Ethereum wants to interrupt the $3,297 Fibonacci resistance degree, with combined short-term efficiency and institutional curiosity fueling market optimism.

As of January 9, Ethereum (ETH) trades for $3,095.10, reflecting a 1.2% decline over the previous 24 hours amid ongoing market volatility. The crypto asset skilled a decent buying and selling vary between $3,058 and $3,133, with intraday dips adopted by partial recoveries. This minor pullback aligns with a 0.8% drop towards Bitcoin (measured at 0.03428 BTC), whereas 24-hour buying and selling quantity stays at over $22.4 billion.

Latest efficiency exhibits combined outcomes as good points of two.4% over 7 days and 4.1% over 14 days distinction with a 6.9% annual decline. With the worth testing key ranges and displaying constructive momentum over the previous week, merchants are left questioning: Can Ethereum break by means of its resistance and maintain its bullish development?

Can Ethereum Maintain a Bullish Development?

Trying on the every day technical chart from TradingView, the worth has just lately examined the Fibonacci resistance degree at $3,297. This rapid resistance has confirmed vital, as Ethereum has been unable to interrupt previous this degree.

Ethereum Prediction

A sustained failure to interrupt by means of this resistance may result in a pullback towards the subsequent help zone, which rests on the $3,071 degree. Ought to the worth break under this help degree, it could take a look at the subsequent main help close to $2,958.

In the meantime, the Superior Oscillator indicator additional helps the technical evaluation, as the present studying of 123.53 suggests a continuation of bullish momentum. Nevertheless, the weakening of the inexperienced bars and the seen purple bar may point out an impending slowdown if Ethereum fails to push above the Fibonacci resistance degree at $3,297.

Massive Cash Nonetheless All in favour of Ethereum

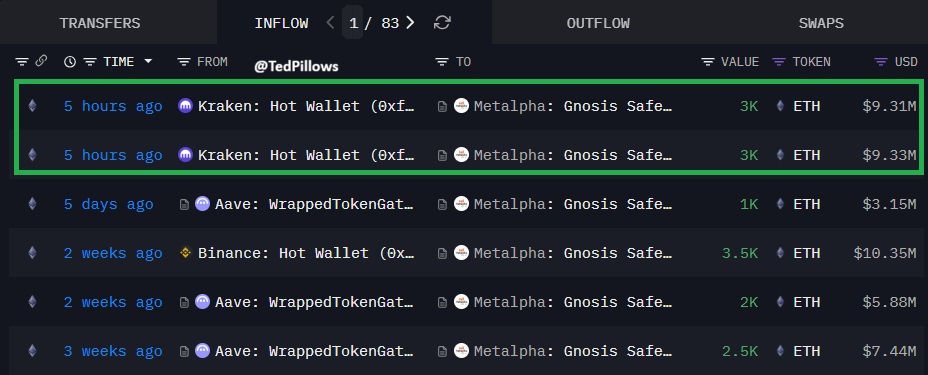

Elsewhere, in accordance to market watcher Ted, huge cash continues to be fascinated about Ethereum, as a latest transaction highlights how a lot market confidence stays. As an example, Metalpha withdrew a complete of $18.64 million in ETH from Kraken earlier immediately, transferring 6,000 ETH in two separate transactions, valued at roughly $9.31 million every.

Ethereum Transfers

This transfer underscores the continuing curiosity in Ethereum, particularly from institutional gamers. This means that giant traders are positioning themselves forward of future worth actions.