In a market gripped by excessive worry, Cardano value as we speak sits close to latest lows as merchants weigh whether or not this strain zone turns into a base or simply one other pause within the downtrend.

Cardano value as we speak: the place ADA stands

Cardano (ADA) is buying and selling round $0.25–0.26 towards USDT, pinned close to latest lows in a market backdrop outlined by excessive worry (worry & greed index at 11) and broad crypto weak spot (complete market cap down nearly 3% in 24 hours, BTC dominance close to 57%).

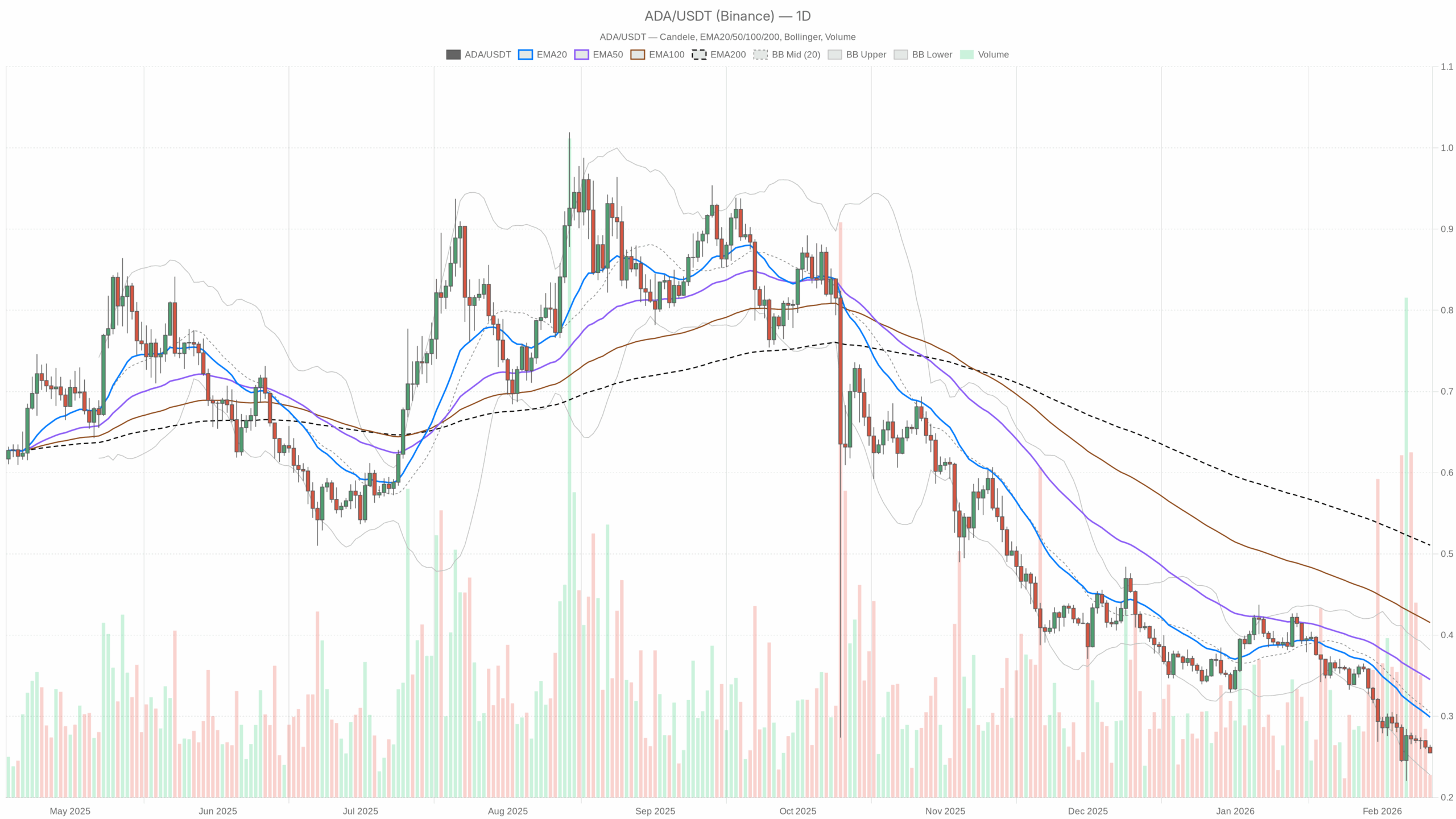

The dominant power proper now could be risk-off positioning throughout crypto, and ADA is on the unsuitable facet of momentum: value sits nicely beneath all key each day transferring averages and is driving the decrease facet of its volatility bands. This can be a bearing-down part of a downtrend, not but a longtime backside.

On the each day timeframe, the primary situation is clearly bearish. The query now could be whether or not ADA is carving out a short-term base for a bounce, or simply pausing earlier than one other leg decrease.

Each day timeframe (D1): macro bias is bearish

Worth vs EMAs (development construction)

– Shut: $0.25

– EMA 20: $0.30

– EMA 50: $0.35

– EMA 200: $0.51

ADA is buying and selling far beneath the 20, 50, and 200-day EMAs. Brief-term development (20 EMA), medium-term development (50 EMA), and the long-term cycle (200 EMA) are all stacked above value and sloping down.

What it implies: it is a mature downtrend the place rallies are, by default, suspect. Bulls want a number of sturdy days simply to retake the 20-day EMA round $0.30 earlier than any discuss of development restore turns into credible.

RSI (momentum and exhaustion)

– RSI 14 (D1): 31.21

Each day RSI is hugging the fringe of oversold with out a bounce but.

What it implies: sellers have been in management, however the draw back momentum is approaching exhaustion territory. That is the place two issues are doable: both a reflexive bounce as shorts take revenue, or a grind decrease the place value stays depressed for longer. There isn’t a confirmed bullish divergence right here, so that is cautionary oversold, not a purchase sign by itself.

MACD (development momentum)

– MACD line: -0.03

– Sign line: -0.03

– Histogram: 0

MACD is damaging, however the line and sign are successfully sitting on high of one another and the histogram is flat.

What it implies: draw back momentum has cooled. The development remains to be down, however the impulse part has stalled. That is typical of a market both basing for a bounce or making ready for a recent impulse after a pause. There may be not but a bullish cross; it’s extra of a ceasefire.

Bollinger Bands (volatility & place)

– Center band (20 MA): $0.30

– Higher band: $0.38

– Decrease band: $0.23

– Worth: $0.25, near the decrease band

Worth is driving the decrease half of the Bollinger envelope, not snapping beneath it.

What it implies: ADA is buying and selling within the low-cost zone of its latest vary however with out capitulation. Volatility is elevated relative to ATR (see beneath), however the market will not be in a volatility spike or squeeze. It’s a pressured, one-sided part the place bids stay cautious.

ATR (volatility and threat measurement)

– ATR 14 (D1): $0.03

Each day common true vary is about 3 cents on a 25-cent asset, round 12% each day swing potential.

What it implies: it is a high-volatility atmosphere relative to cost stage. Place sizing and leverage tolerance must mirror {that a} routine each day transfer can simply be 10–15% in both route.

Each day pivot ranges (near-term map)

– Pivot level (PP): $0.26

– First resistance (R1): $0.26 (clustered with PP)

– First assist (S1): $0.25

The pivot cluster round $0.26 with S1 at $0.25 is unusually tight.

What it implies: the market is compressed close to the lows, with a really slender battle zone. Sustained buying and selling above $0.26 can be the primary small signal of intraday power; dropping $0.25 opens the door to a push towards the Bollinger decrease band close to $0.23.

Each day regime: bearish.

The each day chart units a transparent bearish bias: development is down, value is depressed, and the broader crypto atmosphere is risk-off.

Hourly timeframe (H1): heavy however making an attempt to stabilize

On the 1-hour chart, ADA is buying and selling round $0.26, mainly glued to its short-term averages.

Worth vs EMAs (short-term development)

– Shut: $0.26

– EMA 20: $0.26

– EMA 50: $0.26

– EMA 200: $0.28

Worth is sitting immediately on the 20 and 50 EMAs, with the 200 EMA nonetheless above.

What it implies: short-term momentum has flattened out after the selloff. This can be a traditional equilibrium after a drop: bears are not in full management intraday, however bulls will not be sturdy sufficient to reclaim the larger transferring common at $0.28.

RSI (intraday momentum)

– RSI 14 (H1): 26.84

Hourly RSI is clearly oversold.

What it implies: the short-term tape is stretched to the draw back. That favors not less than a reduction bounce or consolidation fairly than fast continuation, however oversold by itself doesn’t reverse a each day downtrend.

MACD (H1)

– MACD line: 0

– Sign: 0

– Histogram: 0

MACD is totally flat on the hourly.

What it implies: momentum has been wrung out of the intraday transfer; the market is in a ready part. Merchants are waiting for the subsequent impulse fairly than chasing continuation.

Bollinger Bands (H1)

– Center band: $0.26

– Higher band: $0.27

– Decrease band: $0.26

Bands are extraordinarily tight, clustering between $0.26 and $0.27.

What it implies: it is a volatility compression zone proper above assist. These durations normally precede a pointy growth transfer. Given the each day development, the burden of proof is on the bulls. Nevertheless, the setup is binary: a fast push both above $0.27 or beneath $0.25 is more likely to outline the subsequent leg.

ATR (H1)

– ATR 14 (H1): $0.00 (successfully extraordinarily low)

Intraday ATR printing close to zero displays the present micro-range.

What it implies: ADA is in a good intraday coil. As soon as that breaks, the precise realized transfer could be a lot bigger than what the present ATR studying suggests.

Hourly pivot ranges

– Pivot level (PP): $0.26

– R1: $0.26

– S1: $0.25

Once more, a really slender band.

What it implies: $0.25–0.26 is the fast battlefield. Scalpers will watch acceptance above the pivot at $0.26 for a push into $0.27–0.28, whereas a agency break underneath $0.25 places the each day decrease Bollinger band into play.

Hourly regime: bearish, however short-term strain is easing into sideways.

15-minute timeframe (M15): execution zone round assist

On the 15-minute chart, ADA trades close to $0.25, barely beneath its brief intraday averages.

Worth vs EMAs (very short-term movement)

– Shut: $0.25

– EMA 20: $0.26

– EMA 50: $0.26

– EMA 200: $0.26

Worth is underneath all three EMAs clustered round $0.26.

What it implies: the very short-term movement remains to be biased decrease, however the EMAs are flat and tightly packed, which inserts a native base-building try after a robust drop.

RSI (M15)

– RSI 14: 32.83

15-minute RSI is weak however not totally oversold.

What it implies: sellers stay current on small timeframes, however the capitulation part is over. Brief-term merchants are probing each side round assist.

MACD (M15)

– MACD line: 0

– Sign: 0

– Histogram: 0

Momentum is impartial on this micro timeframe.

What it implies: execution right here is about ranges fairly than development: entries and exits will hinge on how value behaves at $0.25–0.26, not on any clear momentum sign.

Bollinger Bands (M15)

– Center band: $0.26

– Higher band: $0.26

– Decrease band: $0.25

Bands are slender, hugging present value.

What it implies: the microstructure is balanced however fragile. A fast push above $0.26 or beneath $0.25 can set off cease cascades as a result of compressed bands.

ATR (M15)

– ATR 14 (M15): $0.00 (virtually negligible)

Very low intraday ATR displays the short-term stalemate.

What it implies: order guide is quiet; any sudden improve in quantity can transfer value greater than these readings would recommend.

M15 regime: bearish, however in consolidation.

Bullish situation for ADA/USDT

For the bull case, ADA wants to show this oversold strain zone right into a sturdy base.

Key steps:

1. Maintain $0.25 assist

The fast must-hold stage is $0.25 (S1 on each each day and intraday). So long as each day candles keep away from a clear shut beneath that stage, dip consumers can argue a short-term backside try.

2. Reclaim the intraday cluster

A sustained push above $0.26 with 1-hour closes holding that pivot, adopted by a take a look at of $0.27–0.28 (close to the H1 200 EMA), would sign that short-term momentum is flipping from protection to countertrend rally.

3. Each day reduction leg

If the 1H 200 EMA round $0.28 will get reclaimed, the pure magnet above is the each day 20 EMA at $0.30. That’s the first significant goal for any reduction rally. From there, a extra formidable goal can be the mid-range space round $0.33–0.35 (towards the each day 50 EMA), however that may seemingly require an enchancment in total market threat sentiment, not simply ADA-specific shopping for.

4. Momentum affirmation

A bull-friendly configuration can be: each day RSI lifting again above 40, MACD beginning to curl up with a optimistic histogram, and value holding above the 20-day EMA on pullbacks. That will shift the narrative from a dead-cat bounce to early restore.

What invalidates the bullish situation?

A clear each day shut beneath $0.25, particularly if value accelerates towards the decrease Bollinger band round $0.23 with RSI sinking deeper into the 20s, would argue that the tried base has failed. In that case, ADA re-enters a trend-acceleration part fairly than a bottoming part.

Bearish situation for ADA/USDT

The bears nonetheless have management on the upper timeframe, and the macro atmosphere backs them.

1. Break of $0.25 and development continuation

If assist at $0.25 lastly provides means with increasing quantity, the trail of least resistance is towards the $0.23 space (each day decrease Bollinger band) and doubtlessly decrease if the broader market stays underneath stress.

2. Failure to reclaim $0.28

So long as ADA stays beneath the H1 200 EMA at $0.28 and nicely underneath the each day 20 EMA at $0.30, each bounce is structurally only a rally into resistance. That aligns with each day EMAs all stacked above value and rolling over.

3. Momentum staying weak

If each day RSI hovers round or beneath 30 with none sturdy rebound, and MACD stays damaging or turns down once more after this pause, it alerts a persistent vendor’s market the place rallies are more likely to be bought shortly.

4. Macro risk-off persists

With international crypto market cap dropping and BTC dominance close to 57%, altcoins like ADA usually underperform. In an atmosphere of utmost worry, capital tends to cluster into BTC, stablecoins, or out of crypto altogether. ADA’s underperformance versus its transferring averages matches that sample.

What invalidates the bearish situation?

If ADA reclaims and holds above $0.30 on the each day chart (the 20-day EMA) with enhancing RSI (above 45) and a constructive MACD curl, the belief of an easy downtrend continuation breaks. At that time, bears should deal with the transfer as a possible trend-change try fairly than a rally to fade.

How to consider positioning round Cardano value as we speak

ADA as we speak is a downtrend in a fearful market, sitting close to assist with compressed intraday volatility. That mixture normally results in binary outcomes: both a pointy bounce off assist as shorts cowl and cut price hunters step in, or a clear breakdown that catches late dip-buyers off guard.

The each day bias is bearish, however the short-term intraday construction is extra drained than aggressive. Imply-reversion merchants will naturally be eyeing the $0.25 space for bounce makes an attempt; development followers shall be extra concerned with promoting failed rallies into $0.28–0.30 so long as each day construction stays broken.

Volatility, each realized and potential, stays excessive relative to ADA’s value stage. That makes place measurement, leverage, and time horizon extra vital than entry precision. In a backdrop of utmost worry, surprises are typically violent, in each instructions.

For now, Cardano value as we speak is much less a couple of clear reversal or breakout, and extra about how the market resolves this tight $0.25–0.26 vary inside a broader downtrend. Merchants who keep targeted on key ranges ($0.25 assist, $0.26 pivot, $0.28–0.30 resistance band) and on the alignment between each day and intraday momentum may have a greater learn on which facet of that binary end result is beginning to win.