Centrifuge, a real-world asset (RWA) tokenization platform, surpassed $1 billion in whole worth locked (TVL) as we speak, Aug. 14, per information from DefiLlama. The milestone TVL development is fueled by rising institutional demand for on-chain tokenized property and its JAAA fund.

The determine represents an almost 94% surge in two weeks and locations Centrifuge alongside solely two different RWA platforms: BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), which holds almost $2.4 billion on-chain, and Ondo Finance, with $1.3 billion in whole tokenized worth, based on RWAxyz.

Centrifuge CEO Bhaji Illuminati instructed The Defiant that the leap comes from various components resembling establishments scaling up tokenization tasks, in addition to stablecoin issuers searching for reserve administration and yield.

A significant driver is JAAA, a completely on-chain model of Janus Henderson’s AAA-rated CLO funding fund. Designed particularly for blockchain, JAAA launched with a $1 billion funding from Grove. In the meantime, Janus Henderson’s first tokenized fund with Centrifuge, JTRSY, scaled to over $500 million in property beneath administration (AUM) inside weeks, The Defiant reported in June.

After which on July 24, Centrifuge introduced the completion of its migration to the Ethereum ecosystem with the launch of Centrifuge V3. This newest model of Centrifuge shifted the protocol from being a parachain on Ethereum Layer 2 Polkadot to a multichain, Ethereum Digital Machine (EVM)-native protocol.

“Our launch of JAAA, a AAA-rated CLO fund yielding roughly 200 bps above the risk-free price, has resonated because the pure subsequent step for crypto establishments in search of an enhanced money product,” Illuminati instructed The Defiant, including that Centrifuge enjoys first-mover standing within the RWA scene:

“Having been within the area because the very starting of RWAs, Centrifuge has developed deep belief with main DeFi protocols and institutional gamers, and the migration to EVM alongside a growth-focused management staff has constructed the inspiration for this milestone.”

Illuminati defined that diversified institutional credit score methods resembling JAAA are what’s driving the corporate’s quickest development. “This exhibits clear market demand for broader RWA publicity,” she stated.

Tokenized RWA Increase

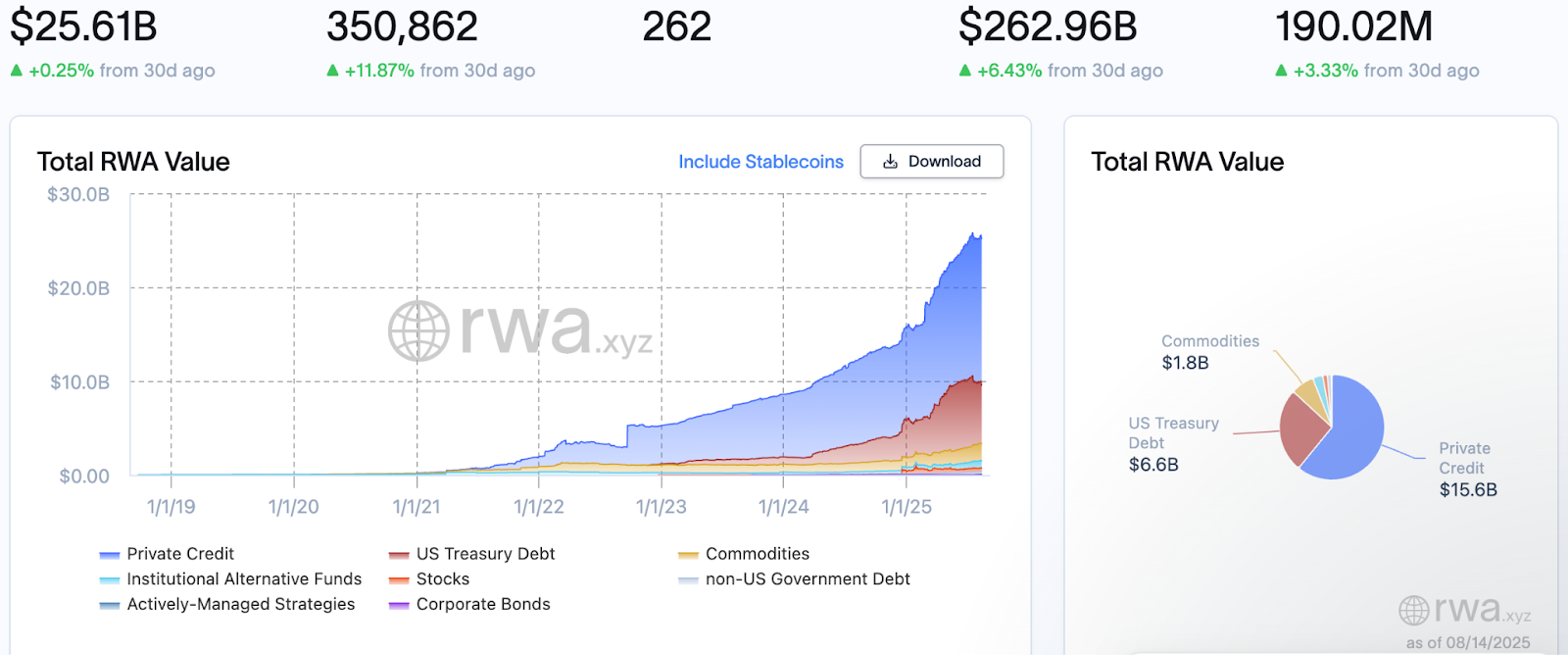

Centrifuge’s milestone comes amid broader tokenized RWA development, with whole on-chain worth of tokenized property rising 63% since January to succeed in $25.6 billion as we speak.

Whole RWA worth on-chain. Supply: RWAxyz

In the meantime, amongst RWA protocols, Centrifuge is presently the fifth largest by TVL, up from eighth place simply two months in the past, per DefiLlama information.

“Each main asset supervisor, financial institution, and fintech now has tokenization on their strategic agenda, and we’re seeing particularly sturdy curiosity from the U.S. with favorable regulatory momentum,” Illuminati stated, persevering with:

“The notion has shifted from tokenization being an experiment to a necessary a part of future market construction. Establishments more and more acknowledge that getting concerned early is vital to sustaining a aggressive edge within the coming wave of onchain capital markets.”