All information is rigorously fact-checked and reviewed by main blockchain consultants and seasoned trade insiders.

- Kamino Finance integrates with Chainlink Information Streams to energy tokenised buying and selling of shares.

- Chainlink leads the oracle sector with 63% market management, demonstrating elevated demand.

Chainlink (LINK) performs an essential infrastructure function within the Kamino xStocks ecosystem. Kamino disclosed that Chainlink offers safe, tamper-proof information feeds for tokenised equities, together with META, TSLA, NVDA, and GOOGL, on Solana.

Kamino has introduced integration with xStocksFi and BackedFi. With this integration, customers can now commerce tokenised shares and exchange-traded funds (ETFs) instantly on the Solana blockchain. Kamino highlighted earlier challenges with capital rotation between crypto and equities. Beforehand, accessing inventory and ETF publicity required off-ramping from Solana and xStocksFi.

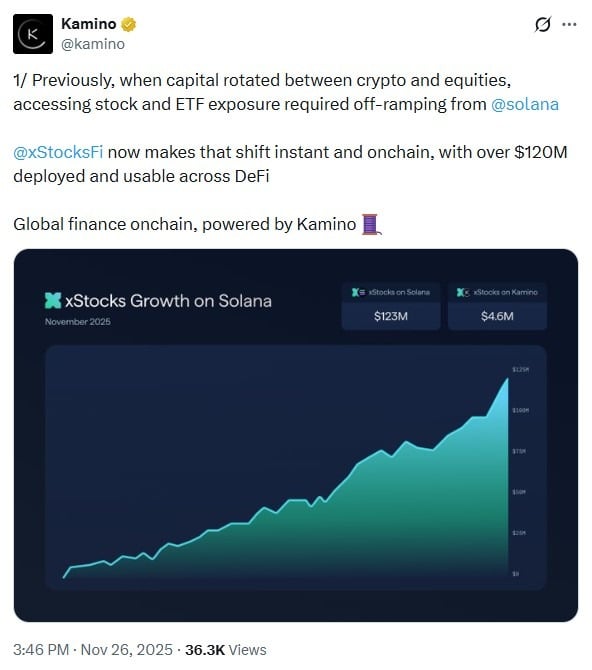

Now, all the pieces occurs on-chain in seconds, with over $120 million already deployed throughout decentralised finance (DeFi) protocols. Kamino revealed it has change into a major venue for xStocks on Solana.

Chainlink and xStocks Partnership | Supply: Kamino

Notably, xStocks are tokenised variations of actual shares and ETFs. Some examples are METAx, GOOGLx, TSLAx, and NVDAx. These belongings are backed 1:1 by precise shares, held with regulated custodians, and deal with dividends by way of computerized rebasing.

Based on the Solana DeFi protocol, customers can purchase belongings like METAx, GOOGLx, TSLAx, and NVDAx via Kamino Swap. This platform permits customers to match costs from liquidity suppliers, know when shares are open/closed, and see precise spreads towards centralised exchanges.

As soon as acquired, customers can use the xStocks as collateral for loans. They will loop for as much as 2x publicity on SPYx, QQQx, and TSLAx via Multiply. This affords an built-in buying and selling interface with charting, entry, and liquidation visibility, and full place administration.

Kamino identified that xStocks integration into its platform has proven constant development, nearing $5 million in dimension with over 270 customers. Regardless of broader crypto market fluctuations, exercise in xStocks has remained regular, reflecting a requirement for fairness publicity.

What Position is Chainlink Taking part in?

Kamino defined within the X thread that Chainlink offers safe, tamper-proof information feeds that allow dependable on-chain buying and selling, lending, and leveraging of tokenised equities. Chainlink sources real-time costs from a number of U.S. fairness exchanges, delivering updates via its customized Information Streams oracle answer.

The function of Chainlink is essential as a result of on-chain liquidity alone is skinny and unstable. One of many key advantages is that Chainlink auto-pauses Kamino operations to stop unhealthy trades. It additionally maintains stability throughout off-hours buying and selling and retains tokenised costs in sync with underlying belongings. The Chainlink protocol matches properly with the xStock integration, contemplating its main place within the oracle sector. As we lined in our newest report, Chainlink instructions the oracle sector with roughly 63% market management.

Flex Perpetual lately built-in Chainlink Information Streams on its platform to energy the buying and selling of the tokenised US equities market. As famous in our earlier submit, Flex leveraged the Information Streams to energy AAPL, MSTR, NVDA, and TSLA. In the meantime, this isn’t the primary time Kamino has used Chainlink Information Streams. In April, Kamino built-in the Chainlink Information Streams to enhance real-time market information high quality and scale back latency.