This can be a section from the 0xResearch publication. To learn full editions, subscribe.

In the event you ask the common individual in crypto what issues the business faces immediately, “too many chains, not sufficient apps” rapidly comes up as a typical gripe.

This criticism has a placing parallel to the times of the early web.

Through the dot-com increase of the late 90s and early 2000s, skeptics equally criticized the perceived overinvestment in extreme infrastructure, significantly fiber optics.

Telecom firms (World Crossing, WorldCom, AT&T) spent billions laying undersea cables and long-haul fiber networks based mostly on the assumption that web site visitors would develop exponentially.

Even web pioneer Bob Metcalfe criticized this perceived overinvestment, arguing that there merely wouldn’t be sufficient demand.

With the posh of hindsight, we now know that Metcalfe was unsuitable (Metcalfe actually ate his phrases in 2006 after he conceded his error).

The explosive surplus of bandwidth is what makes superb merchandise like YouTube, cloud computing, and Netflix doable immediately.

Netflix, for example, was a mail-based DVD rental enterprise for years till it slowly started its transition to streaming in 2007 — due to the foundations of bandwidth infrastructure that had been laid prior.

Briefly, the wager that “if we construct it, demand will come” finally proved true for the web, although it took a decade and the chapter of web infrastructure firms like World Crossing.

Ethereum is (form of) inserting its chips on an identical wager immediately.

Per its rollup-centric roadmap, the Ethereum L1 immediately in impact provides up execution charges to L2s.

However Ethereum plans to finally reap the earnings in information availability (DA) charges by its upcoming upgrades to scale the provision of DA. The concept is that Ethereum DA will finally be so abundantly plentiful that it could induce eventual consumer demand.

Similar to the early web builders, Ethereum researcher Justin Drake believes that “if we construct it, demand will come.”

Drake’s moonshot math seems to be like this: At 10 million TPS, with every transaction paying $0.001 in DA charges to Ethereum, that comes as much as ~$1 billion per day of income for Ethereum.

(This assumes L2s use the Ethereum L1 for DA, versus an alternate DA layer like Celestia or EigenLayer. However Drake believes the advantages of synchronous composability will make it so.)

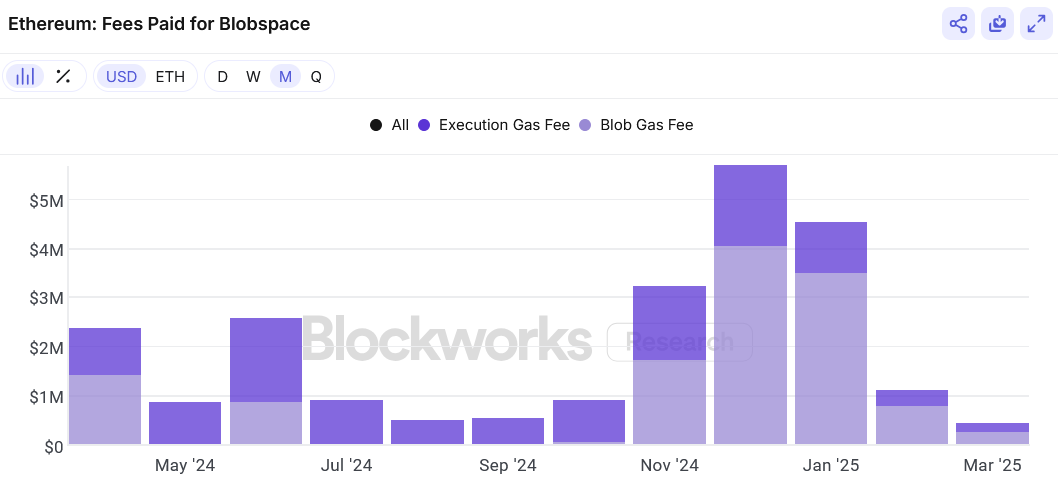

It’s a daring thesis, contemplating DA consumption immediately; Ethereum’s blob gasoline charges got here as much as a couple of mere $272k in March.

Perhaps Ethereum bulls imagine Web3 will play out equally to the historical past of Web2, however Ethereum doesn’t exist in a silo, and it faces stiff competitors from different chains.

We additionally nonetheless have so few guesses as to the sorts of onchain purposes that may dominate blockchain utilization. Will the world want that a lot information availability?

However I digress. The declare that there are “too many chains” might finally be true. But it surely’s too early to inform, because it was within the early days of the web.

If true, markets are serving to curb additional wasteful spending. Working example: The L1 premium has been quickly compressing.

The times of $300-$500 million greenback raises for an L1 are over. L1/L2 blockchain raises in 2024 ranged from as little as $14 million (Initia) to as excessive as $100 million (Berachain) and $225 million (Monad).