Circle’s Cross-Chain Switch Protocol (CCTP) facilitated $7.7 billion in stablecoin bridging quantity in Might, an all-time excessive and an 83.3% enhance from April.

The agency launched its IPO final week, rejecting outright buyout efforts to stay an energetic participant within the stablecoin market. This spectacular development will help reveal Circle’s progress and stable foundations.

Circle’s CCTP Breaks Quantity Data

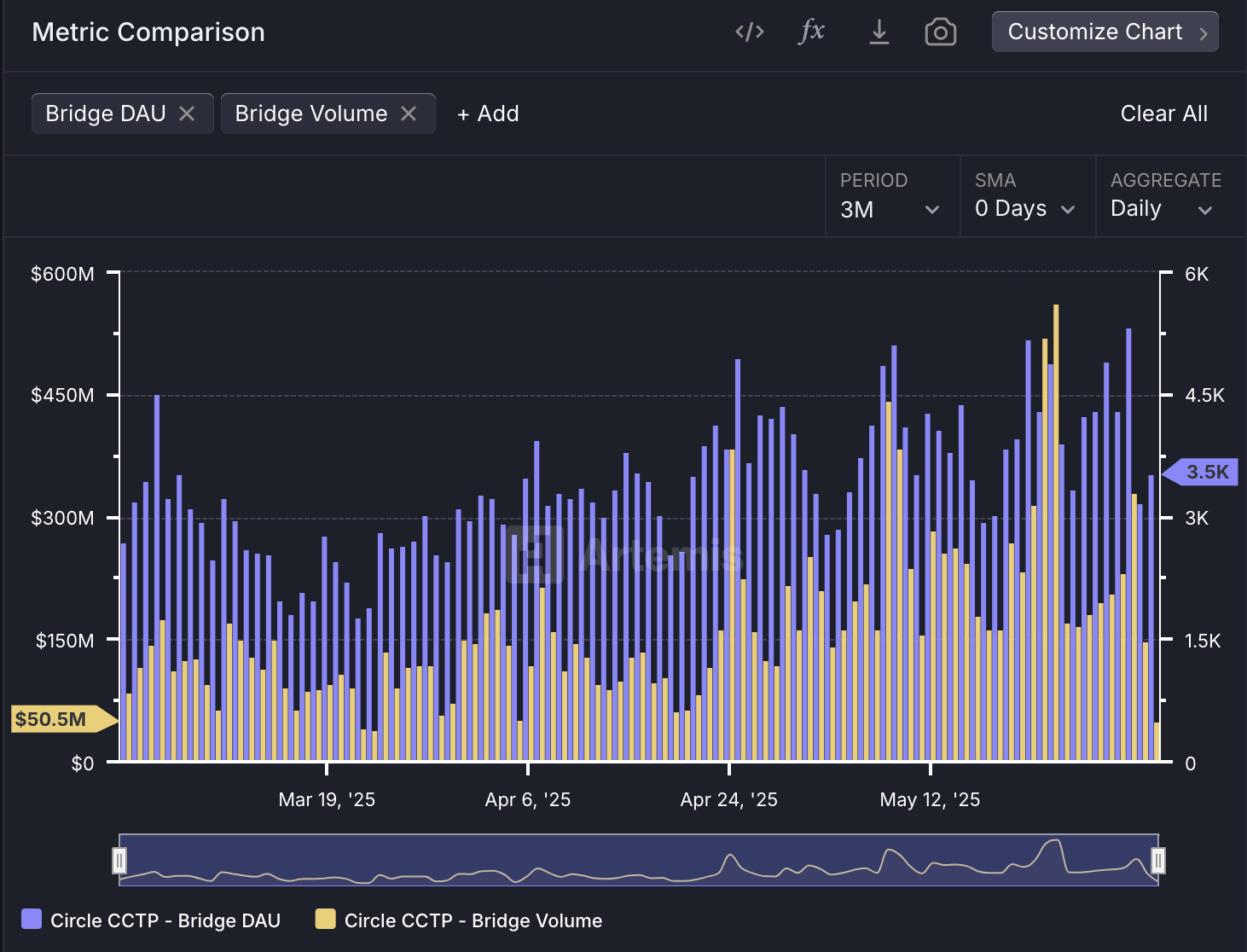

Circle, one of many largest stablecoin issuers, first launched CCTP in 2023 to seamlessly bridge USDC throughout blockchains. Since then, it’s built-in the protocol with a variety of outstanding chains, rising USDC’s interoperability. At present, blockchain knowledge evaluation exhibits that CCTP hit a brand new all-time excessive for bridging quantity final month:

Circle CCTP Bridging Quantity. Supply: Artemis

This CCTP quantity is particularly related for Circle for an additional cause. Particularly, the entire variety of energetic stablecoin addresses additionally reached a brand new report final month: 33.1 million.

In a time when the entire demand for stablecoins and utility options is barely rising, Circle is working to current its funds ecosystem as a gorgeous possibility.

The corporate has been planning an IPO for the previous few months, however it rejected a $5 billion supply from Ripple to amass it outright. As a substitute, the agency opened its inventory sale final week, aiming to boost $624 million whereas sustaining its independence.

CCTP’s report development might sign Circle’s long-term market potential, higher engaging new capital funding. The stablecoin issuer already elevated its IPO dimension immediately, setting a extra formidable goal of $896 million.

Whereas the variety of energetic stablecoin addresses is rising, main funding banks are planning to considerably enhance their presence within the business.

Citigroup predicts a $3.7 trillion stablecoin market by 2030, and it isn’t alone in these bullish predictions. All that’s to say, Circle isn’t the one issuer creating new cross-chain transaction options.

In different phrases, Circle’s report CCTP development comes at a helpful time. USDC’s buying and selling quantity additionally broke information in April, and now the stablecoin’s utility protocols are surging, too.

Circle is intent on remaining an unbiased firm and positioning itself as a robust contender on this sector. To do that, it should want constructive metrics like CCTP’s quantity to maneuver the market.