Vital quantities of Ethereum (ETH) had been shifted to centralized exchanges over the previous day by main gamers, signaling potential promote stress whereas investor sentiment stays weak and the community’s Pectra improve faces delays.

The improve, a key improvement post-Merge, was pushed from March to Might seventh.

$117M+ ETH Moved to Exchanges, Sparks Promote-Off Fears

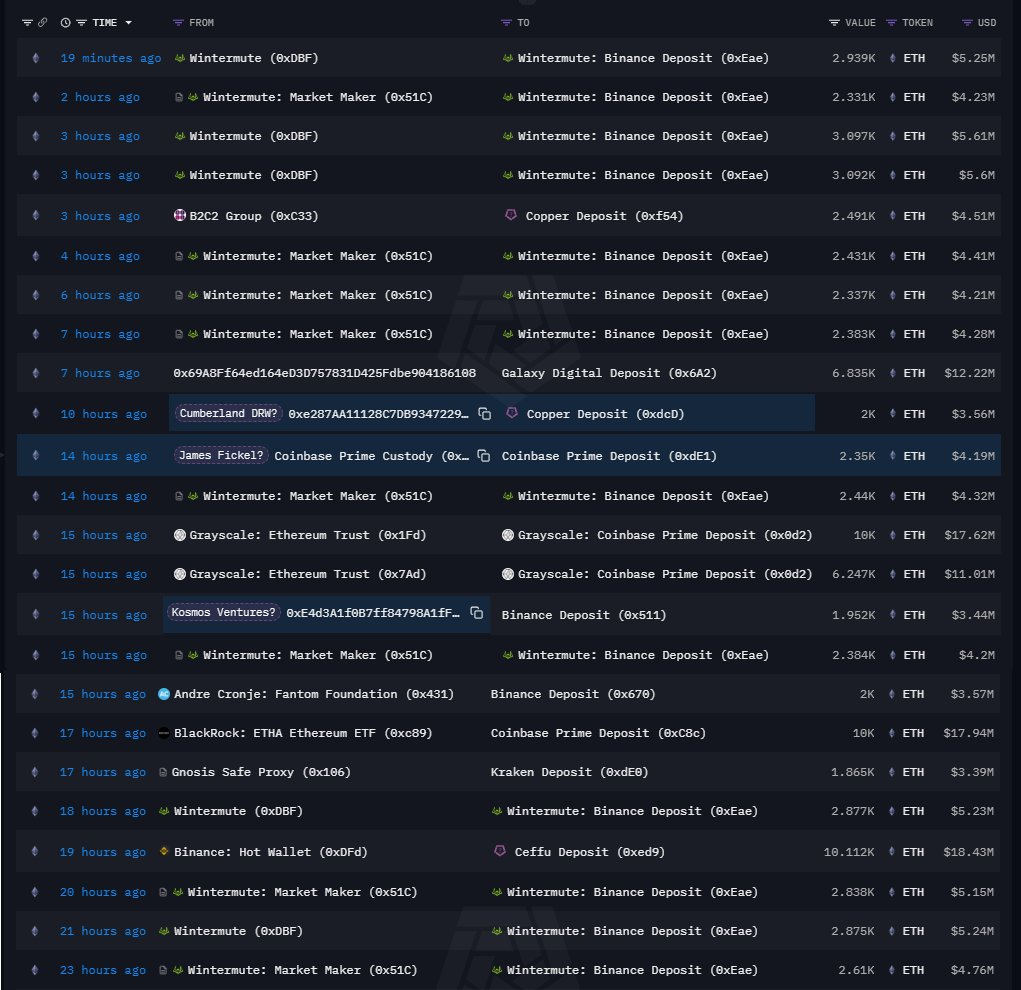

Massive institutional and particular person holders moved tens of hundreds of ETH onto exchanges inside 24 hours. Knowledge reported by The Knowledge Nerd on X included transfers from.

In accordance with The Knowledge Nerd on X, the next transfers had been recorded:

- Grayscale: 16,247 ETH (~$28.63 million)

- BlackRock: 10,000 ETH (~$17.94 million)

- Wintermute: 34,634 ETH (~$62.94 million)

- Andre Cronje (Fantom): 2,000 ETH (~$3.44 million)

- James Fickle: 2,350 ETH (~$4.19 million)

These transfers, totaling over 65,000 ETH (valued above $117 million), are sometimes seen as preparation for promoting, particularly with out offsetting inflows or bullish information.

ETH Value Evaluation for April

Ethereum is at the moment buying and selling at $1,801.12, down 1.3% within the final 24 hours, CoinMarketCap information exhibits. ETH breached essential assist round $1,800, hitting a each day low of $1,751.33, and was trying to reclaim the $1,800 stage.

The 20-day Exponential Shifting Common (EMA) at $1,928 now acts as vital resistance. With ETH under this EMA and 24-hour buying and selling quantity down 32%, short-term momentum seems bearish.

Technical Indicators Sign Bearish Momentum

The each day chart’s Relative Power Index (RSI) studying close to 37.61 suggests bears at the moment management value motion, although the gradient signifies potential short-term consolidation.

The ETH value motion is at the moment close to the decrease finish of the Bollinger Bands and if the assist at ETH value motion neared the decrease Bollinger Band. If assist round $1,734 holds, a retest of the center Band ($1,928) is feasible.

A breakout above the higher Band ($2,112) would require sustained bullish dominance. Conversely, failing to reclaim the 20-day EMA ($1,928) might hold costs suppressed, delaying any potential transfer above $2,000.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t liable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.