Spot Ethereum exchange-traded funds broke an important document as their inflows continued rising.

Ethereum (ETH) ETFs have had inflows within the final 16 consecutive days, breaking a private document. The online influx on Friday, Dec. 14 stood at over $23.6 million, bringing the entire quantity since inception to over $2.26 billion.

In line with SoSoValue, all spot Ethereum ETFs maintain over $13.7 billion in belongings. The Grayscale Ethereum ETF continues to be the largest with over $5.6 billion.

It’s adopted by iShares Ethereum Belief ETF, Constancy Ethereum Fund, Bitwise Ethereum ETF, VanEck Ethereum ETF, and Franklin Ethereum ETF.

One cause for the inflows is the rising hope that the U.S. Securities and Change Fee will permit staking. Such a transfer would imply that ETF holders will profit because the coin’s value rises and from the staking reward. Knowledge by StakingRewards reveals that the staking yield stands at 3.26%.

These inflows have occurred at a time when Ethereum is doing properly. Its value is hovering close to $4,000, and is simply 25% beneath its all-time excessive of $4,870. It has jumped by 153% from its 2023 lows.

On-chain metrics are additionally encouraging. Knowledge by IntoTheBlock reveals that the variety of energetic ETH addresses has risen to over 122.7 million, the best stage in months.

You may also like: Trump’s World Liberty Monetary baggage $55M in ETH holding; sparks positivity for SOL and LNEX

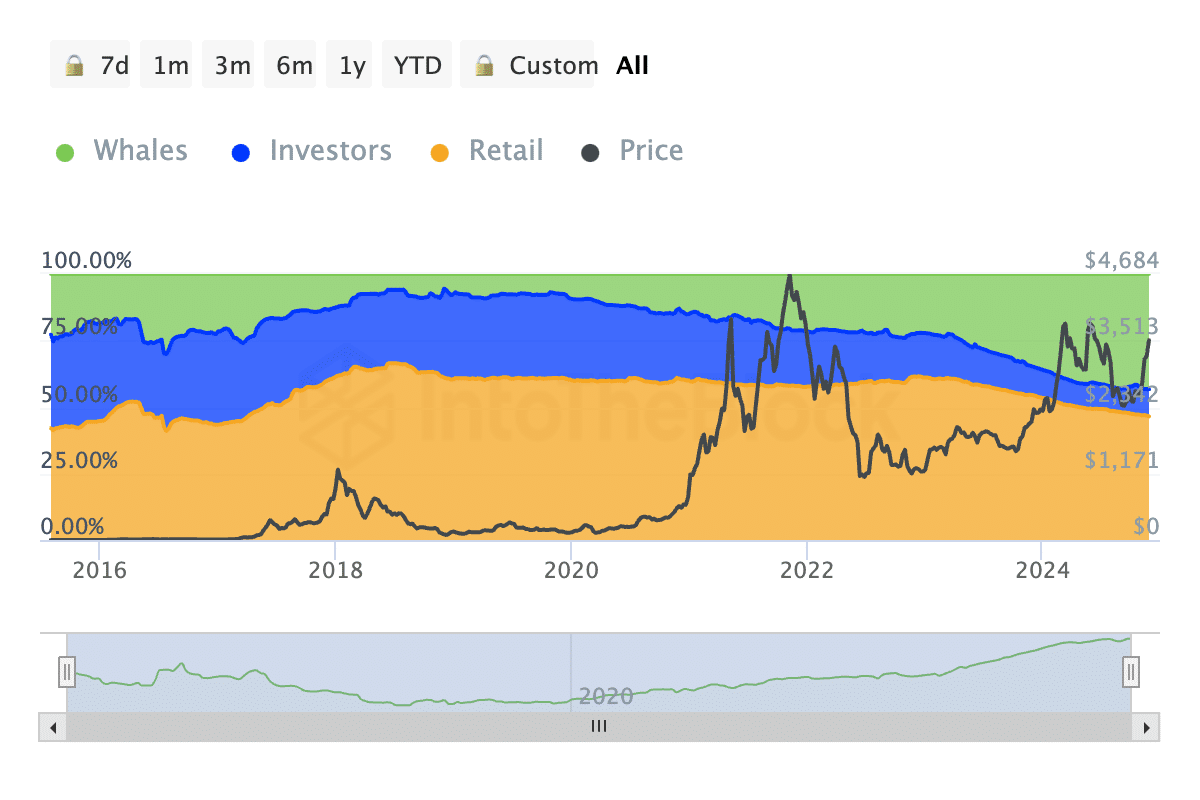

Extra information reveals that Ethereum whales are gaining market share. Whales holds about 43% of all Ethereum cash, increased than about 22% in November, an indication that they’re optimistic concerning the coin.

ETH whales | Supply: IntoTheBlock

Ethereum value evaluation: can ETH hit $5,000?

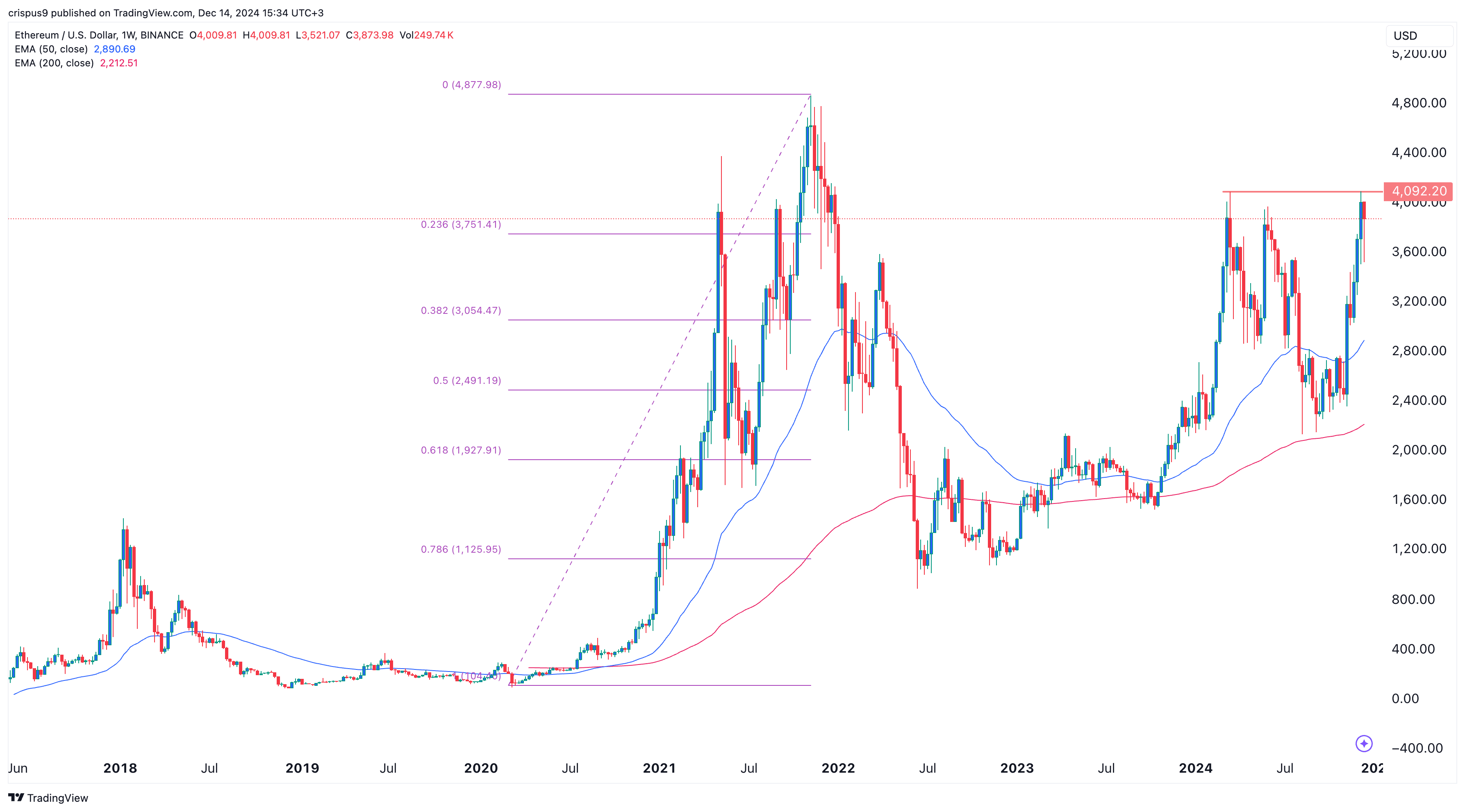

ETH value chart | supply: crypto.information

In a current observe, CryptoQuant predicted that the ETH value was on a path to $5,000, citing the demand and provide dynamics.

On the weekly chart, we see that the ETH value has risen and located a robust barrier at $4,092. It has didn’t cross that stage two occasions earlier than — in March and Could.

Ether has remained above the 50-week and 200-week transferring averages and the 23.6% Fibonacci Retracement stage. Subsequently, ETH wants to interrupt the resistance at $4,092 to invalidate the triple-bottom chart sample.

A transfer above that resistance will push it to the all-time excessive of $4,877 and the important thing stage at $5,000. It must rise by simply 25% to get to $5,000, which is achievable if the crypto bull run continues.

Learn extra: Can Shiba Inu value actually soar to $1 as burn charge jumps?