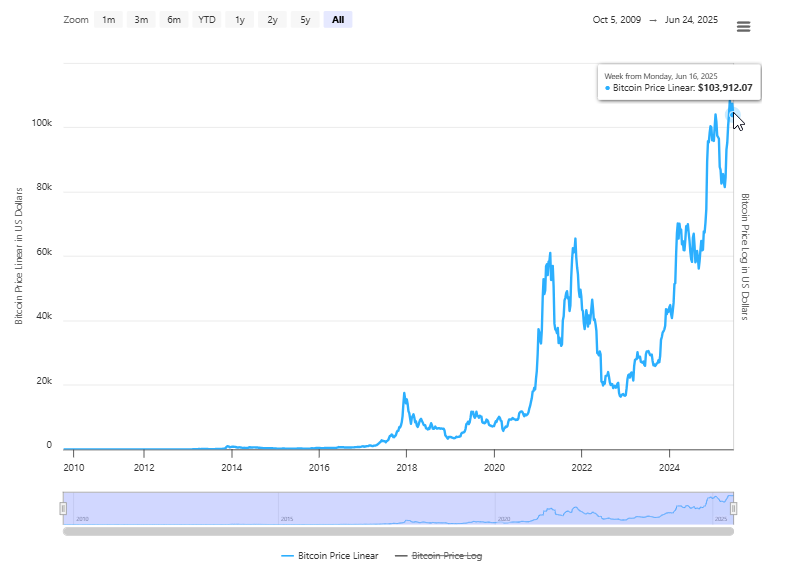

Cardone Capital‘s Bitcoin funding technique has caught consideration with a groundbreaking $101 million buy that establishes the corporate as a pioneer in cryptocurrency adoption. This massive Bitcoin buy represents the primary time an actual property firm has totally built-in Bitcoin into its core enterprise mannequin, signaling a significant shift in institutional Bitcoin shopping for practices. The transfer comes amid Bitcoin market volatility, but demonstrates confidence in long-term Bitcoin accumulation plans.

CardoneCapital provides ~1000 BTC to steadiness sheet turning into first ever actual property/btc firm built-in with full BTC technique, combining the 2 finest at school belongings

14,200 items plus half million sq. ft of A* workplace the group expects so as to add one other 3000 BTC and 5000 items… pic.twitter.com/XvOCO9NkoE

— Grant Cardone (@GrantCardone) June 21, 2025

Cardone Capital’s Bitcoin Progress Plan Amid Market Volatility And Accumulation Technique

Historic Bitcoin Integration Technique

Cardone Capital’s Bitcoin holdings now embrace 1,000 BTC value roughly $101 million, making it the primary actual property/BTC firm to realize full Bitcoin technique integration. This institutional Bitcoin shopping for determination combines conventional property investments with digital belongings in an unprecedented means.

Grant Cardone acknowledged:

“CardoneCapital provides ~1000 BTC to steadiness sheet turning into first ever actual property/btc firm built-in with full BTC technique, combining the 2 finest at school belongings”

The corporate’s massive Bitcoin buy displays rising confidence in cryptocurrency’s position inside conventional funding portfolios, regardless of ongoing Bitcoin market volatility issues.

Formidable Enlargement Plans

The Cardone Capital Bitcoin technique extends far past the preliminary funding. The corporate has introduced plans for important progress throughout each digital and bodily belongings.

Grant Cardone had this to say:

“14,200 items plus half million sq. ft of A+ workplace the group expects so as to add one other 3000 BTC and 5000 items this 12 months.”

This Bitcoin stacking technique exhibits that the corporate is able to enhance its inventory of cryptocurrencies and nonetheless concentrating on actual estates growth. This institutional bitcoin buying technique makes Cardone Capital one of many gold requirements of a hybrid funding technique.

Market Impression and Future Outlook

The Cardone Capital Bitcoin announcement has generated important consideration inside each actual property and cryptocurrency sectors. This massive Bitcoin buy comes at a time when Bitcoin market volatility has created each alternatives and challenges for institutional traders.

The Bitcoin accumulation technique carried by the corporate will not be merely a diversification technique quite it’s a radical change by way of the standard enterprise place to the digital asset integration context. Cardone Capital is bringing collectively a brand new institutional mannequin of buying Bitcoin by integrating actual property information and cryptocurrency investments.

The success of this Cardone Capital Bitcoin technique may affect different actual property corporations to contemplate related strikes, probably accelerating institutional Bitcoin shopping for throughout the sector regardless of Bitcoin market volatility issues.