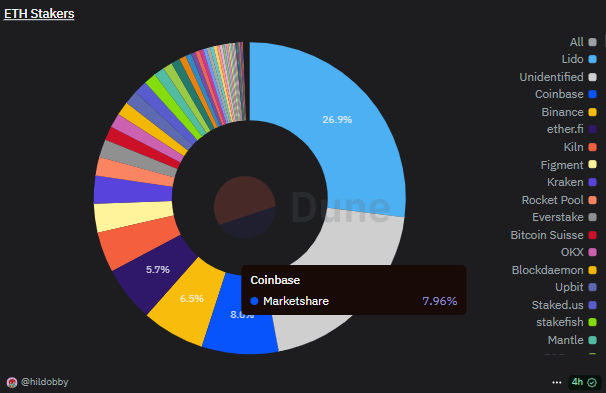

Coinbase is among the largest holders of staked Ethereum (ETH), probably signaling its capacity to supply staking ETFs. The trade controls as much as 8% of staked ETH.

Coinbase is among the largest stakers of Ethereum (ETH), carrying as much as 8% of the staked provide. The centralized trade even surpassed Binance, which carries round 2.2M in staked ETH.

Coinbase is among the many largest proxies for staking, permitting retail traders to realize yield with out locking 32 ETH.

Centralized exchanges work as hubs for safer staking, whereas additionally gaining passive earnings. Coinbase at present presents as much as 2.14% APY for utilizing it as an middleman. At the moment, staking can carry again as much as 3.95% in annualized earnings for those who deposit 32 ETH. Coinbase presents returns for smaller stakes, whereas dealing with the logistics of being a validator.

Coinbase has been proactive in securing a few of the prime chains, lately additionally changing into one of many quick Solana validators.

The trade’s function for Ethereum could also be linked to offering staking-based ETFs. The prevailing funds typically resort to Coinbase Custody for holding their belongings, and will lengthen to Coinbase’s staking service.

Staked ETH might revive ETF shopping for

One of many issues for ETH is the comparatively weak demand for its obtainable ETF. Prior to now couple of days, a lot of the prime ETFs had a internet outflow. The lowered demand follows promoting pressures for ETH, as the worth hovers within the $1,600 vary.

A staking ETF might give incentives to new patrons, as they obtain extra earnings on their funding. Staking has been proposed for different altcoin ETFs, together with Solana and AVAX. Nevertheless, ETH staking stays probably the most dependable supply of standard rewards.

Coinbase additionally contributes by issuing Coinbase Staked ETH, cbETH, an asset that can also be spreading to DeFi protocols. The power to stake ETH, whereas receiving a brand new type of token might add an additional layer of potential earnings. The by-product asset, cbETH, additionally trades at a premium of $1,758.62, giving further incentives for staking with Coinbase.

A staking ETF is at present within the pipeline, pending approval by the US Securities and Alternate Fee (SEC). There are expectations {that a} first approval can probably arrive in seven weeks. The arrival of institutional staking additionally expects an Ethereum replace, which might permit the staking of as much as 2048 ETH in a single validator. One of many obstacles to staking scalability is the 32 ETH restrict, leaving large-scale holders with a number of validators.

The US market nonetheless lacks a staking ETF, however European traders have entry to merchandise with passive earnings, supplied by 21 Shares and Bitwise. An ETF can take away friction and the technical dangers of staking, whereas additionally satisfying the demand for yield.

At the moment, round 34M ETH are staked, increasing the variety of validators. Shopping for an ETF would cut back the complexity of staking, whereas taking away the 32 ETH requirement for retail patrons. Stakers break up over 17,429 ETH from block rewards every week, whereas validators additionally acquire a small share of gasoline charges. ETH retains a yearly inflation of 0.75%, offset by the staking yield.