The extremely anticipated Pectra improve went stay on the Ethereum (ETH) mainnet on Could 7. The improve launched a number of Ethereum Enchancment Proposals (EIPs) that improve varied features of the community, specializing in scaling, staking effectivity, consumer expertise, and interoperability.

Nevertheless, market watchers imagine Pectra might additionally affect the value of ETH and push it over $2,000, a degree not seen since March 28.

Will ETH Attain $2000?

Tracy Jin, Chief Working Officer of MEXC, informed BeInCrypto that the improve generally is a bullish catalyst for ETH. Jin emphasised that the improve would improve Ethereum’s infrastructure and lay the groundwork for a contemporary wave of Web3 improvements.

This, she believes, might appeal to renewed curiosity from institutional buyers and stimulate the continued enlargement of the Ethereum ecosystem. Moreover, Jin predicts that many Web3 builders could select to return to the community. Thus, this may place Ethereum to regain its main function within the altcoin market.

“Technically, a profitable improve might set off a bullish sentiment and breakout second for ETH to maneuver in the direction of the $2,200 zone, probably kickstarting one other cycle of the altcoin season,” Jin informed BeInCrypto.

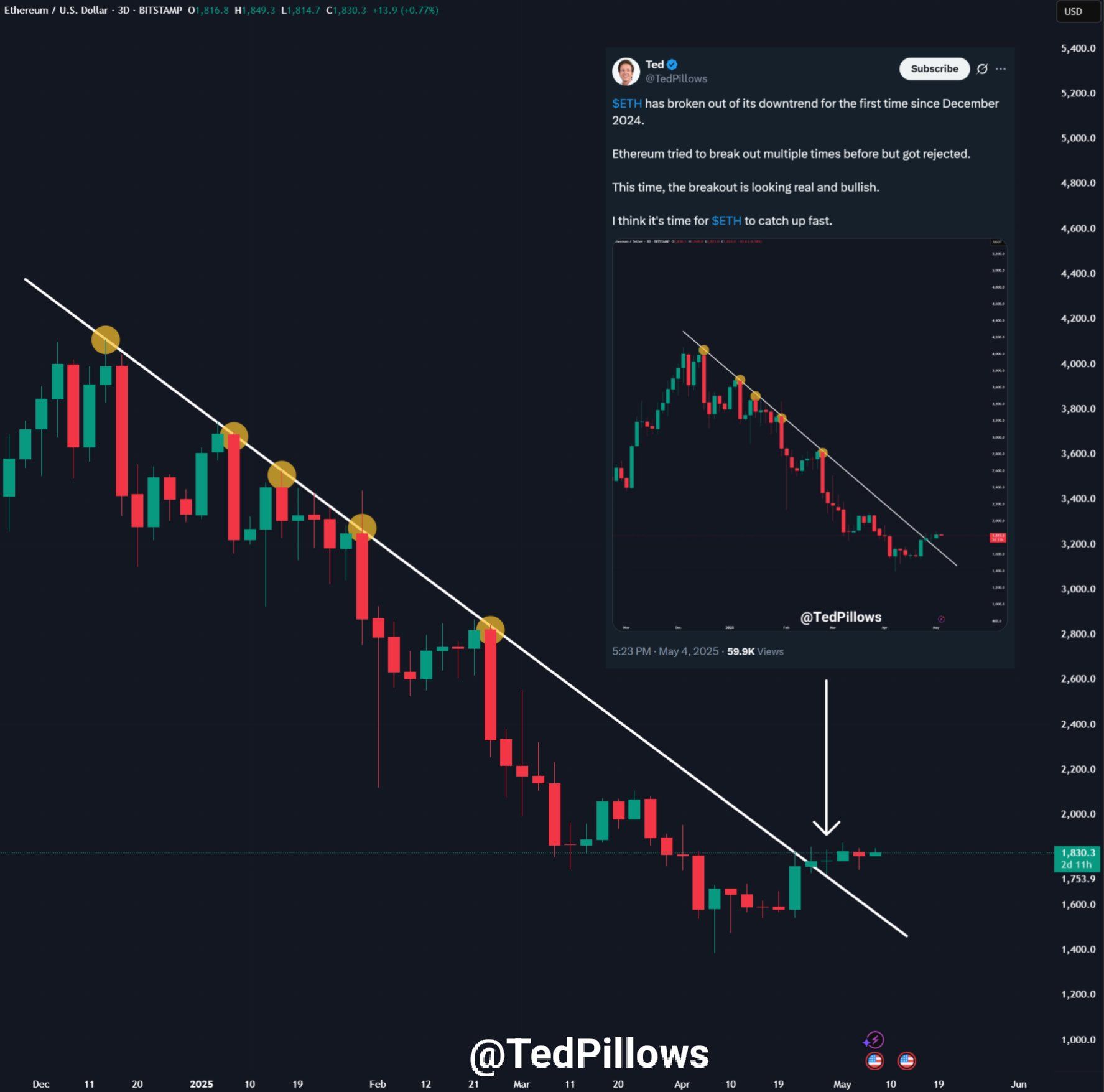

ETH’s latest efficiency helps this optimism. Analyst Ted Pillows famous on X (previously Twitter) that ETH broke out of a four-month resistance degree a number of days in the past.

He added that the altcoin has continued to carry above this degree, in line with the most recent information.

“As I stated earlier than, it’s time for ETH to rally now, and that can occur quickly,” Pillows predicted.

Ethereum Value Prediction. Supply: X/TedPillows

Pillows’ forecast already seems to be materializing. After the improve, ETH rose considerably and reclaimed the $1,900 degree in the present day, marking its highest value since early April.

BeInCrypto information confirmed that the value appreciated 4.9% over the previous 24 hours. At press time, the altcoin traded at $1,929.

ETH Value Efficiency. Supply: TradingView

In the meantime, from an on-chain perspective, CryptoQuant information confirmed that the entire quantity of ETH staked has risen from 33.7 million to 34.4 million for the reason that improve information began gaining traction. This represented a internet influx of 627,000 ETH, indicating rising confidence amongst stakers.

“This might mark the start of institutional positioning, or at minimal, a restoration of confidence post-upgrade. The dimensions of inflows isn’t explosive but — however the path has modified,” Kripto Mevsimi remarked.

Whereas the inflows aren’t substantial, the development means that buyers have gotten extra serious about and assured about collaborating within the Ethereum ecosystem once more.

Nevertheless, not all forecasts are uniformly constructive. Marcin Kazmierczak, Co-founder and COO of RedStone, supplied a extra cautious outlook.

“The long-term affect on Ethereum’s value stays troublesome to quantify with precision. Whereas there’s a constructive correlation between elevated blob area consumption and ETH burning (which reduces provide), these mechanisms don’t function in ceteris paribus circumstances,” Kazmierczak informed BeInCrypto.

He defined that elevated exercise on Layer 2 options might shift transactions away from Layer 1. That is important as a result of L1 transactions historically burn extra charges (i.e., cut back the availability of ETH) in comparison with L2 transactions. As extra transactions transfer to L2, this might cut back the quantity of ETH burned and have an effect on its provide dynamics.

On the similar time, Ethereum’s roadmap can also be progressing to introduce new L1 options designed to scale independently. These initiatives purpose to enhance Ethereum’s scalability with out relying on L2 enhancements.

Nevertheless, Kazmierczak careworn that the frameworks for integrating these parallel scaling approaches are nonetheless in growth.

“In the end, Ethereum navigates terribly advanced territory because it concurrently advances L2 scalability, enhances L1 efficiency, and maintains ETH’s financial soundness. This multifaceted problem represents each a formidable technical dilemma and an thrilling frontier in blockchain structure,” he commented.

As Ethereum charts its path ahead, the Pectra improve has set the stage for a possible value rally. Whether or not ETH can maintain momentum and attain $2,000 stays to be seen.