Solana (SOLUSDT) is sitting in a fragile spot, with the Solana crypto value round $103, hugging the decrease fringe of its current vary whereas broader sentiment is caught in Excessive Worry.

quantity”

quantity”loading=”lazy” />

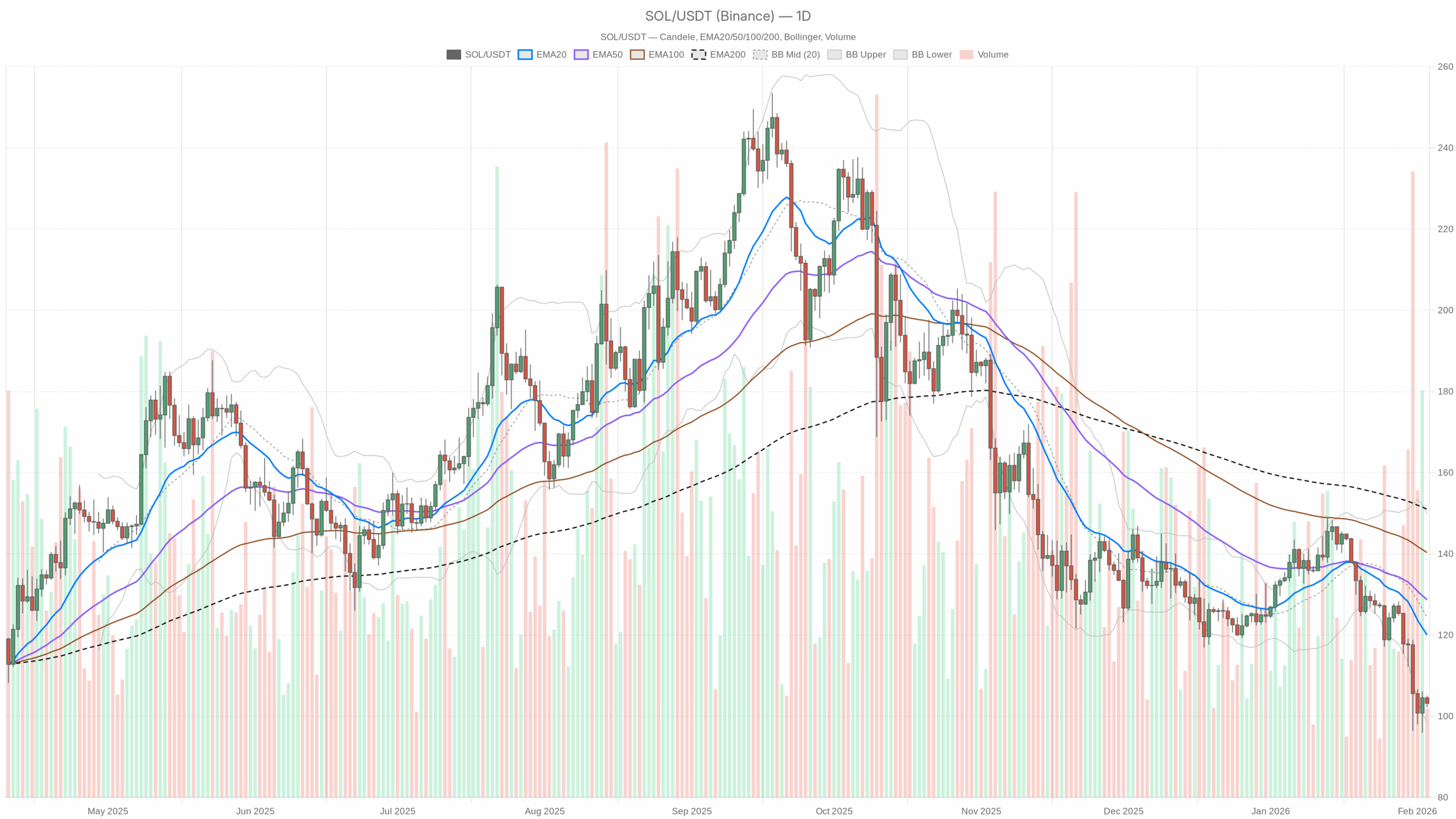

Each day Chart (D1): Macro Bias – Bearish With Early Oversold Circumstances

The day by day timeframe units the core bias, and proper now it’s unambiguously bearish.

Pattern Construction – EMAs

Each day shut: $103.17

EMA20: $120.04

EMA50: $128.69

EMA200: $151.03

Regime: bearish

Worth is buying and selling properly beneath all three key EMAs, with the 20, 50 and 200-day stacked bearishly and fanning out. That could be a textbook downtrend: rallies are being bought, not collected. The hole from spot ($103) as much as the 20-day EMA ($120) is extensive. This typically means two issues without delay: pattern strain is robust, however the market can be beginning to get stretched on the draw back.

RSI (Momentum)

RSI 14 (D1): 29.95

Each day RSI has slipped slightly below 30, getting into classical oversold territory. That doesn’t routinely imply a reversal, however it does recommend the majority of the simple draw back could also be behind us on this leg. Sellers are in management, but they’re starting to push into an space the place sharp countertrend bounces develop into extra widespread.

MACD (Momentum and Pattern High quality)

MACD line: -7.70

Sign line: -4.86

Histogram: -2.84

MACD is deeply unfavorable with the road beneath the sign and a still-negative histogram. The downtrend is established and mature, not a recent breakdown. There isn’t any clear signal of a bullish cross but, so from a pattern perspective the bears nonetheless personal the day by day chart, even when momentum is slowing a bit as RSI strikes into oversold territory.

Bollinger Bands (Volatility and Positioning)

Center band (20 SMA): $124.30

Higher band: $150.09

Decrease band: $98.50

Each day shut: $103.17

Worth is pinned close to the decrease Bollinger Band at $98.50, with the mid-line far above at $124. Solana has migrated from the mid-band right down to the decrease band and is now using it. That’s basic trend-following draw back strain. Nevertheless, as soon as value begins grinding alongside the decrease band for some time, it may be a late space to provoke recent shorts. A pointy imply reversion again towards the mid-band ($120–124) turns into more and more believable if sellers fail to push cleanly by way of $98–100.

ATR (Volatility)

ATR 14 (D1): $7.46

Each day ATR north of $7 on a $100 asset is non-trivial: roughly 7% common day by day vary. Volatility is elevated, however not at panic extremes. This suits with the chart: the market is in a agency downtrend with significant swings, however not a full-on capitulation flush. Merchants ought to assume strikes of a number of {dollars} in both path on any given day.

Each day Pivot Ranges

Pivot Level (PP): $103.48

R1: $104.79

S1: $101.87

Spot is buying and selling virtually precisely on the day by day pivot ($103.17 versus $103.48). That tells you at the moment is a determination level. If value holds above PP the intraday tone leans barely constructive; lose it and value doubtless gravitates towards S1 at $101.87 after which the decrease band zone round $98. Bulls want to start out reclaiming and holding above $105 to indicate any actual intraday authority.

1H Chart: Quick-Time period Stabilisation Inside a Bear Pattern

On the 1H chart, the image is extra balanced than on the day by day, however nonetheless tilted bearish general.

Pattern – EMAs

1H shut: $103.27

EMA20: $103.61

EMA50: $104.29

EMA200: $112.78

Regime: bearish

Worth is hovering just under the 20- and 50-hour EMAs, whereas the 200-hour sits far above close to $113. Quick time period, that could be a weak consolidation beneath resistance. Consumers try to stabilise above $103, however they haven’t managed to interrupt and maintain above the short-term transferring averages, which they would wish to do to show this right into a significant bounce.

RSI (1H)

RSI 14 (1H): 47.56

Hourly RSI is mainly impartial, slightly below 50. The extraordinary promoting strain of the prior days has cooled off, and the market is in additional of a tug-of-war zone. This strains up with the concept the rapid dump part is paused, however not clearly reversed.

MACD (1H)

MACD line: -0.08

Sign line: 0.07

Histogram: -0.15

The hourly MACD is barely unfavorable with a small bearish histogram. There’s no robust pattern on this timeframe proper now. As an alternative, the chart reveals a gentle bearish lean inside a sideways consolidation. It’s the form of construction that usually precedes both a breakdown continuation in keeping with the day by day pattern or a brief squeeze if sellers get too crowded.

Bollinger Bands (1H)

Center band: $103.93

Higher band: $105.38

Decrease band: $102.49

1H shut: $103.27

Worth is buying and selling between the mid-band and the decrease band, nearer to the centre. The bands usually are not extraordinarily extensive, confirming a cooling volatility part after the preliminary drop. That contraction units the stage for the subsequent impulse transfer, with path nonetheless undecided on this timeframe.

ATR (1H)

ATR 14 (1H): $1.14

A median hourly vary of about $1 reveals intraday volatility is lively however manageable. For brief-term merchants, this helps tight tactical setups across the $100–105 space with clearly outlined danger.

1H Pivot Ranges

Pivot Level (PP): $103.15

R1: $103.39

S1: $103.03

On the 1H, value is buying and selling proper on prime of the pivot. Microstructure is finely balanced: acceptance above $103.39 opens the door to exams of the higher band ($105+). Repeated rejection there and a slip beneath $103.03 would reassert intraday draw back.

15-Minute Chart: Execution Context Round $103

The 15-minute chart is for fine-tuning entries and exits, not for outlining the principle buying and selling bias.

Pattern – EMAs (15m)

15m shut: $103.28

EMA20: $103.29

EMA50: $103.58

EMA200: $104.21

Regime: bearish

Worth is sort of precisely on the 20-EMA and slightly below the 50- and 200-EMAs on the 15m chart. That could be a very short-term equilibrium inside a broader downtrend. It’s the kind of construction the place one impulsive transfer, pushed by information, a BTC transfer, or a liquidation cascade, can rapidly tilt the board both method.

RSI (15m)

RSI 14 (15m): 48.22

Momentum on 15m is impartial, in keeping with the EMA image: there’s no clear intraday edge for bulls or bears at this precise second. It’s a ready room earlier than the subsequent push.

MACD (15m)

MACD line: -0.20

Sign line: -0.24

Histogram: 0.04

The MACD strains are each unfavorable however very shut to one another, with a barely optimistic histogram. That’s the first trace of a micro-level bullish try, however by itself it’s weak and simply reversed. It solely turns into fascinating if it strains up with a break above the 15m and 1H EMAs and a stronger BTC backdrop.

Bollinger Bands & ATR (15m)

Center band: $103.29

Higher band: $104.47

Decrease band: $102.11

ATR 14 (15m): $0.43

Worth is locked across the center band with comparatively tight bands and a 15m ATR of $0.43. Very brief time period, the market is catching its breath. Scalpers ought to count on sub-$1 swings per 15-minute candle beneath regular situations, with occasional spikes if a bigger transfer kicks off.

Market Context: Threat-Off, BTC-Dominated Tape

Broader crypto knowledge backs the concept Solana is buying and selling in a risk-off atmosphere:

- BTC dominance: ~57.6% – capital concentrated in Bitcoin, altcoins underweight.

- Complete market cap: ~$2.71T with a slight unfavorable 24h shift, and quantity down ~35% – risk-taking is muted, participation lighter.

- Worry & Greed Index: 17 – Excessive Worry, in step with late-stage promoting phases but in addition with the atmosphere through which robust bounces can happen when positioning will get too one-sided.

On-chain and DeFi exercise round Solana DEXs comparable to Raydium and Orca reveals typically decrease price progress within the final month, with a few outliers. Total, it alerts cooling speculative exercise throughout Solana DeFi, which aligns with the value strain on SOL itself.

Important Situation for Solana Crypto Worth

Given the dominance of the day by day chart, the principle situation for SOLUSDT is presently bearish. The pattern is down, momentum is unfavorable, and macro sentiment is risk-off. Nevertheless, oversold situations and intraday stabilisation imply the subsequent leg could also be choppier and extra two-sided than the final one.

Bearish Situation (Major)

Within the dominant bearish path, the hourly and 15m consolidations resolve downward in keeping with the day by day downtrend. That may imply:

- Repeated failures to reclaim and maintain above the 1H EMA50 (round $104–105).

- Break beneath the day by day S1 ($101.87) after which beneath the decrease Bollinger Band zone (round $98.50).

- RSI staying heavy round 30 on D1 with no significant bounce, indicating persistent distribution moderately than full capitulation.

Beneath this situation, the market makes use of each small bounce towards $105–110 as liquidity to chop publicity. ATR round $7 suggests day by day swings may be sharp: a decisive breakdown might rapidly discover decrease helps (sub-$95, then the $90s) if compelled sellers step in.

What would invalidate the bearish situation?

The bear case begins to weaken if SOL can:

- Shut a day by day candle again above the 20-day EMA (presently round $120) and maintain it as assist.

- Print a transparent bullish cross on the day by day MACD with RSI exiting oversold and pushing towards 45–50.

- Present sustained buying and selling above $110 with rising quantity, signalling real dip-buying moderately than brief protecting.

Till these components present up, bounces are statistically extra prone to be rallies inside a downtrend.

Bullish Situation (Countertrend / Secondary)

The bullish path is extra contrarian, however not inconceivable given how stretched the day by day chart is.

On this situation, the $98–100 space acts as a native demand zone. Oversold RSI and excessive concern feed a short-covering rally:

- Worth holds above the day by day decrease Bollinger Band (round $98.50) and refuses to just accept beneath the psychological $100 stage.

- 1H and 15m charts break and maintain above their EMA50 after which grind towards the 1H EMA200 (round $112–113).

- A push by way of $110 would doubtless goal the day by day mid-Bollinger area round $120–124, which additionally aligns with the 20-day EMA.

This may nonetheless be a bear-market bounce until the day by day construction really flips. Stronger affirmation would come from a contraction in BTC dominance and a pickup in altcoin breadth, not simply an remoted transfer in SOL.

What would invalidate the bullish situation?

The upside case fails rapidly if:

- SOL loses and holds beneath $98–100 with increasing quantity.

- RSI on D1 stays oversold however value continues to grind decrease, an indication of a trending oversold market moderately than a reversal.

- Each try above $105 is met with heavy promoting, preserving value capped beneath the 1H and 4H EMAs.

In that state of affairs, the bounce turns into nothing greater than intraday noise inside a stronger downtrend.

How one can Learn This Second for Positioning

The Solana crypto value motion is caught between pattern and imply reversion. The day by day pattern is clearly down, and that deserves respect. On the identical time, the mix of:

- RSI close to 30 on the day by day,

- value close to the decrease Bollinger Band, and

- intraday EMAs flattening on 1H and 15m

suggests the market is doubtlessly nearer to a bounce window than to the beginning of a recent, untouched downleg.

For directional merchants, it is a basic late-trend atmosphere: chasing shorts blindly at $100 carries extra danger than it did at $130–140, whereas fading the transfer aggressively with out affirmation is equally harmful. Volatility, as captured by ATR, ensures that being flawed even for a single day may be expensive.

Threat administration issues greater than directional conviction right here. Place sizing ought to assume day by day swings of at the least 5–10%, and situation planning must be express. Merchants ought to know what ranges would show their concept flawed, comparable to a clear break of $98 on the draw back or a reclaim of $120 on the upside, moderately than counting on a static bias. The tape is telling you: the pattern is down, however the market is drained. The following few days will present whether or not drained sellers or courageous dip-buyers have the stronger hand.

If you wish to monitor markets with skilled charting instruments and real-time knowledge, you possibly can open an account on Investing utilizing our companion hyperlink:

Open your Investing.com account

This part comprises a sponsored affiliate hyperlink. We could earn a fee at no extra price to you.

Disclaimer: This textual content is a market commentary for informational and academic functions solely. It isn’t funding recommendation, an endorsement of any asset, or a suggestion to purchase or promote. Crypto markets are extremely unstable and dangerous; at all times do your individual analysis and contemplate your danger tolerance earlier than making any buying and selling choices.