to Crypto Momentum

In a notable shift, Google has reversed its plan to ban non-custodial crypto wallets from the Play Retailer. This ensures Android customers worldwide can proceed to entry wallets like MetaMask and Belief Pockets, preserving the rules of decentralization and consumer management.

For Bitcoin and the broader crypto market, that is an oblique win; it removes a possible barrier to adoption and retains the self-custody narrative alive, which is essential for long-term belief in digital belongings.

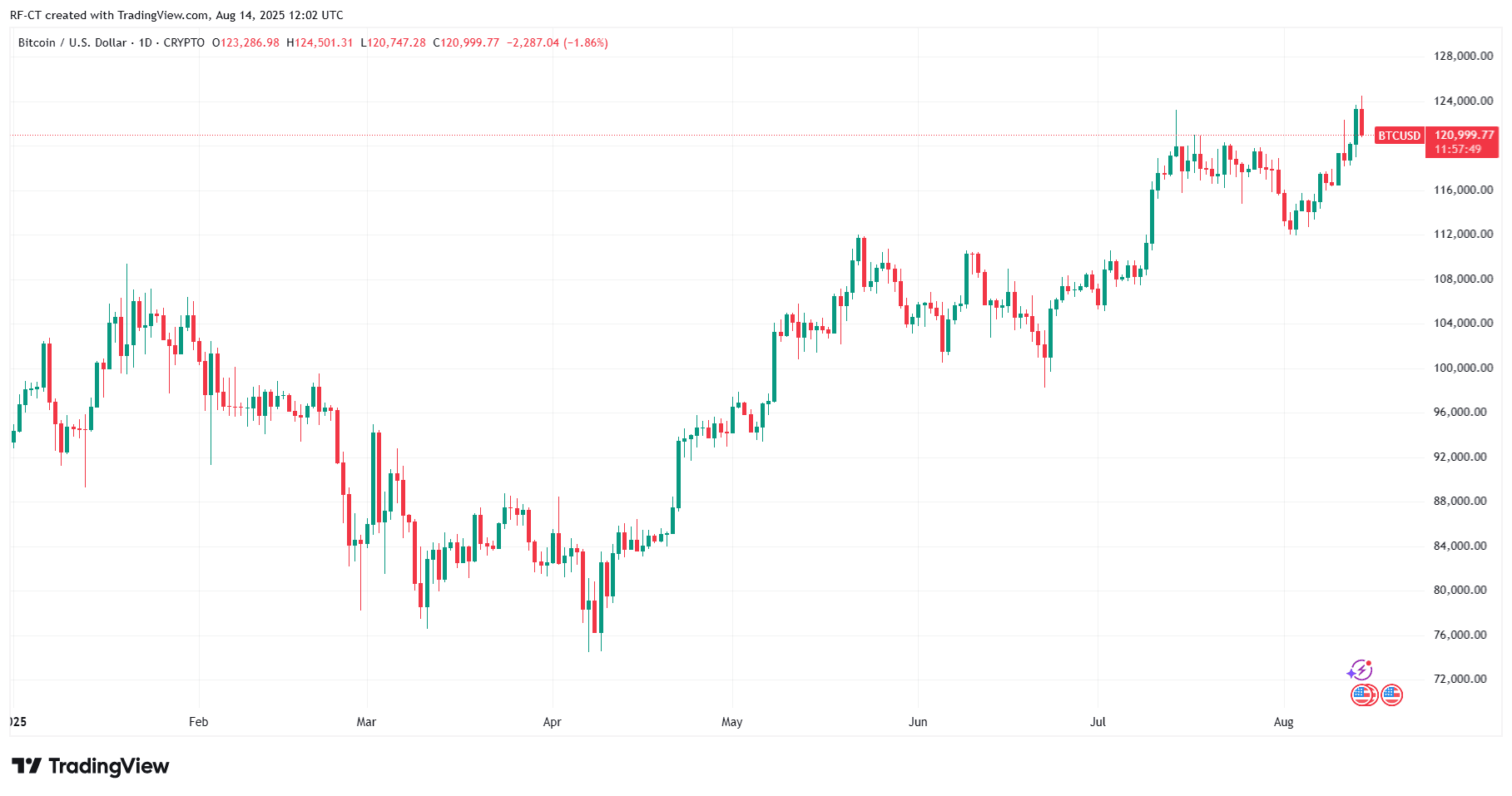

Bitcoin’s $124,501 All-Time Excessive

Driving a wave of optimism, Bitcoin surged to a contemporary all-time excessive of $124,501, powered by each institutional demand and retail enthusiasm. This rally not solely pushed BTC previous Google in market capitalization but additionally positioned it strongly forward of a doubtlessly market-shifting U.S. knowledge launch.

U.S. Information Might Determine the Winner – What It Means for Bitcoin

At 8:30 AM ET, three key U.S. financial experiences will drop:

1. Producer Value Index (PPI)

Measures wholesale-level inflation — what producers are paid for his or her items and providers.

- Why it issues: Excessive PPI can sign that shopper costs will rise later; low PPI suggests easing inflation.

-

Influence on BTC:

- Decrease PPI → Bullish for Bitcoin because it will increase the probability of Fed price cuts.

- Increased PPI → Bearish as it might hold charges excessive, decreasing urge for food for threat belongings.

2. Core PPI

Identical as PPI however excludes risky meals and power costs.

- Why it issues: Provides a clearer image of underlying inflation developments.

-

Influence on BTC:

- Decrease Core PPI → Robust bullish sign; may push BTC towards $130K+.

- Increased Core PPI → Might set off a pullback as markets worth in longer-term increased charges.

3. Preliminary Jobless Claims

Measures how many individuals filed for unemployment advantages for the primary time prior to now week.

- Why it issues: Displays the well being of the labor market and financial momentum.

-

Influence on BTC:

- Increased claims → Alerts financial weak spot, will increase probability of price cuts → Bullish for BTC.

- Decrease claims → Alerts a powerful financial system, may delay cuts → Probably bearish short-term.Why This Information Strikes Crypto

All three experiences instantly affect the Federal Reserve’s rate of interest coverage. Charges dictate the move of liquidity in markets:

- Decrease charges or rate-cut expectations → Extra liquidity, traders search increased returns → Bullish for Bitcoin.

- Increased charges or delayed cuts → Stronger greenback, safer yields in bonds → Might stress Bitcoin costs.

For Bitcoin, the response is usually immediate; merchants alter positions inside seconds, resulting in sharp worth swings. A good studying may assist BTC solidify its lead over Google, whereas a disappointing one may see it slide again down the rankings.

Earlier than and After the Information: Market Playbook

- Earlier than: Anticipate cautious buying and selling, decrease liquidity, and uneven strikes as merchants look ahead to the numbers.

- After: Volatility will spike. Optimistic knowledge may launch Bitcoin towards $130K+, whereas destructive readings might set off a swift correction. Altcoins are prone to observe BTC’s lead as soon as the mud settles.

The clock is ticking: will BTC prolong its lead over Google, or will a market shake-up put the tech big again on prime?

$BTC, $Bitcoin